Gold hits multi-month highs as Elon Musk warns the U.S. is “going bankrupt fast,” Ray Dalio revives debt crisis concerns, and dollar weakens.

Gold prices jumped on Tuesday after a sharp slide in the U.S. dollar, triggered by growing concerns over America’s soaring debt. The move follows a public clash between Elon Musk and Donald Trump over federal deficits, and a new essay from Ray Dalio warning of a looming “debt bomb.”

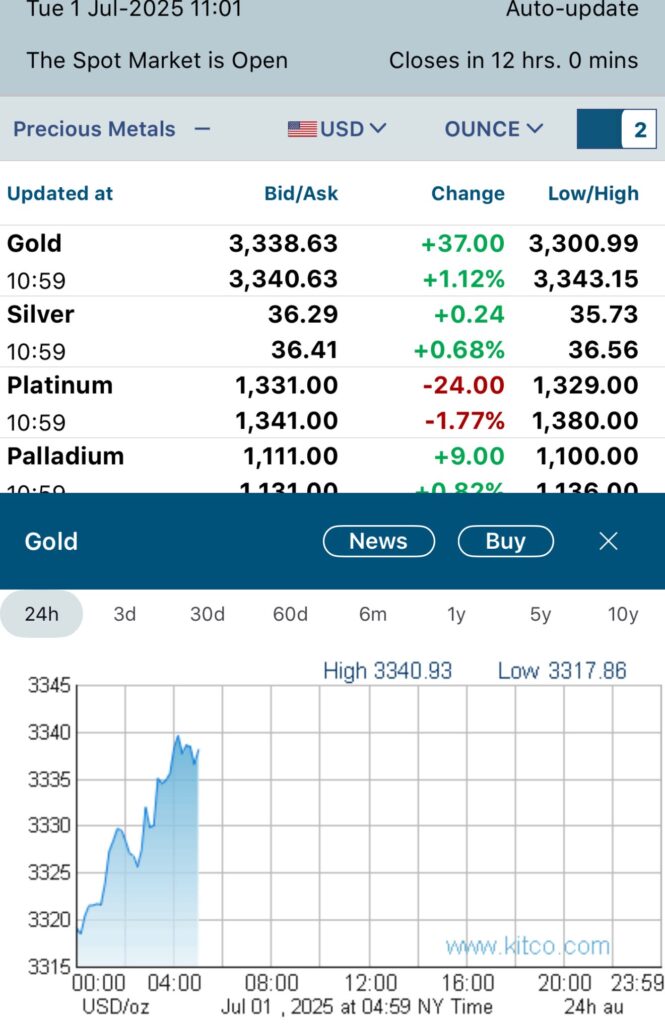

Spot gold was trading at $3,338.63 per ounce, up $37.00 or +1.12%, with highs reaching $3,343.15, according to Kitco. Silver also rose to $36.29, up 0.68%.

Tesla CEO Elon Musk tweeted: “The U.S. is going bankrupt fast,” in response to Trump defending his administration’s handling of the national debt. The exchange quickly gained attention in markets and media. Investor and author Willem Middelkoop shared the development, noting the market reaction:

Gold jumps after dollar slides further

Trump-Musk fight over US debts and deficits could be the reason

Musk tweeted US is going bankrupt fast

Ray Dalio writing about the US ‘Debt Bomb’

Meanwhile, Ray Dalio, founder of Bridgewater Associates, published a fresh warning on LinkedIn, writing that the U.S. is nearing a fiscal tipping point where debt service becomes unsustainable.

“We are near a tipping point in which the burden of debt service becomes unsustainable,” Dalio warned. “History shows that leads to either debt restructuring or high inflation.”

Gold’s rise reflects investor demand for safe-haven assets as confidence in the dollar falters. Central bank gold buying also remains strong, with China and Turkey among the largest accumulators this year, according to the World Gold Council.

Silver followed gold’s trajectory, trading near levels not seen since 2021, though still below its 2011 high of $49.45 (LBMA data).