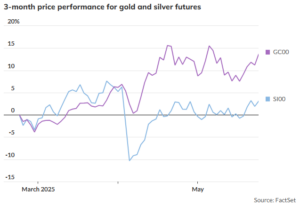

Gold and silver futures have fallen roughly 4% from their highs this year. Photo: Getty Images

Gold and silver futures have fallen roughly 4% from their highs this year. Photo: Getty Images

Gold’s record run has left silver behind, and although the white metal hasn’t played catch-up as quickly as many investors had expected, the price ratio between the two metals has held firm near historical highs, and silver faces a global deficit for fifth straight year. That suggests silver is still undervalued.

Gold and silver are correlated, but “gold is the better hedge and diversifier, especially in times when growth risks are ramping [up],” said Peter Grant, vice president and senior metals strategist at Zaner Metals.

Renewed fears around economic and financial stability provided a boost to gold as a haven asset last week, but those same worries dulled the outlook for silver as an industrial metal.

Gold based on the most-active futures contract posted a climb of 5.6% last week, while silver futures tacked on a more modest 3.9%, according to Dow Jones Market Data.

There are times when silver can be more volatile than gold, Grant said, pointing to early April as an example. Silver prices plunged more than 15% from April 2 to April 4, following President Donald Trump’s “liberation day” tariff announcement. Gold, meanwhile, fell roughly 4% during that same period.

“Demand destruction on the industrial side can overwhelm heightened investor interest, and silver underperforms,” Grant said.

Gold futures climbed as high as $3,509.90 an ounce on April 22 to mark the highest price on record but have declined by just over 4% since then in what looks to be a “cool-off from an overheated rally,” said Peter Spina, founder and president of investor websites GoldSeek.com and SilverSeek.com.

A pullback in gold can hit silver prices in a “more amplified manner,” but Spina said he continues to see an opportunity to “snap up some silver at a better price” — and quickly, as the price tends to return higher, too.

That’s especially true given that silver is suffering from a global structural market deficit, he said. Global silver demand was expected to top silver supply for a fifth year in a row in 2025, according to the Silver Institute.

Gold-silver ratio

While gold and silver prices have been volatile in recent weeks, the price ratio between the two — the number of ounces of silver needed to buy one ounce of gold — has held relatively steady recently at a key level at or near 100.

That ratio averaged 84.8 from 2023 to 2024, David Wilson, director of commodities strategy at BNP Paribas, wrote in a May 14 note. BNP Paribas forecasts that ratio to remain largely in a higher range of 100 to 110 as “global macro uncertainty stemming from U.S. tariffs hampers silver upside, but supports gold” through the second half of the year.

Still, Wilson said there is upside risk to price expectations for silver if investor appetite for risk assets returns on significantly reduced trade tensions, which could lead silver to outperform gold. BNP Paribas forecasts an average 2025 price of $33.20 an ounce for Comex silver.

The key downside risk for prices, meanwhile, would be a failure of the main parties in the trade war to conclude “meaningful” trade deals once current tariff pauses have lapsed, Wilson said.

For now, at around 100 and higher, the gold-silver ratio is “flashing to the market that there is a sale on silver,” said GoldSeek.com’s Spina.

However, that ratio is down from its peak this year.

The gold-silver ratio peaked at 106 to 1 after the stock-market selloff in April, said Stefan Gleason, president and chief executive officer at Money Metals Exchange. But at current levels, he believes “silver is a major bargain for those with a medium to long-term investment horizon.”

‘Silver is a major bargain for those with a medium to long-term investment horizon.’

— Stefan Gleason, Money Metals Exchange

“The ‘Sell America’ trade is still on,” he said. “That’s giving gold and silver a tailwind.”

Given all the love gold has enjoyed lately from central banks, institutional investors, Asian investors and others, Gleason said he does not rule out more gold outperformance versus silver, “especially if we see a liquidity event in the credit markets or a general stock-market crash.”

Moody’s on May 16 downgraded the U.S. government’s credit by one notch, to Aa1 from Aaa, boosting gold’s haven appeal and contributing to gold’s rise for the week that ended May 23.

Zaner Metals’ Grant, meanwhile, told MarketWatch that the current gold-silver ratio near 100 suggests that silver is undervalued relative to gold.

That may signal a buying opportunity, he said, but silver has “struggled on upticks above $33.” He expects to see more “range trading” for silver, for now.

If trade and growth risks moderate further, Grant said he expects silver to start overperforming versus gold, which would bring the gold-silver ratio down. He sees that as the more likely scenario.

Change in correlation

Lately, silver has been moving more in tandem with the stock market than gold has been, said Money Metals Exchange’s Gleason.

That’s not unusual, given that silver is a more “economically sensitive” metal, he said, noting that “silver’s price action often looks like a blend between gold and copper.”

Grant, meanwhile, said that if investors are looking for a “hedge or wealth-preserving asset,” they should focus more on gold. Although silver also serves as a precious metal, it is increasingly becoming a “speculative asset more akin to copper than gold,” he said.

The recent rise in the gold-silver ratio suggests that the two metals are “becoming less correlated,” he said. At the same time, copper and silver are becoming “increasingly correlated due to shared supply and demand factors” driven by technological and electrification trends.

He pointed out that silver is a byproduct of copper mining. With global copper indicating a surplus of 289,000 metric tons for this year, according to the International Copper Study Group, production may not be as much of a priority.

That may lead to an even larger supply deficit in the silver market, Grant said.

That could be bullish for silver prices, pushing the gold-silver ratio back toward the 25-year average, which is around 68 ounces of silver to buy one ounce of gold, he said.

Written by Myra P. Saefong of MarketWatch

SilverSeek.com, Silver Seek LLC makes no representation, warranty or guarantee as to the accuracy or completeness of the information (including news, editorials, prices, statistics, analyses and the like) provided through its service. Any copying, reproduction and/or redistribution of any of the documents, data, content or materials contained on or within this website, without the express written consent of SilverSeek.com, Silver Seek LLC, is strictly prohibited. In no event shall SilverSeek.com, Silver Seek LLC or its affiliates be liable to any person for any decision made or action taken in reliance upon the information provided herein. Full disclaimer and disclosure on conflict of interests

© 2003 – 2025 SilverSeek.com, Silver Seek LLC

Shared by Golden State Mint on GoldenStateMint.com