Summary

- Recent deep revisions to jobs data reveal unexpected labor market weakness, making a September Fed rate cut highly likely.

- The most major risk to a rate cut is a sudden spike in inflation, especially in Core PCE, which could force the Fed to hold rates steady.

- Disinflating housing prices and rising home supply are positive signs for inflation, supporting the case for a rate cut.

- GDP appears stable for now, but underlying trade dynamics warrant caution; overall, the Fed is on track to cut rates unless inflation surprises.

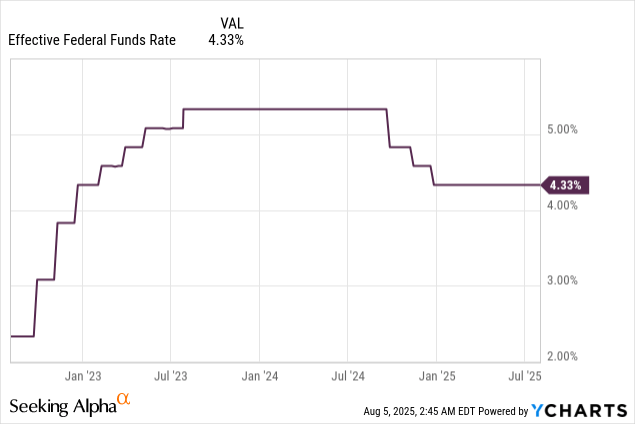

- It seems we are now on track to break the streak of rates pinned at their current “moderately restrictive” level.

Pla2na

Introduction

I’ve been writing about interest rates since I began writing on Seeking Alpha two years ago, which was around the time rates hit their relative peak for this cycle — or at least, that’s my guess so far, we’re not out of the woods yet.

Rates have been consistently held since this year started, after the “hawkish cuts,” or a quick succession of rate cuts, starting with a larger 50bp drop, that allowed the Fed to loosen from peak rates and adopt its “wait and see” approach that has drawn the ire of many who want lower rates, including President Trump, who has been hounding Fed chair Powell for months on the subject.

A Rate Cut is Finally in Sight

Last week, I covered the July 30th Fed meeting, where they held rates again, although we did see some governors break ranks and vote against the committee — two of them did, Bowman (no relation) and Waller. It was notable because it was the first time since 1993 that the FOMC voted in such a level of disunity, even if the final vote was still 9-2.

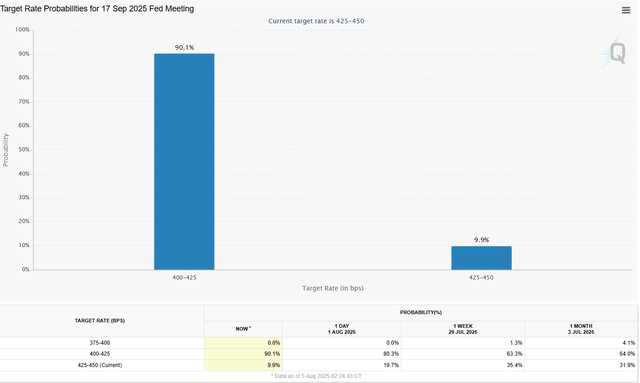

That jobs report that caused the market to fall on Friday, the day after the Fed meeting, really shook up the futures market. They went from predicting a 35.4% chance of no rate cut at the next Fed meeting in September a week ago to only a 10% chance. The other 90? All pointing toward a 25bp cut.

In that article, I wrote:

A sharp turn in data, like an outward weakening of the labor market…could sway [the 35% chance of rate cuts]…

I expect that we will see a cut in September still, but that may be the only one for the rest of the year, assuming that the economy continues on its current path. It’s just too strong to consider reducing rates and inviting inflation back…

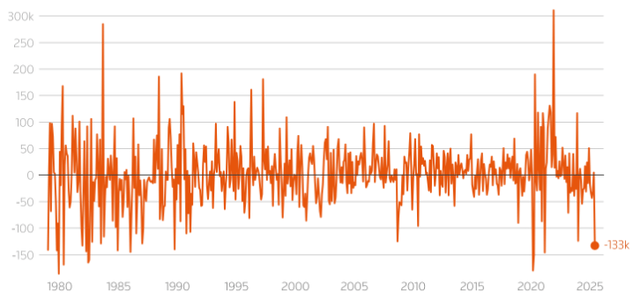

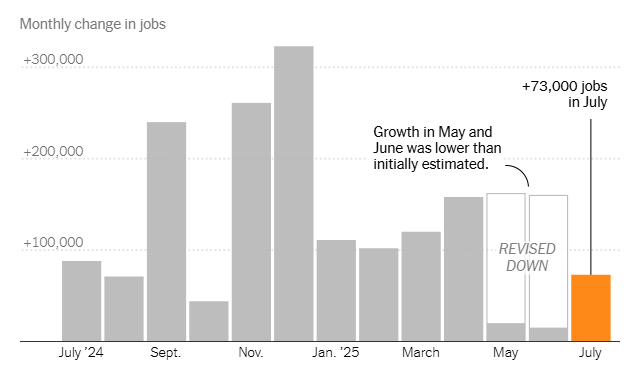

I didn’t expect the market to change so suddenly, but really — few did. That’s why the deep revisions to the job cuts caught the market by surprise and caused the sell-off on Aug. 1st. The labor market we thought we had turned out to be far weaker, with a subtraction of 257,000 jobs from the prior two months.

Christine Zhang, New York Times

Comparing it to prior jobs revisions, we see that this one was unusually large, the largest since the COVID-19 pandemic. Before that? During and after the GFC.

That might sound like I’m predicting doom for the economy, but that’s not the case. Revisions this deep are not necessarily signs of recession, though they do tend to happen during those times. No — they are signs of business uncertainty. We know that businesses are deeply uncertain due to a number of political issues, like the unknown tariff situation that has been developing and changing quickly. With the US-China deal still being negotiated, there is a lot of tension still in the air.

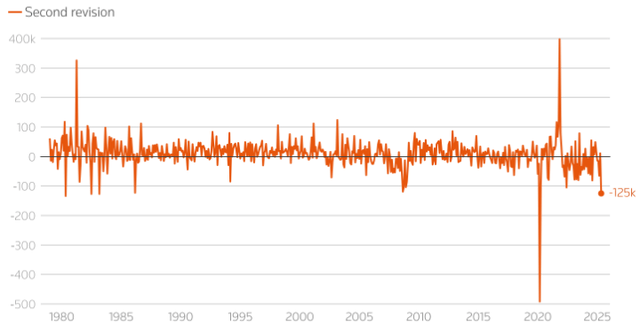

What was also surprising was the size of the second revision to May. The BLS typically does two revisions to each month, and the revision is down far more than it is up. However, second revisions tend to be much smaller in scale. Not this one. Excluding the pandemic revision of 500,000 jobs (ouch!), the second revision for May was the worst we’ve seen since 1983.

Suddenly, the labor market is far weaker than we thought. That will provide the Fed the ammunition they have been wanting, and saying in their statements and pressers over and over again — the labor market is too strong to cut rates.

For the record, this isn’t the first warning signs I’ve seen from the labor market. Recently, I wrote about prime-age employment stats, and I recommend checking that out to see some of the data that doesn’t make it to the headline jobs reports. There is some provenance to this revision that isn’t just businesses overreacting to politics or uncertainty in trade policy. It goes deeper than that and has been forming for longer than President Trump has been in office.

The Reason I Could Be Wrong: Inflation

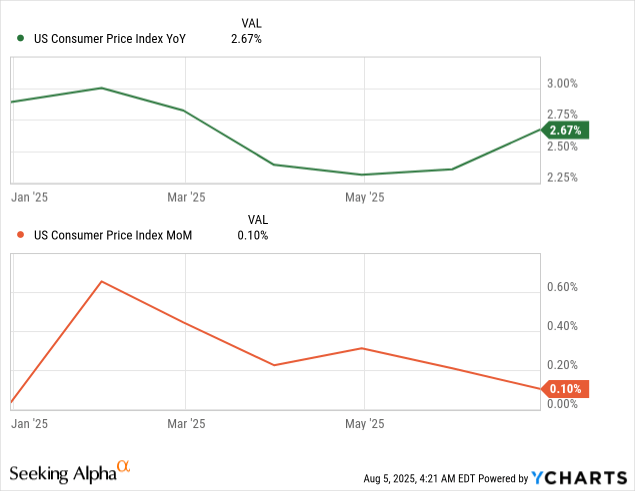

There are inflation reports between now and the next Fed meeting, and terrible reports could cause them to hold steady even in the face of this weakening labor market. Despite all the weakness we see, that could be brushed aside if inflation jumps.

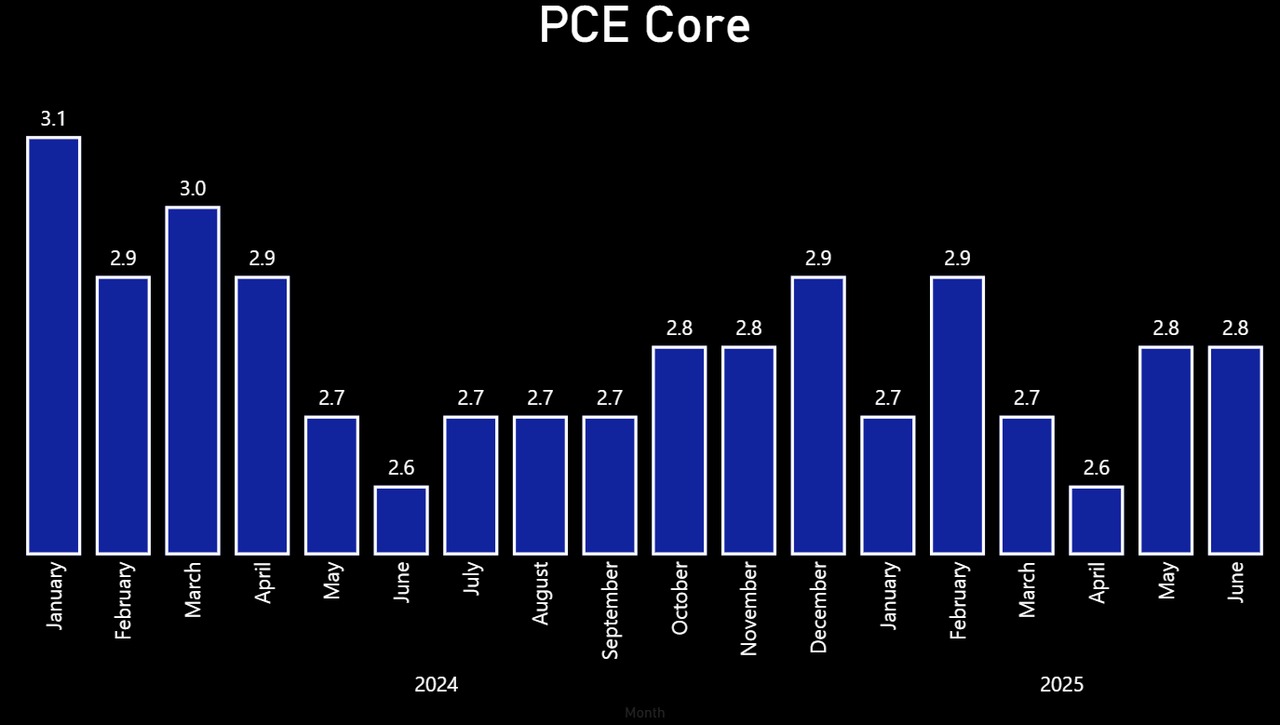

If inflation jumps back above 3%, we should expect to see those Fedwatcher futures plummet back down to no cut. CPI jumped in June, but that doesn’t mean it will keep its pace up. A positive trend in CPI is usually a point of concern, even if it’s short-lived.

Core PCE, personal consumption expenditures (the Fed’s preferred inflation gauge to the more commonly used CPI) less food and fuel, show a rate in line with the months prior to the hawkish cut, which doesn’t inspire too much confidence.

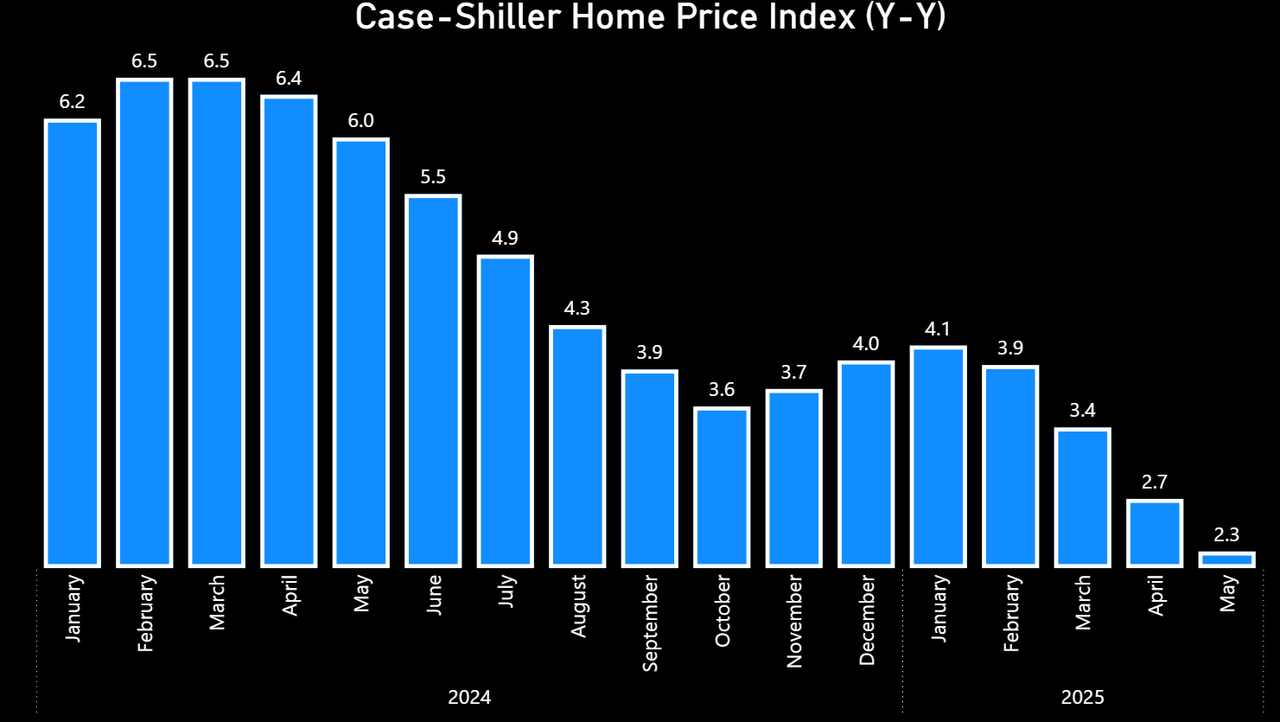

Looking at housing in particular, because shelter has been one of the standout pieces of inflation over the last few months, and we see positive data. Home prices are starting to disinflate, especially compared to the 2024 price gains in the Case-Shiller Home Price Index.

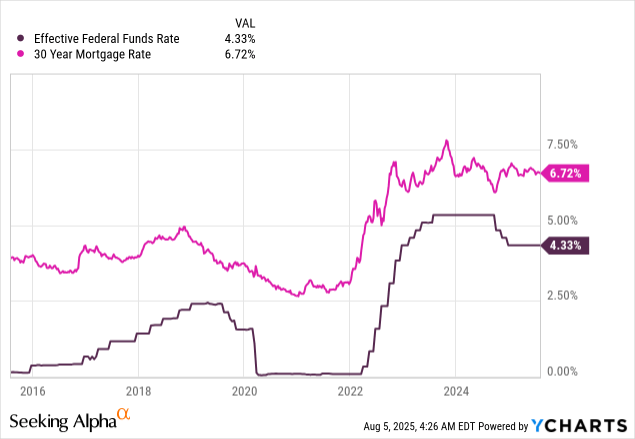

Because interest rates have been pinned so high — “moderately restrictive” as they say over at the Fed — mortgage rates have been very high. While the Fed doesn’t directly control mortgage rates, they do have a hand in them. We can see it very clearly in this next chart.

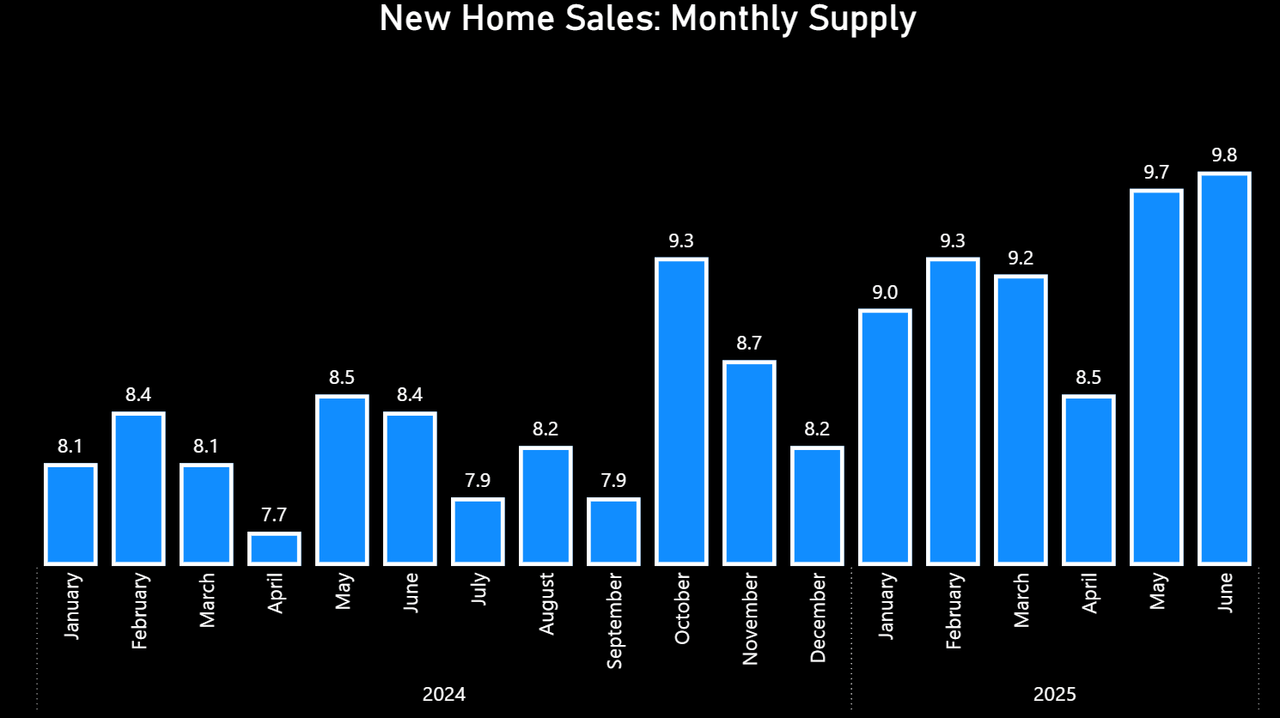

When mortgage rates fell below 3% a few years ago, people went refinance crazy, for good reason. This means that folks who want to move homes would have to ditch their really cheap, fixed-rate mortgage for a far more expensive one. That’s not a winning proposition for many, and is one of the causes of home inventory stagnation over the last few years. That trend is starting to break, and we’ve now got two successive months of increasing supply, which is surely helping the price disinflation. If these trends continue, that would be a positive for inflation figures, and could be one of the reasons we see inflation continue to level out.

A Note on GDP

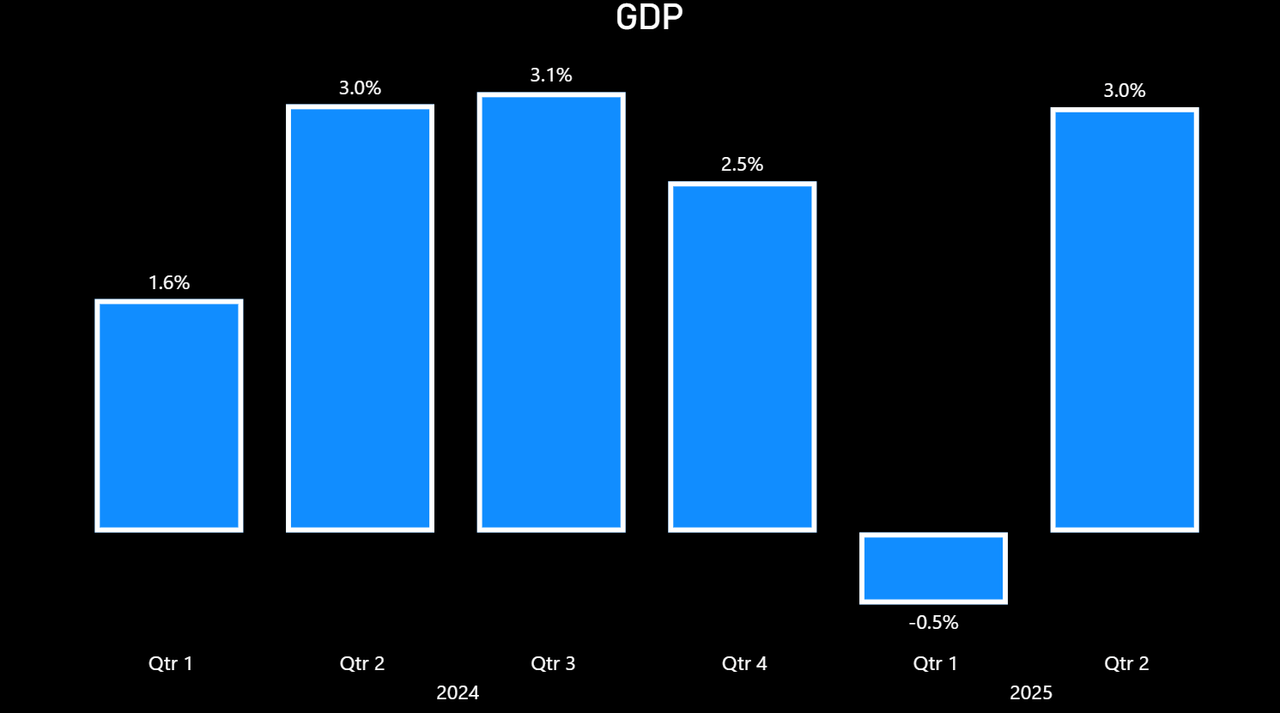

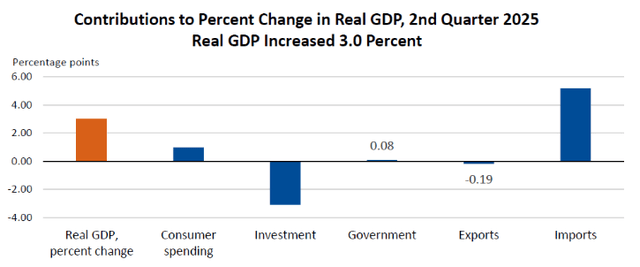

GDP recovered nicely from the import frenzy that caused Q1 to be negative. However, the 3% gain we see is largely driven by the opposite problem, where imports are unusually low.

This makes sense, as the Q1 frenzy was designed to raise inventories so that businesses could ride out the tariff chaos. They are doing that currently, and so are importing less. For now, GDP data is looking fine, and we will need to wait until the import levels even out before we really evaluate where GDP is headed. Note how much the net exports category contributed to GDP in Q2.

Conclusion

Ultimately, we are now on track for the Fed to cut in September. While I believed that this has long been the plan, weakness in the labor market due to the unexpected and deep jobs revisions for May and June now assure a rate cut.

The only thing that thwart my thesis and force the Fed to stay its hand again is another jump in inflation, particularly in Core PCE. However, trends like disinflating housing prices and rising supply show that we may be in for more neutral reports. I don’t expect CPI or PCE to fall much more without cause, especially as businesses across the supply chain continue to prepare themselves for known tariff rates (at least with the EU, Japan, UK, and a few others). Watch those reports closely, because that is the key to derail the rate cut. Otherwise, it’s coming, and needs to after these last reports.

Thanks for reading.

Analyst’s Disclosure:I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Shared by Golden State Mint on GoldenStateMint.com