Key Points

- Fed Governor Christopher Waller said Friday that he doesn’t expect tariffs to boost inflation significantly so policymakers should be looking to lower interest rates as early as next month.

- “If you’re starting to worry about the downside risk [to the] labor market, move now, don’t wait,” he said.

- Most Fed policymakers prefer a wait-and-see approach, with market pricing indicating the next rate cut won’t come until September.

Federal Reserve Governor Christopher Waller said Friday that he doesn’t expect tariffs to boost inflation significantly so policymakers should be looking to lower interest rates as early as next month.

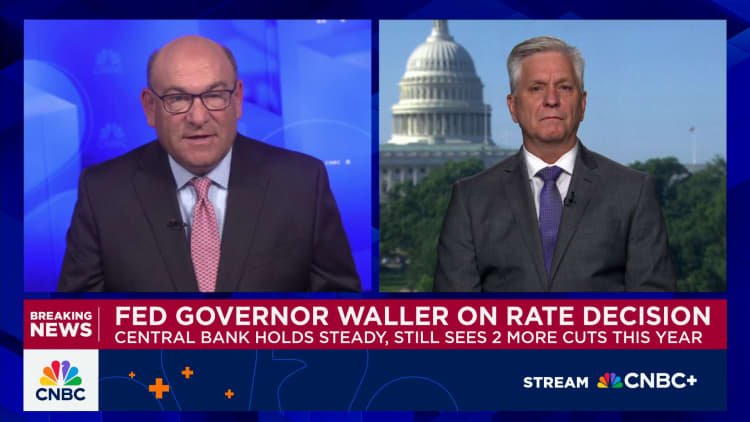

In a CNBC interview, the central banker said he and his colleagues should move slowly but start to ease as inflation is now longer a major economic threat.

“I think we’re in the position that we could do this and as early as July,” Waller said during a “Squawk Box” interview with CNBC’s Steve Liesman. “That would be my view, whether the committee would go along with it or not.”

The comments come two days after the Federal Open Market Committee voted to hold its key interest rate steady, the fourth straight hold following the last cut in December.

President Donald Trump, who nominated Waller as a governor during his first term in office, has been hectoring the Fed to lower interest rates to reduce borrowing costs on the $36 trillion national debt.

In his remarks, Waller said he think the Fed should cut to avoid a potential slowdown in the labor market.

“If you’re starting to worry about the downside risk labor market move now don’t wait,” he said. “Why do we want to wait until we actually see a crash before we start cutting rates? So I’m all in favor of saying maybe we should start thinking about cutting the policy rate at the next meeting, because we don’t want to wait till the job market tanks before we start cutting the policy rate.”

Stock market futures saw gains after Waller’s remarks.

Whether Waller will be able to marshal much support for his position is unclear.

The FOMC, Waller included, voted unanimously to hold at this week’s meeting, keeping the benchmark federal funds rate locked in a target range of 4.25%-4.5%.

According to the “dot plot” of individual officials’ expectations for interest rates this year, seven of the 19 meeting participants said they see rates holding steady this year, two saw just one cut likely, while the remaining 10 expect two or three reductions. The dispersion reflected a sense of uncertainty around policymakers about where rates should head.

Trump has called for dramatic moves, saying he thinks the benchmark rate should be at least 2 percentage points lower and even suggested it should be 2.5 percentage points below the current level of 4.33%.

However, Waller said he thinks the committee should be move slowly.

“You’d want to start slow and bring them down, just to make sure that there’s no big surprises. But start the process. That’s the key thing,” he said. “We’ve been on pause for six months to wait and see, and so far, the data has been fine. … I don’t think we need to wait much longer, because even if the tariffs come in later, the impacts are still the same. It should be a one-off level effect and not cause persistent inflation.”

Other officials have been reluctant to cut as they wait to see what longer-term impact Trump’s tariffs have, primarily on inflation but also on the labor market and broader economic growth.

Chair Jerome Powell said repeatedly at his post-meeting news conference Wednesday that he believes the Fed can stay in its wait-and-see mode as the labor market continues to hold up. Inflation data of late has shown little pass-through so far as companies burn off inventory accumulated in the run-up to the tariff announcement, and amid concerns that consumer demand is slowing and reducing pricing power.

Futures market pricing indicates virtually no chance of a rate cut at the July 29-30 meeting, with the next move expected to come in September.

Shared by Golden State Mint on GoldenStateMint.com