Summary

- The Dow Jones Industrial Average has reached new all-time highs, following widespread investor optimism about AI and softer-than-expected inflation.

- Investors may feel euphoria, but there are still many risks to consider at this time, now more than in recent history, as valuations, concentration, and economic risks boil up.

- However, this is not a reason to panic. A measured approach is to re-evaluate your current positions for your risk tolerance, in case these valuations signal low future returns.

- Consider other assets like ex-U.S. stocks and small caps, which have been left behind during the mega-cap tech bull run. These could benefit from a market rotation.

- Ultimately, I am still bullish but cautious and believe it is prudent for investors to never discount U.S. stocks even during these times. They often surprise to the upside, even if earnings are trailing valuations currently.

Eudyptula/iStock via Getty Images

Introduction

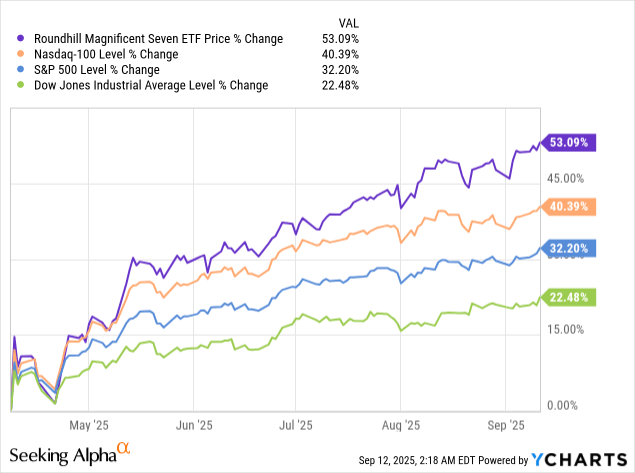

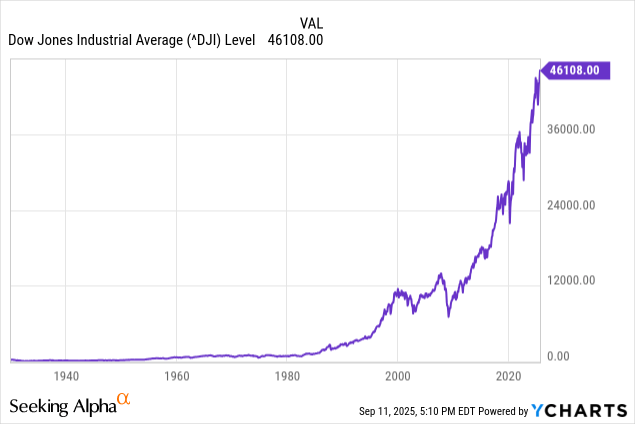

The headlines ran bullish as we crossed the 46,000 level on the Dow Jones Industrial Average Index (DJI). It’s not just the Dow; the S&P 500 Index (SP500), NASDAQ Composite Index (COMP:IND), and market darling group, the Magnificent Seven, are all also at all-time highs after rebounding from April lows and continuing the “most hated V-shaped rally (0:15),” which appears to be all gas, no brakes, as the kids say.

It’s times like these I feel like grounding is important for investors, as irrational exuberance plays out around us.

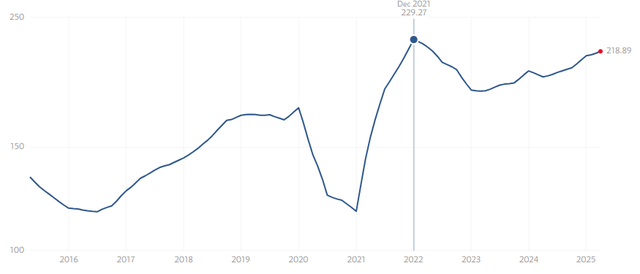

Look at just how far the Dow has come in the last century (95 years, I can only go back to 1930). This really puts into perspective the explosive growth of the market post-GFC. The growth has been so steep in the last 15 years.

It’s easy looking at that chart to say that the answer is to always hold on tight. It would be a cheap shot to show a picture of the NIKKEI 225 Index (NKY:IND) from 1989-2023, where they had lost decades, plural. Current America is not 1990s Japan, and I won’t pretend that it’s anywhere close.

However, there are a few major risks to consider for investors in these broad market indexes that I think we should consider here.

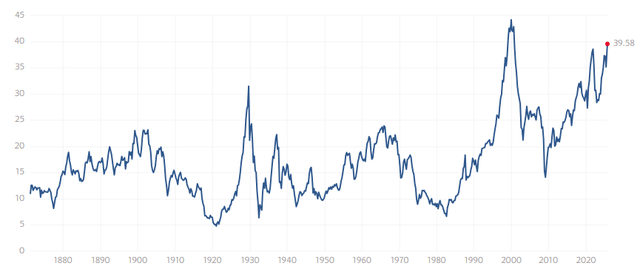

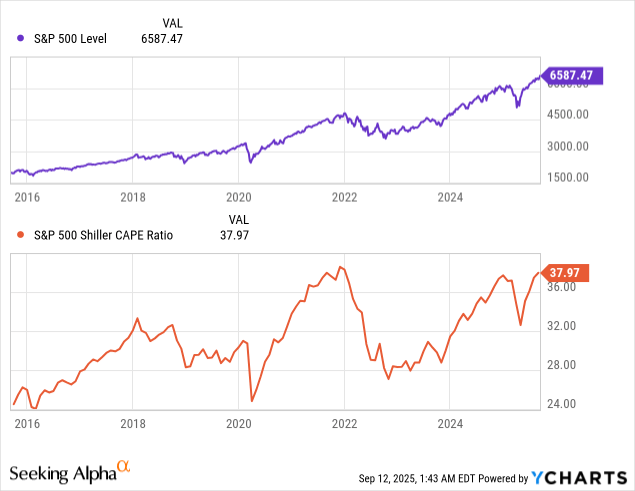

Valuation Risk

The implication of this market being at all-time highs is also that valuations are at all-time highs. Beware that in past market conditions when valuations were this high, the following years usually had lower returns than expected and definitely lower than the previous years that led up to the valuation peak.

Sometimes, crashes follow. Other times, it’s just long periods of low market performance as earnings catch up to valuations. Those periods seem less common and shorter in our modern era.

S&P 500 Shiller CAPE Ratio — Inflation Adjusted (Multipl)

I’m not prescribing a crash or some major correction here, for the record. I’m bullish on the market, still sticking to my call back in June; I think we could go another 10% higher on the Nasdaq by the end of the year, which would bring the S&P and Dow along with it.

Knowing that we are in a bubble is different from knowing when it will pop.

All that is to say that we should be expecting the unexpected from here and that being prudent matters most in times like this when valuations are frothy. When valuations crater, it’s usually not due to a surge in earnings justifying them. It’s usually due to a cratering share price.

Even though we are at all-time highs in the market and at relative highs in valuation, we are still below the earnings per share highs we saw in 2022. This is not as big a deal as it may seem but it is worth noting as we enter an economy that is growing more from AI CapEx than consumption.

Median earnings for U.S. large caps are still trending in the right direction, part of why I am still bullish, but this chart is telling of the market conditions in a lot of ways.

S&P 500 Median Earnings Per Share (Multipl)

Concentration Risk

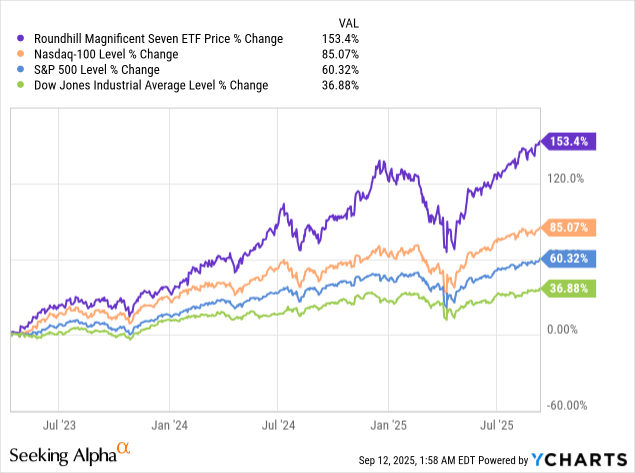

I’ve hammered this point before, but it bears mentioning again: the S&P 500 (SPX) and other major indexes like the NASDAQ 100-Index (NDX) have a concentration problem where they are incredibly top-heavy. The top ten stocks make up over 50% of the Nasdaq 100, with its top stock, NVIDIA Corporation (NVDA), taking up nearly 10%.

The Dow Jones has a different problem, because while it is more naturally concentrated due to its holding of 30 stocks, it uses a price-weighting scheme that makes it top-heavy as well, but in a different way. Its largest holding is The Goldman Sachs Group, Inc. (GS) at over 10%.

To be fair to the Magnificent Seven, stocks that are the cause of a lot of this movement, you can see their clear correlation with all of these market indexes, even the Dow. You can sort the indexes by concentration of mega-cap tech, high to low (in our case, top to bottom of this next chart), and see the same performance patterns in all of them, but less and less pronounced—read as “volatile.”

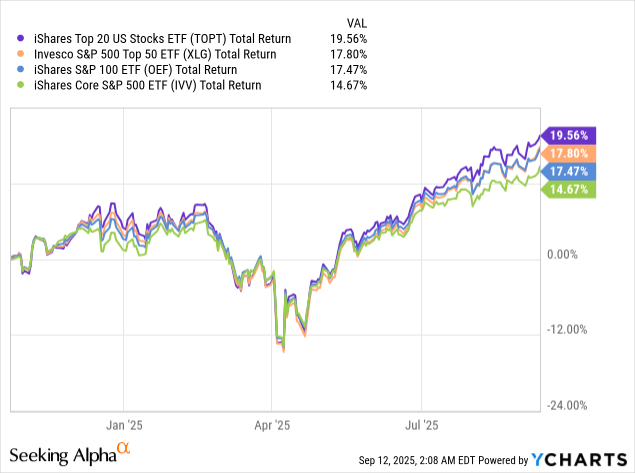

When you sort the S&P 500 by holdings, going from most to least concentrated, you get the same effect. This timeline is shorter due to the limited lifespan of the top 20 ETFs, TOPT.

Economic & Fed Risk

Warning: I’m going to be a bit of a wonk and link a lot of data here so I can keep this short but deep and allow folks to go deeper if they want.

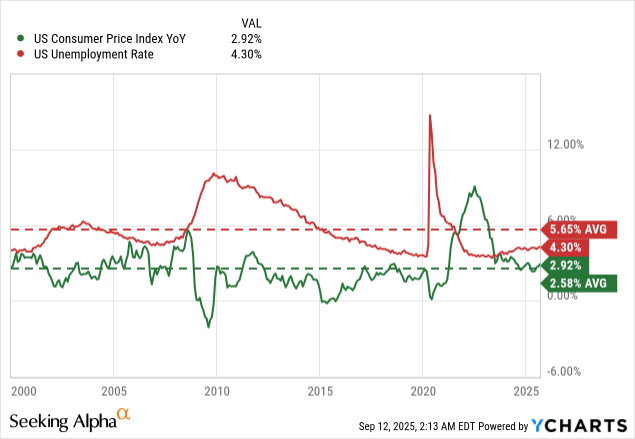

On the note of economic risk, I think we are in overall decent economic shape given we see central bank rates come down as they are expected to over the next few months, and over a longer timeframe, inflation is still running a little hot and is getting hotter, but unemployment is still below its historical average, despite weakening labor data and heavy revisions.

This confluence has put the Federal Reserve in a monetary policy “rock and hard place” with its Federal Funds Rate, which drives prevailing interest rates, and it has been looking like they will begin another cutting cycle and, over the long term, will keep up quantitative easing practices as a “default” policy mode even if it means accepting higher inflation levels.

All the while, the U.S. Treasury is looking to expand the national debt by another $1.6T in H2 2025, continually pushing more money into the system as they borrow to spend while cutting revenue from the largest sources (income and corporate taxes).

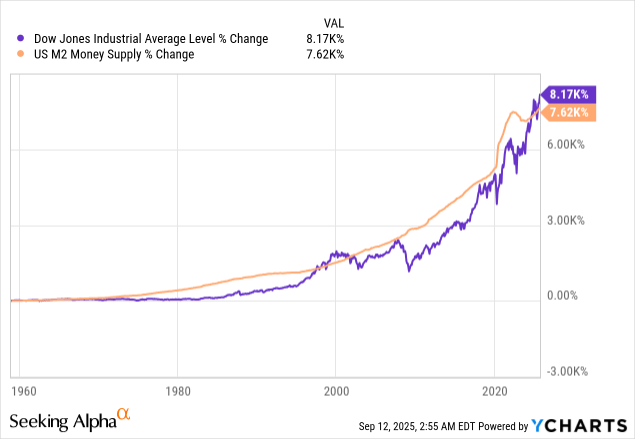

At the simplest level where it is still useful, monetary and fiscal policy are aligning in such a way that we should expect an increase in overall liquidity, which is beneficial for asset prices.

We commonly measure liquidity with money supply, or M2.

A derailing of this narrative, say if we have a Fed that begins to call for rate hikes, would be a risk that investors need to watch out for. The market is currently pricing in a very dovish Fed, and if they don’t get it, they may cause a scene. A hawkish Fed could cause further contraction of M2, which would in turn pull asset prices with it.

What I’m Doing About It

The answer to these concerns is the same: manage your risk. That looks different for different investors — one of the beauties of DIY investing.

While some investors use options; others prefer to manage risk via position sizing, which is my favorite to advocate and use, personally and professionally.

Make sure not to use “position sizing” as a way to push yourself entirely out of the market. Even at all-time highs, there is a chance we go higher. Regardless of all the warnings I can give, prices can go up for any reason, and they often do in the short term. The data I’m pointing to here is all long-term, and so it’s important to stay invested for the long term, even if your positions are kept small to ensure that your risk tolerance is met.

I am considering trimming back my equity positions from where they are now, nearly fully deployed, but my optimistic view of the market’s technicals has me staying in for now. I am positioned well, however, and have not overexposed myself to the market if there is a deep pullback or a correction to valuations.

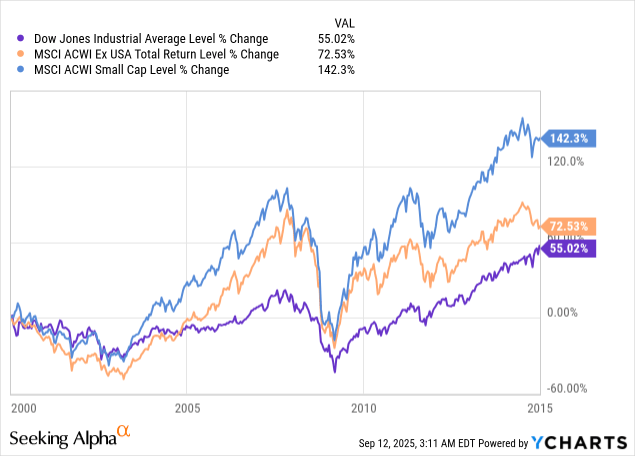

However, as I have been writing about, I believe it is in investors’ best interests to consider markets outside U.S. large caps, which are not at all-time highs and could have a significant comeback. If anything, the expected returns are higher due to buying in at lower valuations. While cheap can stay cheap forever, and there are great arguments for American exceptionalism, the charts don’t lie. Sometimes, betting on small caps and ex-U.S. stocks is the way to go.

I think we may be entering a phase like that over the next few years. That will be a longer-term trend and may take even longer to play out, depending on how long the AI party continues in full swing.

That party is still on in the U.S. for now, and I will not be reducing my U.S. exposure, but I am adding to other positions currently, and I think it’s very prudent to consider the stocks left behind as we reach these fresh all-time highs.

Conclusion

With the major indexes hitting new highs, I believe it’s a good moment for investors to ground themselves and be reminded of the major risks still at play in this market, like valuations running away from earnings (ex-Mag 7), index concentration in the top firms, and looming economic risks dependent on monetary and fiscal policy decisions out of the hands of investors.

The best way to deal with it is twofold:

- Reevaluate your risk tolerance, making sure that you are positioned so that a deep, prolonged correction wouldn’t force you to sell, either from a solvency or psychological standpoint.

- Consider opportunities to diversify when U.S. markets are at all-time highs, especially for investors with portfolios heavy on U.S. large-cap stocks.

Thanks for reading.

Writer, educator, and investment advisor from Southern California. Author of The Macro Obsession newsletter, host of the Political Pariahs podcast.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Shared by Golden State Mint on GoldenStateMint.com