The US economy contracted for the first time in three years to start 2025, as a surge in imports dragged down GDP and prices increased more than forecast.

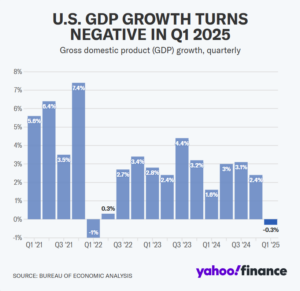

The Bureau of Economic Analysis’s advance estimate of first quarter US gross domestic product (GDP) showed economic growth contracted at an annualized rate of 0.3% during the year’s first three months, more than the 0.2% decline expected by economists surveyed by Bloomberg. The reading came in significantly lower than the 2.4% rate of growth seen in the fourth quarter of 2024.

This marked the first quarter of negative GDP growth since the first quarter of 2022.

“While a decline during an expansion is unusual, it’s not unheard of and the economy isn’t in a recession,” Oxford Economics chief US economist Ryan Sweet wrote in a note to clients on Wednesday.

The decline was driven by a large surge in imports, which are a subtraction in the calculation of GDP. Imports surged at an annualized rate of 41.3% in the first quarter as companies front-loaded orders ahead of anticipated tariffs from the Trump administration. The surge in imports was good for a -5% contribution to the GDP calculation in the first quarter.

Final sales of goods to domestic purchasers, another sign of demand in the economy, grew at a 3% annualized rate in the first quarter, above the 2.9% seen in the fourth quarter of 2024.

The “core” Personal Consumption Expenditures index, which excludes the volatile food and energy categories, grew by 3.5% in the first quarter, above with estimates for 3.2% and above the 2.6% seen in the prior quarter.

The report measures economic activity through the first three months of the year ending in March, meaning it covers how the US economy functioned ahead of President Trump’s tariffs but not after the president’s April 2 announcements, increased the effective tariff rate to its highest level in more than a century.

Economists and the Federal Reserve have been anticipating tariffs to push inflation higher and weigh on economic growth in the coming quarters.

Stock futures fell following the release as investors digested the quarterly economic growth update and a weaker-than-expected reading of private payroll additions for April. Data from ADP showed private payrolls grew by just 62,000 in April, far fewer than the 115,000 expected by economists.

S&P 500 futures (ES=F) slid 1.3%, while those on the tech-heavy Nasdaq 100 (NQ=F) dropped 1.8%.

Dow Jones Industrial Average futures (YM=F) sank 0.8% after the blue-chip index notched its longest win streak of 2025 on Tuesday.

A general overall view of a United States flag on the field as saxophonist Michael Phillips performs the national anthem before the game between the Arizona Cardinals and the Los Angeles Rams at SoFi Stadium. (Credit: Kirby Lee-Imagn Images)

· USA TODAY Sports via Reuters Connect / Reuters

Josh Schafer is a reporter for Yahoo Finance. Follow him on X @_joshschafer.

A general overall view of a United States flag on the field as saxophonist Michael Phillips performs the national anthem before the game between the Arizona Cardinals and the Los Angeles Rams at SoFi Stadium. (Kirby Lee-Imag

Shared by Golden State Mint on GoldenStateMint.com