Summary

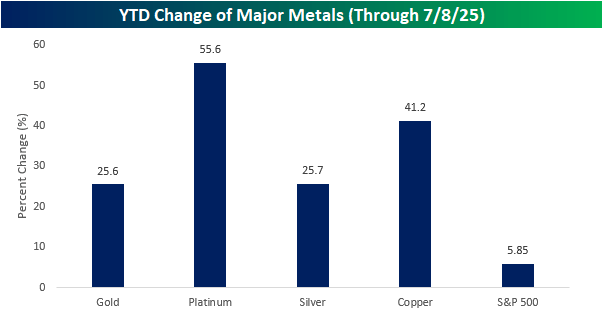

- With copper‘s surge on Tuesday, it was up an impressive 41.2% YTD, but still trailed platinum‘s monster gain of 55.6%.

- While gold is up less than any of the other four metals this year, through yesterday’s close, the only other year with a larger YTD gain was in 2016.

- Silver and copper have both experienced 20%+ YTD gains through 7/8 more than gold and platinum.

Oselote

We noted the fact that major metals were all up sharply on the year. With copper’s surge on Tuesday, it was up an impressive 41.2% YTD, but still trailed platinum’s monster gain of 55.6%. While in any other year, the 25%+ gains in gold and silver would be impressive, but they look modest next to the gains in the other two, and the 5.85% gain for the S&P 500 almost looks pathetic.

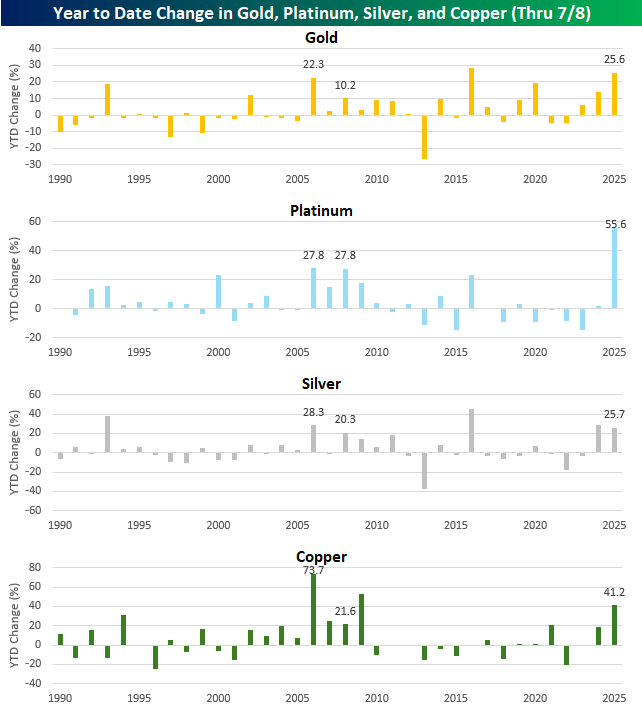

The charts below show the YTD change in all four metals through July 8th of each year since 1990.

Again, while gold is up less than any of the other four metals this year, through yesterday’s close, the only other year with a larger YTD gain was in 2016. The only other year it was up over 20% was in 2006 (22.3%).

Platinum’s 55.6% gain is easily a record through this point in the year. In fact, it’s double the prior record of 27.8% that was reached in 2006 and 2008. The only other year that platinum gained more than 20% YTD through 7/8 was in 2000 (23.6%) and 2016 (23.4%).

Silver and copper have both experienced 20%+ YTD gains through 7/8 more than gold and platinum. Silver had a larger YTD gain last year and has now had six 20%+ YTD gains since 1990. Copper’s 41.2% gain this year ranks as the best since 2009 (53.1%) and is the seventh time that the commodity has rallied more than 20% YTD.

While all four commodities have experienced other YTD gains of 25%+, this year is the first time all four have rallied 25%+ YTD through 7/8 in the same year. The only time they ever all simultaneously rallied 20%+ YTD was in 2006, and the only other year when all four were even up 10% YTD at this point in the year was in 2008. Other years since 1990 have seen big runs in the metals, but none of them have been quite like the 25%+ across the board gains in 2025.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Bespoke Investment Group provides some of the most original content and intuitive thinking on the Street. Founded by Paul Hickey and Justin Walters, formerly of Birinyi Associates and creators of the acclaimed TickerSense blog, Bespoke offers multiple products that allow anyone, from institutions to the most modest investor, to gain the data and knowledge necessary to make intelligent and profitable investment decisions. Along with running their Think B.I.G. finance blog, Bespoke provides timely investment ideas through its Bespoke Premium (https://bespokepremium.com/) subscription service and also manages money (https://bespokepremium.com/mm) for high net worth individuals.

Visit: Bespoke Investment Group (https://bespokeinvest.com/)

Shared by Golden State Mint on GoldenStateMint.com