The Scorecard

Source: www.stockcharts.com

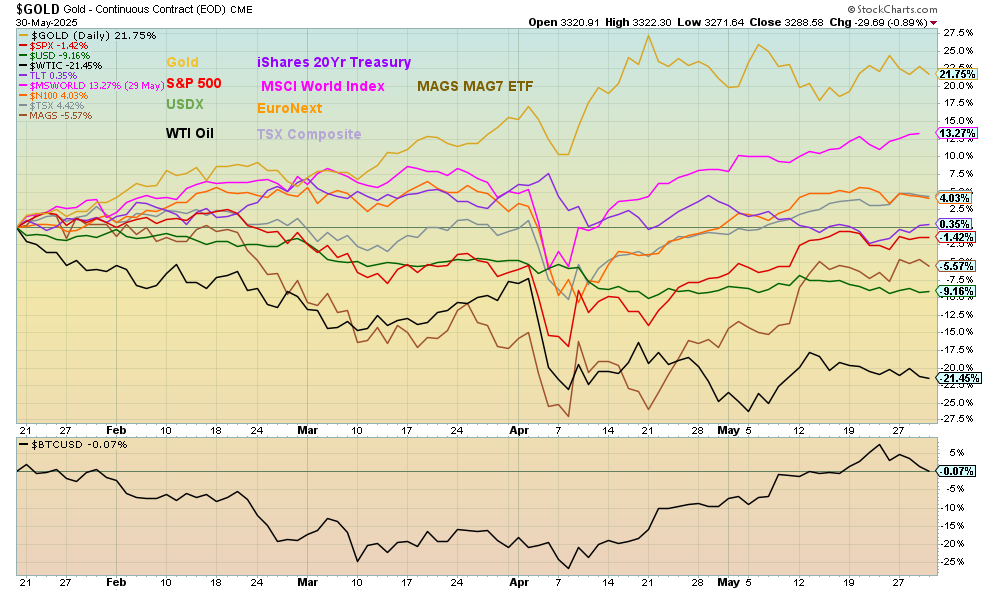

We did a few switch arounds on our Scorecard chart. The EuroNext Index replaces Stoxx Euro 50, the MSCI World Index replaces the Emerging Markets ETF (EEM), and we dropped the iShares MSCI Momentum US, replacing it with MAGS, the MAG7 ETF. All are more well known and we follow them weekly. Gold remains in the lead, up 21.8%, followed by the MSCI World Index, up 13.3%. Notably, MAGS is down 5.6% since Inauguration Day while the EuroNext is up 4.0%. Oil still drags along, the bottom down 21.5%, while Bitcoin after its big rebound is now fading, down about 0.1%.

Gold

Source: www.stockcharts.com

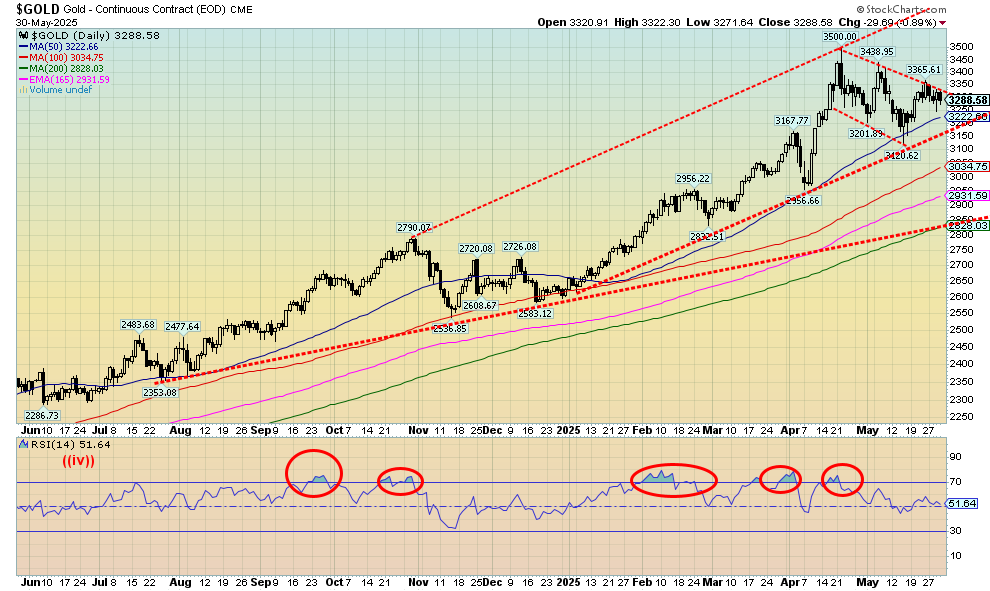

Gold continues its corrective mode. Two things are contributing to our positive thoughts that this is temporary. First, we continue to form what looks to us as a bull flag. Naturally, we await a breakout, preferably over $3,400 as that would suggest to us new highs ahead over $3,500. We need, of course, to hold the downside currently near $3,100. Second, despite the corrective period, both silver and gold stocks are holding in. Gold dropped in total 10.8% thus far from the $3,500 top. But silver fell only 6%, while the gold stocks, as represented by the Gold Bugs Index (HUI), fell 14.9% from its recent top while the TSX Gold Index (TGD) fell 14.7%. All have since rebounded with gold up 5.3%, silver up 4.2%, the HUI up 12.4% and the TGD up 10.0% from their recent lows.

It wasn’t a stellar week for the precious metals. Gold fell 2.0%, silver was off 1.6%, while platinum fell 3.4%. The gold stocks had an off week with the Gold Bugs Index (HUI) up a small 0.1% while the TSX Gold Index (TGD) was off 0.3%. Gold stocks faring better? View that as positive. As for other metals, palladium was down 3.3% and copper down 3.3%. For the record, elsewhere oil continues to be weak with WTI oil down 1.4%, Brent off 3.3%, natural gas (NG) at the Henry Hub up 4.4% and NG at the EU Dutch Hub down 7.3%. The Arca Oil & Gas Index (XOI) was down 0.1% while the TSX Energy Index (TEN) was down 1.6%.

However, our focus continues on gold, the best-performing major asset in 2025 and the best performer since 2000. Yet gold, particularly in North America, remains under-owned and the junior gold mining stocks that dominate on the TSX Venture Exchange (CDNX) also remain grossly under-owned and ultra cheap, despite very good specs in quite a number of cases. That’s why we believe the best is yet to come in the precious metals market. A blow-off phase?

As noted, we are buoyed by what appears to us as a bull flag on gold and an ascending triangle forming on silver. Both patterns are ultimately bullish, but we await a breakout over $3,500 for gold and above $36 for silver. The gold stocks would no doubt follow, if not lead.

Given the chaos and volatility, we noted in our annual forecast gold (and silver and gold stocks) remain our number one pick for 2025. So far, we haven’t been disappointed. As we have so often said, gold is what you want in times of geopolitical uncertainty, economic uncertainty, and loss of faith in government. We have all three.

Disclaimer

David Chapman is not a registered advisory service and is not an exempt market dealer (EMD) nor a licensed financial advisor. He does not and cannot give individualized market advice. David Chapman has worked in the financial industry for over 40 years including large financial corporations, banks, and investment dealers. The information in this newsletter is intended only for informational and educational purposes. It should not be construed as an offer, a solicitation of an offer or sale of any security. Every effort is made to provide accurate and complete information. However, we cannot guarantee that there will be no errors. We make no claims, promises or guarantees about the accuracy, completeness, or adequacy of the contents of this commentary and expressly disclaim liability for errors and omissions in the contents of this commentary. David Chapman will always use his best efforts to ensure the accuracy and timeliness of all information. The reader assumes all risk when trading in securities and David Chapman advises consulting a licensed professional financial advisor or portfolio manager such as Enriched Investing Incorporated before proceeding with any trade or idea presented in this newsletter. David Chapman may own shares in companies mentioned in this newsletter. Before making an investment, prospective investors should review each security’s offering documents which summarize the objectives, fees, expenses and associated risks. David Chapman shares his ideas and opinions for informational and educational purposes only and expects the reader to perform due diligence before considering a position in any security. That includes consulting with your own licensed professional financial advisor such as Enriched Investing Incorporated. Performance is not guaranteed, values change frequently, and past performance may not be repeated.

Shared by Golden State Mint on GoldenStateMint.com