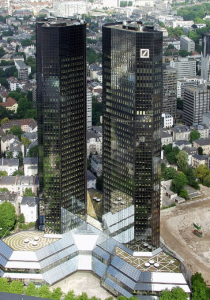

On April 13, 2016, a settlement was reached in the court case over silver price manipulation against Deutsche Bank. One day later, a similar announcement was made in the context of gold price manipulation. This admittance of precious metal price fixing manipulation lent validation to the many rumors that had been circulating for years about this very practice. Voices that chimed in over the manipulation were previously relegated to the likes of conspiracy theorists, but in light of all this new information, it is difficult to not take note.

Price fixing of metals has a long-standing history. In 1897, London had the world’s leading silver market. The price of silver had been on the decline, and the market was volatile. Taking steps to protect their market positions, the first silver fixing took place at the London office of Sharps and Wilkins, with Mocatta & Goldsmid, Pixley & Abell, and Samuel Montagu & Co being the first dealers to participate. [i] The brokers met once a day with their buying and selling orders in hand, where they would then enter a room and negotiate the price for silver based on those orders. The ‘fixing’ price of silver controlled the price of the metal in every important financial center throughout the world, with telegraphs used to communicate the price. As The Times explained it,

“The method was for each broker to total up his orders, and from his ‘book’ he estimated what he considered the price should be. From the result he sent a note to one or other of the brokers giving his opinion; in return he would get a reply giving other points of view and possibly suggesting a sale to, or a purchase from them, of so many thousand ounces. After an interchange of notes of this nature the price would be mutually agreed upon and officially announced.”[ii]

Gold fixing began in 1919, in a wood-paneled room at N.M. Rothschild & Sons Ltd.’s London office, with the members of the London Gold Market Fixing Ltd. Dealers who met in the room each had small Union Jack flags to signal the need to change orders. Each firm would declare how many bars of gold they wanted to buy or sell at the current spot price, and the price would be raised and lowered until the buy and sell amounts were within 50 bars, or about 620 kilograms. It was at that point the fix was set. Buyers would be charged 20 cents per troy ounce as a premium to fund the fix process, and would use timing and predictions to make a profit. [iii] Until 1968, the price was fixed only once a day. A second fixing was introduced at 3 p.m. which would coincide with the opening of the US markets. This remained the method until the process switched to a telephone conference call in 2004, when Nathan Mayer Rothschild left the precious metals business in London and sold its place on the fixing to Barclays.

The silver price fix methodology and price platform was changed in August 2014, after 117 years, and is now the LBMA Silver Price. CME and Thomson Reuters took over the administration, under sweeping reforms of the entire precious metals market. Now the price is set every day by seven participants; China Construction Bank, HSBC Bank USA NA, JPMorgan Chase Bank, The Bank of Nova Scotia – ScotiaMocatta, The Toronto Dominion Bank, UBS AG, and Morgan Stanley, which joined just this October 25, 2016. These transactions occur daily, at noon London time, and are set in US dollars per fine troy ounce, with an indicative price in Sterling and Euro price available for settlement.

On March 20, 2015, the historic London Gold Fix was discontinued and replaced by the LBMA (London Bullion Market Association) Gold Price, for which ICE Benchmark Administration (IBA) became the administrator. IBA hosts an electronic auction process for the LBMA Gold Price. This process is now independently administered and tradeable, with electronic and physical settlement, and is conducted in dollars. Aggregated and anonymous bids and offers are published on-screen, and in real time.[iv] The transactions occur at 10:30am and 3:00pm London time. Currently, there are thirteen accredited contributors who participate in the LBMA Gold Price. These include Bank of China, Bank of Communications, China Construction Bank, Goldman Sachs International, HSBC Bank USA NA, ICBC Standard Bank, JP Morgan, Societe Generale, Standard Chartered, The Bank of Nova Scotia – ScotiaMocatta, The Toronto Dominion Bank, UBS, and Morgan Stanley.

The move from the earlier benchmark, to the newer LBMA Gold and Silver Price, was a direct result of scrutiny over illegal practices and manipulation that might be occurring in the price fix. The impetus for the scrutiny was an interest-rate rigging scandal, the manipulation of the London interbank offered rate, also known as Libor, [v] The Libor investigation, which started in 2012, implicated multiple banks—notably Deutsche Bank, Barclays, UBS, Rabobank, and the Royal Bank of Scotland. [vi] Between regulators in the US, the UK, and the EU, the banks have been fined more than $9 billion for rigging Libor. In early 2013, the Commodity Futures Trading Commission (CFTC), began examining the price fix. Then late in 2013, Deutsche Bank announced the decision to pull out of setting the gold and silver fix, and put their seat up for sale.[vii] Following the Libor scandal, it proved to be very difficult to sell their seat, and when it could not be sold, Deutsche Bank resigned, and the LBMA benchmark was implemented. [viii]

The investigation into the manipulation of the price fix of precious metals continued on even after the process had changed. In 2014, the FCA fined Barclays $40.2 million (£26 million) for lax controls after one of its traders allegedly manipulated the gold fix at the expense of a client.[ix] According to The Wall Street Journal “More than 25 lawsuits have been filed against Barclays, Deutsche, HSBC, Bank of Nova Scotia and Société Générale over their alleged role in setting the gold fix. The plaintiffs are seeking damages for losses suffered due to the alleged manipulation of the price of the metal and gold derivatives. Law firm Berger & Montague, the court-appointed co-lead counsel for the proposed class-action suits, said the gold fix affected trillions of dollars worth of gold and related financial contracts”. A class action lawsuit seeking $1 billion in damages on behalf of Canadian investors was launched December 18, 2015 in the Ontario Superior Court of Justice. The class action alleges that the defendants conspired to manipulate prices in the gold market under the guise of the benchmark fixing process, known as the London PM Fixing, for a ten-year period.[x]

One of the biggest settlements reached in regard to the scandal has been between Deutsche Bank and the Department of Justice (DOJ). In April of 2016, Deutsche Bank signed a binding settlement term sheet, and started negotiating a formal settlement agreement. On October 18, 2016 Deutsche Bank agreed to pay $38 million to settle the US litigation. Vincent Briganti, a lawyer for the investors, said the deal provides “substantial monetary compensation plus cooperation from Deutsche Bank in the continued prosecution of this important case against the non-settling defendants.” [xi] As part of the settlement, Deutsche Bank will be working with the court to help the plaintiffs pursue similar claims against other banks, and they are expected to turn over instant messages and other communications. [xii]

The coming months are going to reveal many of the hidden truths of the precious metals market. Speculations on how this will affect the market will begin to emerge, and more processes may change, and the ramifications of the manipulation will be addressed. This price fix manipulation has effected the very way gold and silver fix prices are handled, but will this method be any better, with any more transparency and safeguards to protect investors? As new information is exposed, we will discuss what that means for you, and the future of the precious metals market.

[i] Timothy Green, ‘Precious Heritage: Three hundred years of Mocatta & Goldsmid’ (London: Rosendale Press, 1983),

[ii] The Times, ‘Dealings in Precious Metals, How Business is conducted’, 20 Jun 1933

[iii] http://www.bloomberg.com/news/articles/2014-02-28/gold-fix-study-shows-signs-of-decade-of-bank-manipulation

[iv] http://www.lbma.org.uk/lbma-gold-price

[v] http://www.wsj.com/articles/SB10001424127887324077704578358381575462340

[vi] http://www.cfr.org/united-kingdom/understanding-libor-scandal/p28729

[vii] http://www.wsj.com/articles/SB10001424052702304603704579326202725433242

[viii] http://www.bloomberg.com/news/articles/2014-04-29/deutsche-bank-resigns-from-gold-fix-after-seat-sale-fails

[ix] http://www.wsj.com/articles/big-banks-face-scrutiny-over-pricing-of-metals-1424744801

[x] http://www.sotosllp.com/class-actions/current-cases/gold-manipulation/

[xi] http://www.reuters.com/article/us-deutschebank-settlement-silver-idUSKCN0XA2RU

[xii] http://www.bloomberg.com/news/articles/2016-04-13/deutsche-bank-settles-silver-price-fixing-claims-lawyers-say

All data and information provided is intended solely for informative purposes and is not intended to be considered individualized advice or investment recommendations. You understand that you are using any and all information available on or through this site at your own risk.