Summary

- The S&P 500 paused after a strong rally, driven by concerns over Oracle’s cloud margins and profit-taking in tech stocks.

- Carlyle Group estimates weak job growth but robust overall economic activity, with a 2.7% growth rate led by business investment and consumer spending.

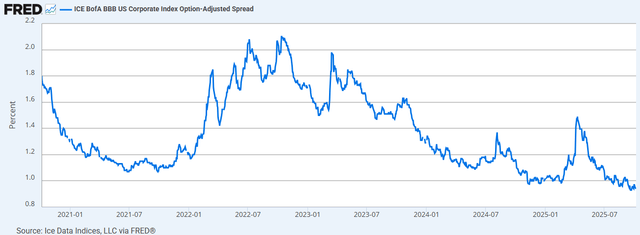

- Another soft jobs report could prompt a Fed rate cut, while narrowing corporate bond spreads signal investor confidence and no imminent recession.

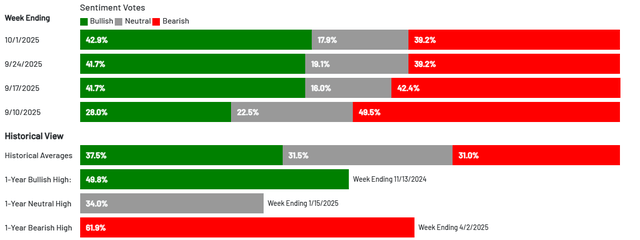

- Despite new highs, retail investor skepticism persists, setting the stage for a potential fourth-quarter rally, especially outside frothy AI sectors.

- This idea was discussed in more depth with members of my private investing community, The Portfolio Architect.

sitox/E+ via Getty Images

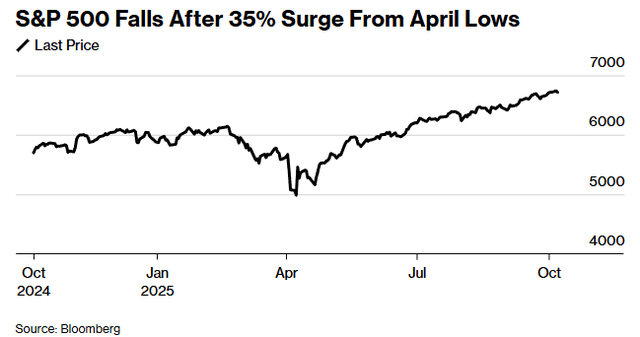

After seven consecutive days of gains, the S&P 500 took a well-deserved breather yesterday. The impetus for the selling was a report asserting that margins for Oracle’s cloud business were much lower than originally thought, which sent the stock reeling and took many software and chip names with it. I sense investors were looking for an excuse to take some profits in what has been an epic run of 35% from the April low. A period of consolidation should come as no surprise between now and when the federal government finally reopens. We should also have the tailwind of better-than-expected earnings reports, which start in earnest next week.

To fill the void of economic statistics we no longer have from the federal government, Carlyle Group is now releasing its own estimates on economic activity, using its portfolio of public and private companies as a resource. The investment manager estimates that the economy created just 17,000 jobs last month, which would fall short of the 54,000 expected to be reported by the Bureau of Labor Statistics. That may be an alarmingly low number if not for the fact that we know the labor market is in a holding pattern until businesses have more clarity on trade and tariff policies.

Another soft jobs report along the lines of what Carlyle is projecting would probably guarantee another rate cut of 25 basis points by the Fed at the end of this month. That would be the best of both worlds, because as weak as job growth is today, warranting another rate cut, the other statistics that measure economic health are far more robust. Carlyle Group estimates the rate of economic growth was at a run rate of 2.7% in September, which is still above the economy’s long-term trend. It was led by business investment and consumer spending. It isn’t just the stock market that is confident in the economic outlook, because corporate bond spreads have collapsed, which is an indication that bond investors are just as confident. You don’t see spreads narrow in front of a recession. They do just the opposite.

Despite new all-time highs, there remains a decent level of skepticism from retail investors today. The American Association of Individual Investors saw a sharp spike in bulls from depressed levels after the Fed cut short-term rates last month, but the percentage is not far from its historical average and well off its one-year high. Meanwhile, the percentage who are bearish remains well above its historical average of 31%. This is far from irrational exuberance.

With corporate bond spreads narrowing, more rate cuts on the horizon, and relatively subdued investor sentiment, we have the recipe for a fourth-quarter rally to bring 2025 to a close. AI-related investments may be exhibiting signs of froth, but other sectors of the market still present attractive value propositions.

Lawrence Fuller has been managing portfolios for individual investors for 30 years, starting his career at Merrill Lynch in 1993 and working in the same capacity with several other Wall Street firms before realizing his long-term goal of complete independence when he founded Fuller Asset Management. He also manages the Focused Growth portfolio on the new fintech platform called Dub, which is the first copy-trading platform approved by securities regulators in the US, allowing retail investors to copy the portfolio and ongoing trades of the manager they choose automatically. You can also find him on Substack and lawrencefuller.substack.com.

He is the leader of the investing group The Portfolio Architect, which focuses on an overall economic and market outlook that complements an all-weather investment strategy designed to produce consistent risk-adjusted market returns. Features include: Portfolio construction guidance, access to an “All-Weather” model portfolio and a dividend and options income portfolio, a daily brief summarizing current events, a week ahead newsletter, technical and fundamental reports, trade alerts, and 24/7 chat. Learn More.

Analyst’s Disclosure:I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Lawrence Fuller is the Principal of Fuller Asset Management (FAM), a state registered investment adviser. He is also the manager of the Focused Growth portfolio on the copy-trading platform Dubapp.com. Information presented is for educational purposes only intended for a broad audience. The information does not intend to make an offer or solicitation for the sale of purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. FAM has reasonable belief that this marketing does not include any false or material misleading statements or omissions of facts regarding services, investment, or client experience. FAM has reasonable belief that the content as a whole will not cause an untrue or misleading implication regarding the adviser’s services, investments, or client experiences. Past performance of specific investment advice should not be relied upon without knowledge of certain circumstances or market events, nature and timing of investments and relevant constraints of the investment. FAM has presented information in a fair and balanced manner. FAM is not giving tax, legal, or accounting advice.

Mr. Fuller may discuss and display charts, graphs, formulas, and stock picks which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions. Consultation with a licensed financial professional is strongly suggested. The opinions expressed herein are those of the firm and are subject to change without notice. The opinions referenced are as of the date of publication and are subject to change due to changes in market or economic conditions and may not necessarily come to pass.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Shared by Golden State Mint on GoldenStateMint.com