Summary

- The Silver/Gold ratio is signaling strong potential for a resumption in the short-term rally in commodities, but not a new long-term bull market (yet).

- Silver’s outperformance over gold has offered a tactical trade opportunity, which is ongoing.

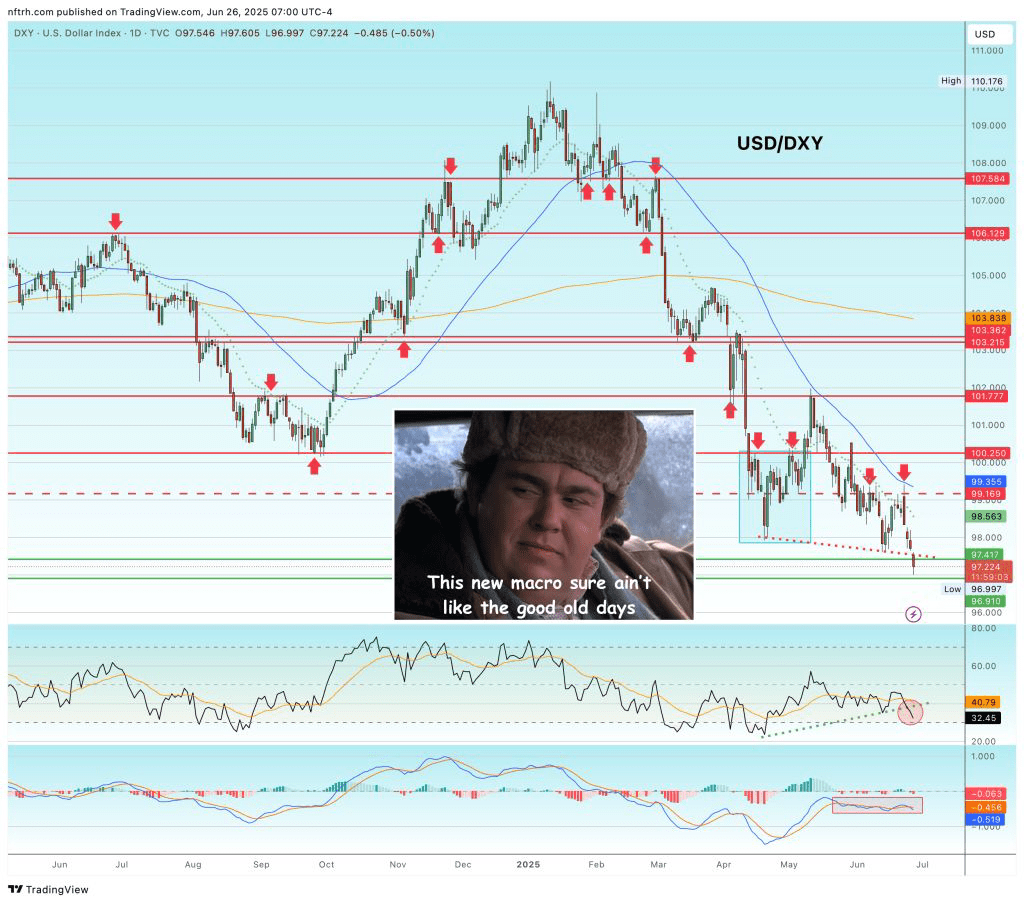

- The US dollar’s weakness and recent commodity price action support the case for a counter-trend move, but wildcards like geopolitics remain in play for certain commodities, like crude oil.

- I expect this commodity rally to be temporary, likely ending with the next market liquidation rather than evolving into a super-cycle.

- We look forward, always. Not always right, but always with logical game plans and strategies.

The Silver/Gold ratio trades, my name for a wider commodity rally, are on the cusp of another leg up

You could call them “inflation trades”, but the post-2021 phase and its heavy inflationary effects * saw commodities generally trend downward as hawkish Fed policy ** supported the US dollar.

So I came up with a new and more accurate way to describe a widespread commodity bull phase; the Silver/Gold ratio trades. When silver leads gold, the indication is that cyclical markets, pumped as they were through the magic of inflationary policy, are still okay.

With the Fed perceived to be in a box, antagonized by pesky inflation signals from the bond market as well as signs of a slowly decelerating economy, the time was probably right for silver to put on a show and take up leadership from gold.

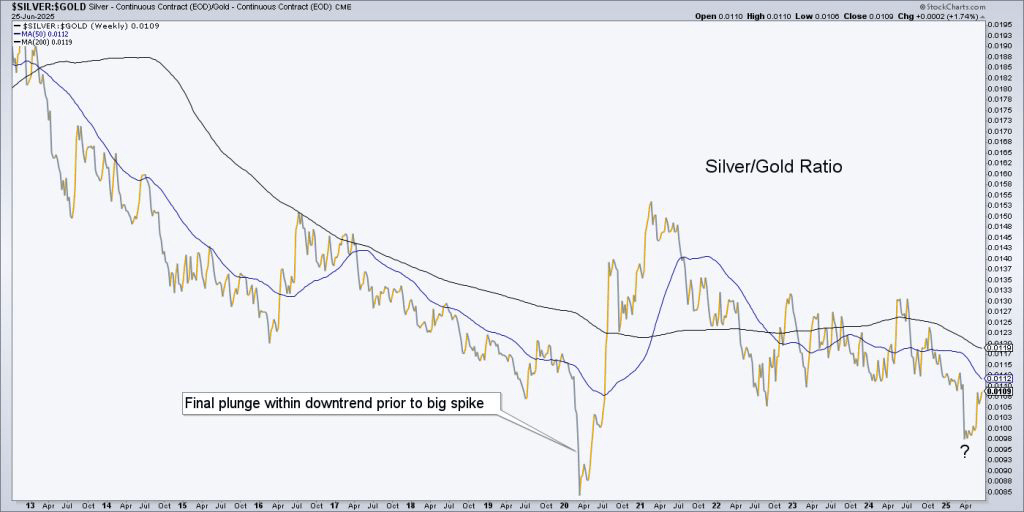

In NFTRH 858 (April 13th) we began watching the chart below, noting the following.

I have a sneaking feeling that silver could make a catch-up move to its big bro. Just a hunch, as this weekly chart of the Silver/Gold ratio (SGR) proves there is little technical basis for it other than sometimes violent moves in one direction (in this case, down) are followed by violent moves in the other direction.

The SGR is thus far getting drubbed in its ongoing weekly chart downtrend. For an example refer to 2020. That tank job was an event driven situation, much like today’s is an event driven situation of a different stripe. If silver were to take leadership in the near-term, I would see it as a relatively short “trade”, not a long phase if the liquidity constrained, deflationary macro view is to play out. If silver were to wait an extended period, such a phase could follow a deflation scare and central bank policy flip to dovish.

It’s worth considering at least, and as you know, I am no raving silver bug. I did initiate PSLV per the update linked above and added a bit more as I contemplated the potential noted just above. If silver were to outperform soon, I’d see it as a trade. If it were to do so after a deflation scare, it could be more structural in line with an inflating macro as central banks and governments do all they can to bring on Inflation/Stagflation.

Silver/Gold ratio (weekly chart) (stockcharts.com)

This current version of the chart updates the situation and still shows an intact downtrend. But the SGR is indeed on message. However, there was no deflation scare and as noted back in April, the implication is for a trade, not a new macro phase. Not nearly yet, anyway.

As a side note, this is the type of “look-ahead” that we do on a weekly basis. I won’t always be right, but I will always be forthright in my efforts to decipher the macro situation at any given point.

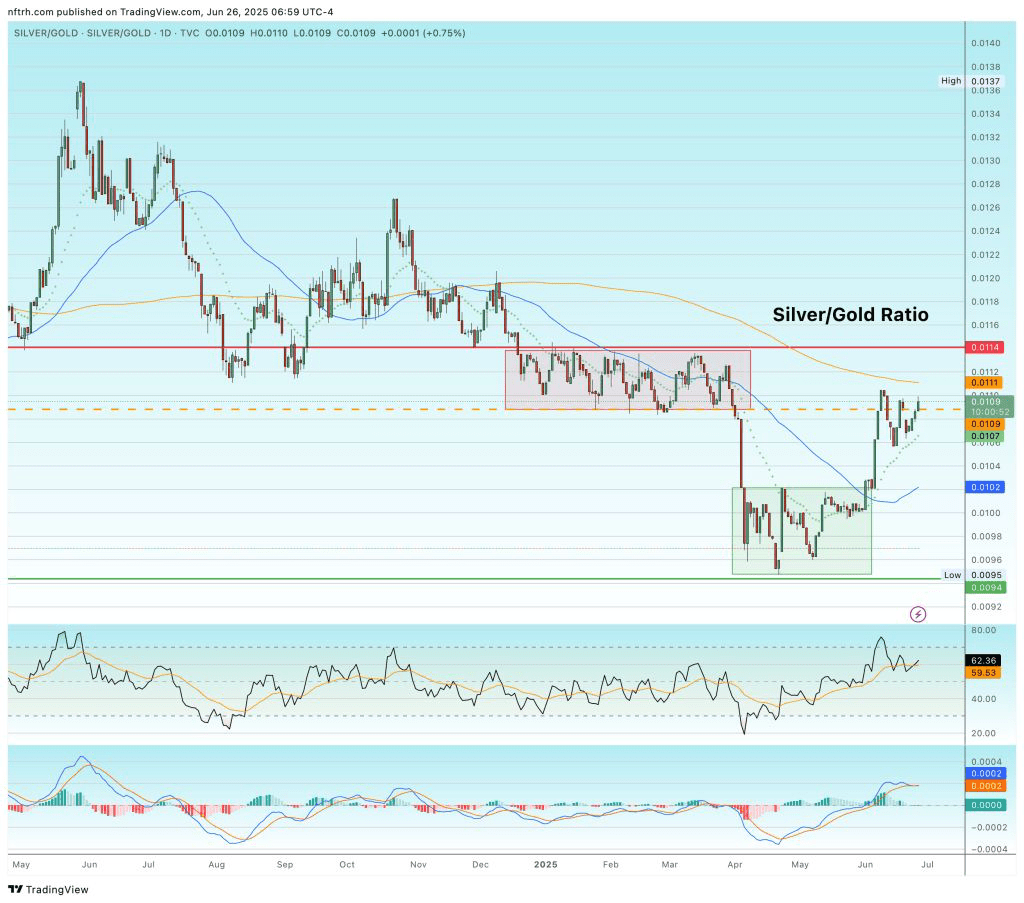

Dialing in the view to a daily chart, our goal for the SGR has been for at least one more leg up and this morning in pre-market at least, the ratio is on plan.

Silver/Gold ratio (daily chart) (Tradingview.com)

US Dollar index (Tradingview.com)

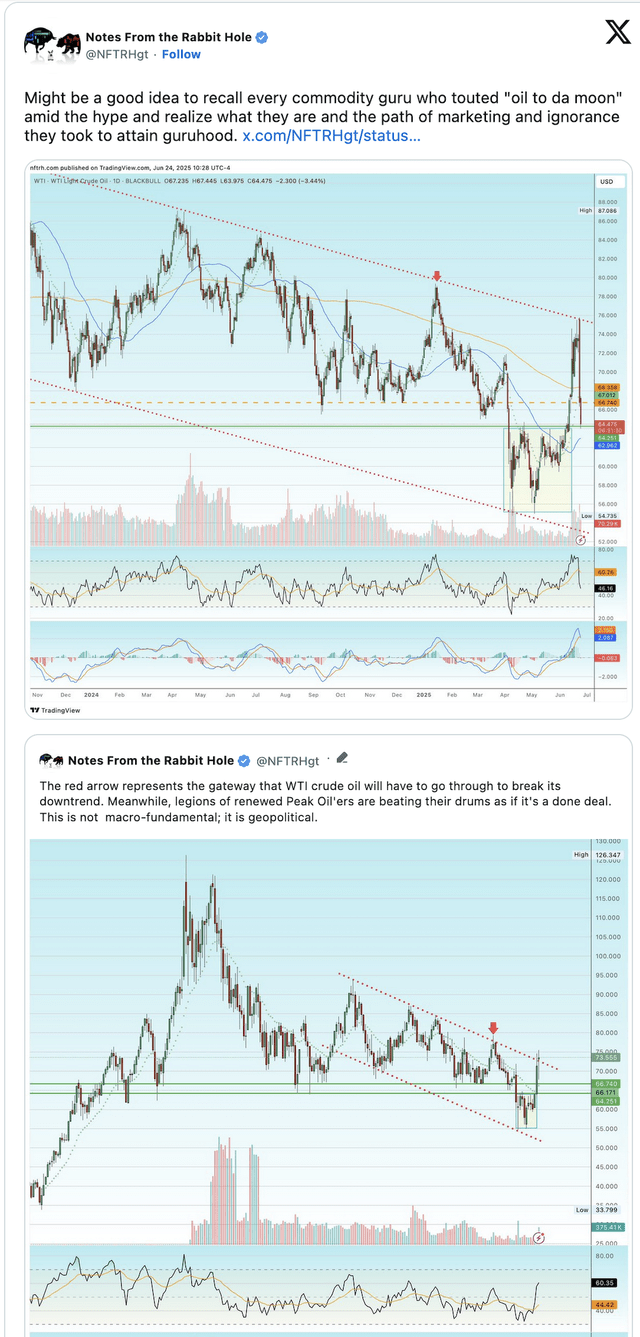

Gary’s posts at X (x.com)

Note that the X posts above did not receive much attention, or at least approval. That could be a sign of how aligned the herds were behind the popular belief, claiming bombing = skyrocketing oil = inflation!

Many people submit to the dogma of ill-conceived macro market analysis. This now public NFTRH+ update did show some real reasons to be bullish on oil back on June 4th.

The decks are again clear for oil to rally, as it has been driven back down to a support area. But there is a spectrum of other commodities out there, from traditional industrial metals to specialty items like Uranium, Rare Earth Materials and Platinum Group Metals. All in varying degrees of rally mode.

If the Silver/Gold ratio takes another leg up, look for that party to continue… and, given our view that this is a trade, not a new “super-cycle” era, probably fail spectacularly at the next market liquidation.

But first things first, a counter-trend rally in the Silver/Gold ratio and a tailwind for the commodity complex.

* The actual inflationary machinery was the Fed/Government combo of monetary and fiscal panic in Q1, 2020.

** Too late as I repeatedly noted at the time.

Gary Tanashian is proprietor of NFTRH.com. Actionable, hype-free technical, macro economic and sentiment analysis is provided in the premium market report ‘Notes From the Rabbit Hole’ (https://nftrh.com/nftrh-premium/). Complimentary analysis and commentary is available at the public website (https://nftrh.com).

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Shared by Golden State Mint on GoldenStateMint.com