By THE SILVER ACADEMY

For more than two centuries, silver has been at the center of a hidden struggle—one that has shaped the fate of nations, the fortunes of empires, and the wallets of ordinary people. Since the days of the Articles of Confederation in 1781, when states were left to print their own money, silver has been both coveted and suppressed. Today, as silver surges toward historic highs, the curtain is finally being pulled back on the biggest price-fixing scheme in history—and the world is about to find out just how valuable silver really is.

A Legacy of Manipulation

From the earliest days of the United States, silver was scarce, hoarded, and traded mostly as foreign coin. As the young nation struggled to manage its finances, paper money flooded the market, inflation soared, and confidence in the currency collapsed. The Constitution centralized monetary power, but even then, silver’s destiny was shaped by the interests of bankers, merchants, and politicians.

Fast forward to the modern era. The removal of silver from U.S. coins in 1965 marked the beginning of a new kind of suppression. The government openly used its silver stockpile to keep prices down, ensuring that silver would never again threaten the dominance of the dollar. This was not just economic policy—it was a deliberate campaign to keep silver in check.

Coinage Act of 1873

The Coinage Act of 1873, often called the “Crime of 1873,” changed the way the United States handled its money by stopping the free coinage of silver into dollars. This meant that people could no longer bring silver to the government to be turned into coins, which reduced the amount of money circulating in the economy and made the country rely more on gold.

As a result, the value of silver dropped sharply, hurting miners and others whose livelihoods depended on silver mining. At the same time, the reduced money supply led to deflation, making debts harder to pay off for farmers and workers who often owed money. This situation was made worse by the Panic of 1873, a severe economic depression that caused many businesses to fail and workers to lose their jobs. Workers struggled with lower wages and fewer job opportunities, while banks and creditors benefited from the stronger value of money.

The unfairness of the Coinage Act led to protests and the rise of the Free Silver Movement, which fought to bring silver back as a form of currency to help ease the burden on working people. The controversy over this law highlighted the deep economic divisions in the country and showed how government decisions about money could hurt ordinary workers. The legacy of the Coinage Act of 1873 is a reminder that monetary policy can have major consequences for people’s jobs and lives.

The Paper Silver Scam

Today, the manipulation is more sophisticated than ever. In the world’s largest futures markets, banks trade billions of ounces of “paper silver”—contracts that promise delivery of metal but rarely do. Most of the 2.9 billion ounces traded every day exist only on paper, allowing a handful of big banks to control the price. If even a fraction of these contracts were called for physical delivery, the system would collapse overnight.

Recent scandals have exposed traders for spoofing and price manipulation, but these are just symptoms of a much deeper problem. The real scandal is the sheer scale of the short positions—positions that dwarf global annual production and are almost never backed by real metal.

The Physical Reality: A Looming Shortage

While bankers play games with paper, the real world is running out of silver. The amount of silver available for immediate delivery is shrinking fast, and demand is exploding. Solar panels, electric vehicles, artificial intelligence, robotics, and now solid-state batteries are all powered by silver. New battery technology promises to revolutionize the auto industry, with silver-based batteries offering longer range, faster charging, and greater longevity than anything else on the market.

If just a fraction of the world’s vehicles adopted this technology, annual silver demand could consume most of the global supply. And that’s just batteries—silver is also essential for solar panels, medical devices, aerospace, and more.

Why Silver? The Metal That Powers the Future

Silver is the best conductor of electricity, the most reflective metal, and the most malleable and ductile. It is irreplaceable in modern technology, and as the world electrifies, silver’s importance will only grow. Yet, for decades, its price has been held down by a small group of banks and governments who benefit from cheap silver.

The Coming Silver Rush

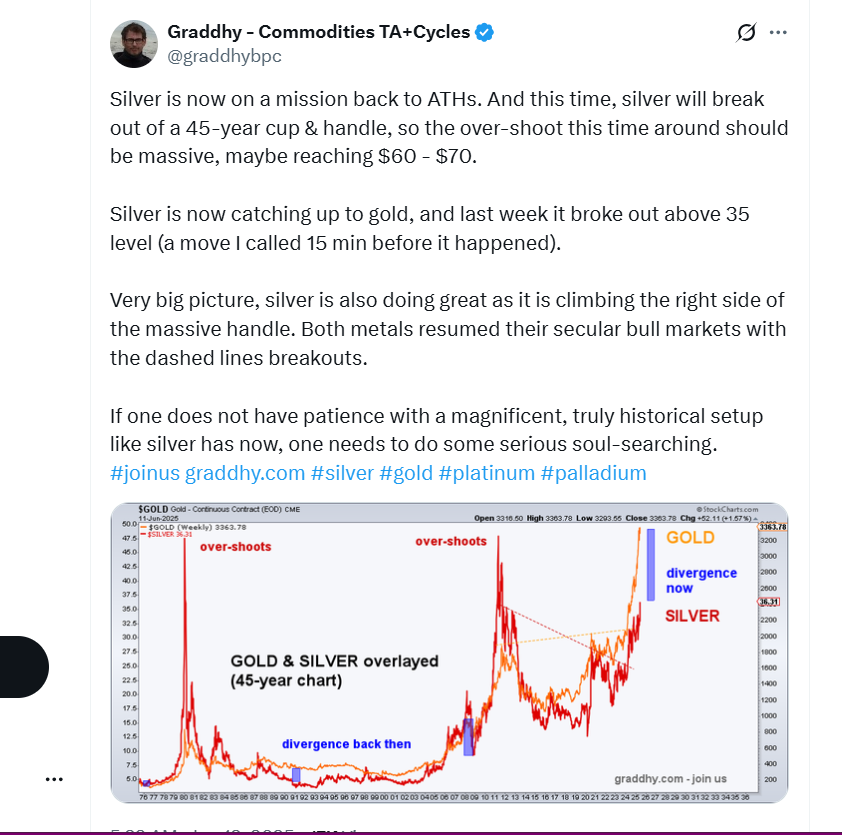

Now, the dam is breaking. Silver has surged past $35, shattering old resistance levels and igniting a bull run. The gold-to-silver ratio is narrowing, and some analysts believe it could return to historic lows. With gold at $3,400, a ratio of 50:1 would put silver at $68—a price that would shock the world and expose the manipulation for all to see.

Nations are already positioning for this surge, buying silver and draining exchanges. Meanwhile, markets in China—where only physical silver is traded—are creating a gap between the “fake” price in the West and the real price in the East.

A Call to Action: The End of the Silver Suppression Era

The time for silence is over. The silver market is a powder keg, and the fuse has been lit. For 244 years, the true value of silver has been hidden from the people. Now, as demand explodes and supply dwindles, the manipulation cannot be sustained.

Investors, citizens, and policymakers must demand transparency and an end to the paper silver scam. The future of energy, technology, and even national security depends on silver. It is time to reclaim this precious metal from the hands of the manipulators and restore it to its rightful place as the people’s money.

As silver resumes its historic bull run, those who lack patience for this magnificent setup may need to do some serious soul-searching. The greatest monetary revolution since the founding of the Republic is underway—and silver is leading the charge.

The secret is out. The time for silver is now.