Summary

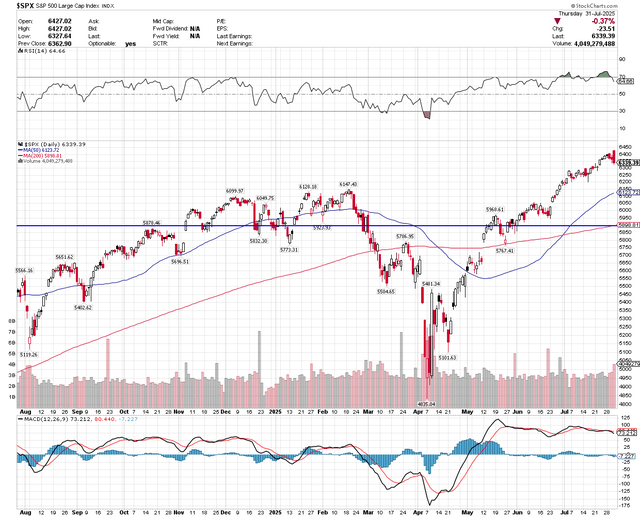

- Tariff uncertainty is overshadowing AI-driven optimism, with new U.S. tariffs impacting global trade sentiment and weighing on the S&P 500.

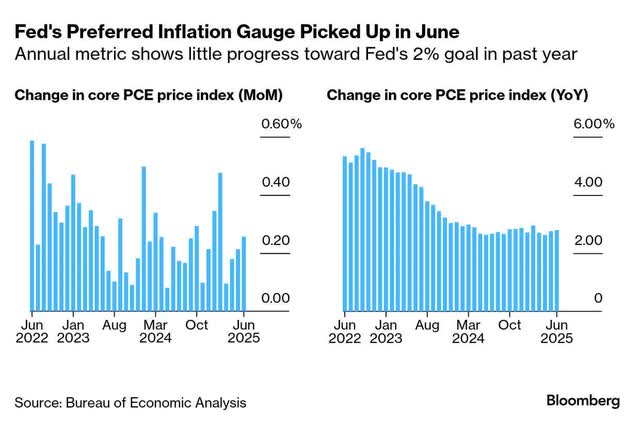

- Core PCE inflation has ended its disinflationary trend, with expectations for it to rise above 3%, discouraging a Fed rate cut in September.

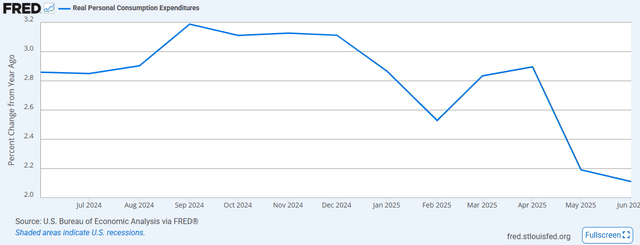

- Real disposable income is flat and consumer spending growth is slowing, raising concerns about economic momentum and the risk of stagflation.

- I expect a market correction as these headwinds persist, but view it as a buying opportunity if economic growth and the labor market remain resilient.

- This idea was discussed in more depth with members of my private investing community, The Portfolio Architect.

DNY59

The S&P 500 fell for the third day in a row, despite Microsoft and Meta Platforms rising on strong earnings results, as investors seemed more concerned about today’s deadline for “reciprocal” tariffs. I have been concerned that the reality of tariffs would start to overshadow AI euphoria as this day approached. The president is expected to sign an executive order that imposes new tariff rates on all trading partners effective today, with the exception of the EU, UK, Japan, and South Korea. Those countries struck the framework for agreements. The president already announced unilateral rates on India and Brazil, while Mexico has been granted another 90-day extension, and China seems to have one as well. Now that we hopefully have a degree of certainty on trade policy, investors will refocus on the economic data.

The Fed’s preferred inflation gauge rose 0.3% in June, which resulted in the personal consumption expenditure (PCE) price index increasing at an annual rate of 2.6% compared to 2.5% in May. The core rate, which excludes food and energy, also rose 0.3%, resulting in no change in the annual rate of 2.8%. Last month’s inflation was fueled by price increases for goods, which included clothing, household goods, and recreational equipment. The PCE for goods rose 0.4% last month. There could be some offset from PCE services, which rose just 0.2% last month, but the overall trend is no longer our friend. That will dissuade the Fed from cutting interest rates in September.

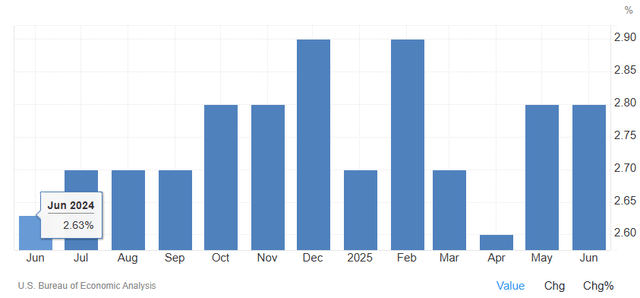

Some have asserted that there is no inflation today, but the chart below portrays a different picture. The core rate of inflation (PCE) has risen from 2.6% in June 2024 to 2.8% in June 2025. The disinflationary trend has come to an end by this metric, and I expect we will see the core PCE rise above 3% over the next few months, which will be the highest rate in two years. This is not catastrophic, but it will adversely impact real income and real personal spending.

We also learned yesterday that real disposable income was flat in June, while real personal spending rose 0.1% to round out two of the softest quarters in consumer spending since the pandemic. Purchases of durable goods fell for a third month in a row. To remove the noise in the monthly numbers, I prefer to look at inflation-adjusted (real) consumer spending growth on a year-over-year basis. By that metric, we are still holding above 2%, but the rate of growth has slowed demonstrably over the past year. This accounts for 70% of our overall economic growth.

I think a rising rate of inflation combined with very sluggish consumer spending is going to stall the stock market’s rally between now and the next Fed meeting, as investors grow concerned over a transitory period of stagflation. Our stock market is priced for perfection, but the macroeconomic backdrop is far from perfect right now. This is not a call for a bear market or a recession. It’s a major speedbump on our way to a soft landing at this stage. It is one that I think could result in another market correction that tests the long-term moving average for the S&P 500, which sits at 5,900. Provided economic growth sustains, price increases are temporary, and the labor market holds up, it should be another buying opportunity in the bull market that started in October 2022.

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Lawrence Fuller is the Principal of Fuller Asset Management (FAM), a state registered investment adviser. He is also the manager of the Focused Growth portfolio on the copy-trading platform Dubapp.com. Information presented is for educational purposes only intended for a broad audience. The information does not intend to make an offer or solicitation for the sale of purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. FAM has reasonable belief that this marketing does not include any false or material misleading statements or omissions of facts regarding services, investment, or client experience. FAM has reasonable belief that the content as a whole will not cause an untrue or misleading implication regarding the adviser’s services, investments, or client experiences. Past performance of specific investment advice should not be relied upon without knowledge of certain circumstances or market events, nature and timing of investments and relevant constraints of the investment. FAM has presented information in a fair and balanced manner. FAM is not giving tax, legal, or accounting advice.

Mr. Fuller may discuss and display charts, graphs, formulas, and stock picks which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions. Consultation with a licensed financial professional is strongly suggested. The opinions expressed herein are those of the firm and are subject to change without notice. The opinions referenced are as of the date of publication and are subject to change due to changes in market or economic conditions and may not necessarily come to pass.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Shared by Golden State Mint on GoldenStateMint.com