Summary

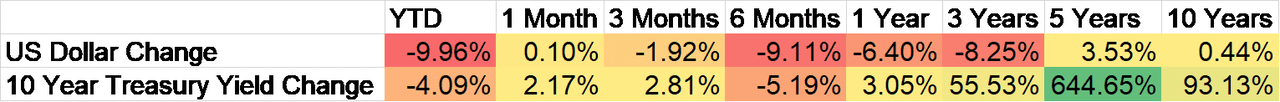

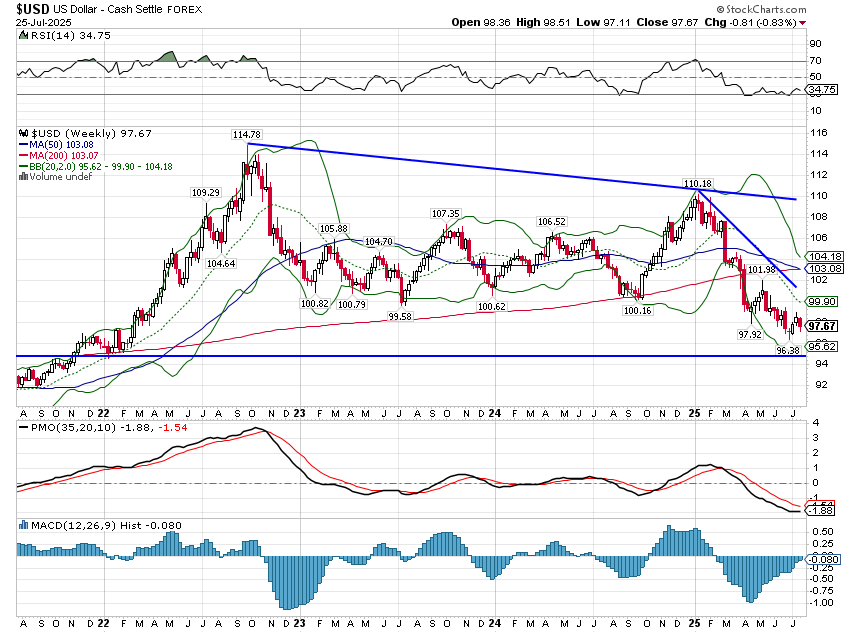

- The dollar had a rough week, down 0.83%; the rally that I said last week looked like it might be the start of a correction of the downtrend, faded fast.

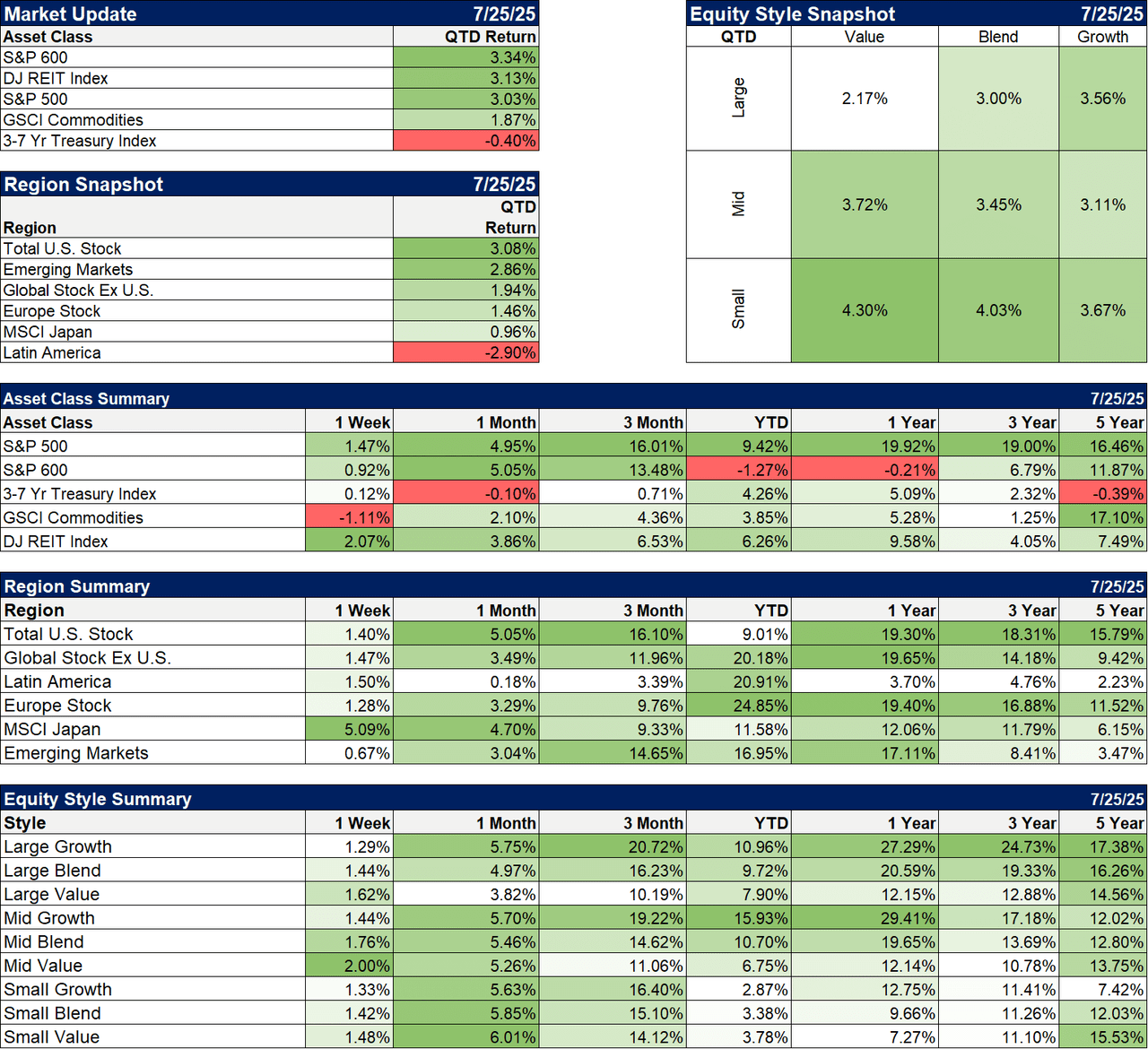

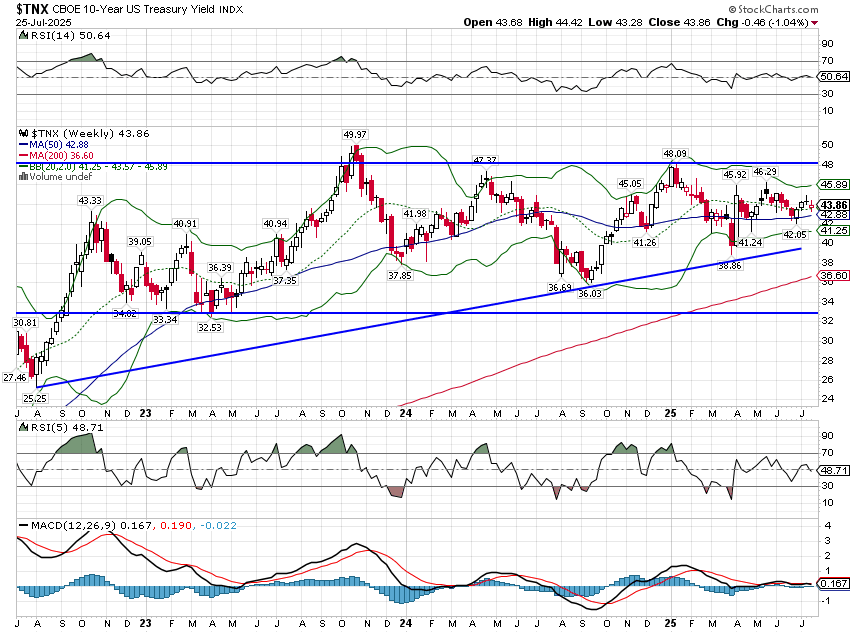

- The first month of the quarter will be done next week, and so far the only losers are bonds.

- The leading sectors YTD are industrials (+18.3%), technology (+13.1%) and utilities (+13.2%), which I think can be translated as “AI” – build data centers, install technology, turn on the power.

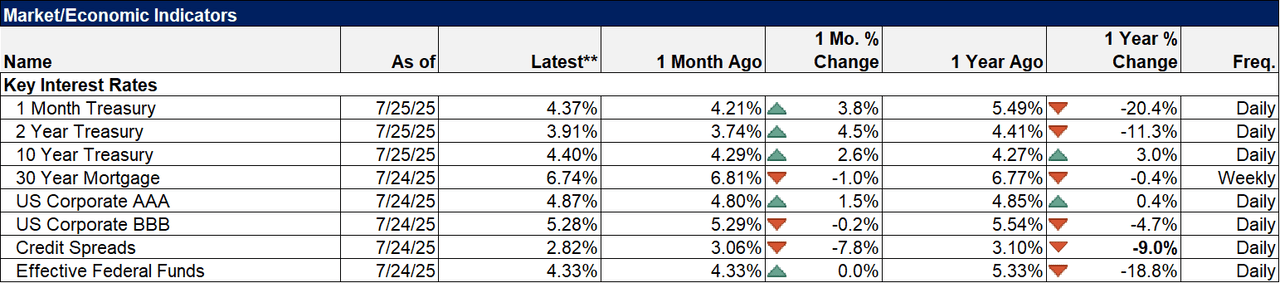

- Credit spreads have narrowed again as risk appetite has picked up and are now just about 25 basis points from their tightest reading this economic cycle.

- The economic data recently has been softening slightly. It isn’t anything dramatic, and it’s just a few items, so it’s more of a vibe than anything concrete.

So if you think your life is complete confusion

Because you never win the game

Just remember that it’s a grand illusion

And deep inside we’re all the same

We’re all the same

So if you think your life is complete confusion

Because your neighbors got it made

Just remember that it’s a grand illusion

And deep inside we’re all the same

Styx, The Grand Illusion

Money illusion is a term coined by Irving Fisher in his book Stabilizing the Dollar and popularized by John Maynard Keynes. Fisher’s book The Money Illusion, published in 1928, expounded on the subject. Money illusion is a cognitive bias in which money is thought of in nominal, rather than real, terms. The face value of money (nominal) is mistaken for its purchasing power (real), anchored at a previous point in time. Unfortunately, the purchasing power of modern fiat money degrades over time, so a millionaire today is not what it once was. President Trump illustrated the term perfectly last week during a short interview:

“So when we have a strong dollar, one thing happens: It sounds good. But you don’t do any tourism. You can’t sell tractors, you can’t sell trucks, you can’t sell anything”.

“It (a strong dollar) is good for inflation, that’s about it.”

“Now it doesn’t sound good, but you make a hell of a lot more money with a weaker dollar – not a weak dollar but a weaker dollar – than you do with a strong dollar”

“It makes you feel good. I love strong dollars.”

Making “a hell of a lot more money” doesn’t mean much if that money doesn’t buy as much as it once did. The President devalues the benefit of a strong dollar, saying that “it is good for inflation, that’s about it” but it is much more than just its impact on the CPI. A strong dollar is good for America because it allows us to buy more of what we need, to produce more of what we want, at prices we can afford. A weaker dollar may reduce the price of American goods in other currencies’ terms, which might allow American companies to sell a higher volume of their products to foreigners. The illusion is the belief that the only thing that changes is the price of US goods for export, but the cost side of the ledger isn’t immune from a weak dollar. Over half of our imports are intermediate goods, inputs used to manufacture final products, and a weaker dollar means that all of those inputs will be more expensive. The ability to buy more stuff with the same number of dollars is the essence of economic growth (productivity) and literally the goal of capitalism. A strong dollar has the same effect, it is a rise in purchasing power, and you get it by having an economy worthy of it. A weak dollar does the opposite, it is a loss of purchasing power. Why would we want that? Free lunches are always an illusion.

The administration creates the illusion of success, of progress by announcing trade deals with other countries that aren’t worth the paper they’re written on, mostly because, at least so far, there doesn’t seem to be anything written down. The President and others in his administration make claims about the deals that are often interpreted quite differently by the other country involved. President Trump announced a trade deal with the UK on May 8th, but there is still no formal documentation of it, merely an executive order that defines the “general terms” of the agreement. Questions have already arisen about parts of the “deal”, specifically on the President’s later announced global tariffs on steel and aluminum. The UK thought they would be spared those, but now additional conditions and quotas have been attached to the previously announced “deal”.

On July 3rd, the President announced on his social media platform that he had reached a trade deal with Vietnam, one that imposes 25% tariffs on Vietnamese goods shipped to the US. That was, apparently, quite a surprise to the Vietnamese, who thought they had negotiated a rate of 11% only to have the President change it at the last moment. As of now, three weeks after the announcement, there is no formal documentation, not even a press release from the Vietnamese side. President Trump announced a trade deal with Japan last week and touted a “Japanese/USA investment vehicle” worth $550 billion that will be deployed “at President Trump’s direction” into key American sectors that include energy infrastructure and production, semiconductors, critical minerals, pharmaceuticals, and shipbuilding, according to a “fact” sheet released by the US. The US, according to the press release, would retain 90% of the profits, which was immediately disputed by the Japanese who said profits would be split based on “the degree of contribution and risk taken by each party”. The “deal” calls for 15% tariffs on Japanese goods, including autos, but Treasury Secretary Bessent said that “if the president is unhappy, then they will boomerang back to the 25% tariff rates, both on cars and the rest of their products”. It’s almost like the US side doesn’t want to sign an actual agreement. Japanese trade negotiator Ryosei Akazawa said:

“In my past eight trips to the United States during which I held talks with the president and the ministers, I have no recollection of discussing how we ensure the implementation of the latest agreement between Japan and the United States.”

The Japan deal was touted by the President as the biggest ever and very favorable to the US, but US automakers are already objecting, saying:

…any deal that charges a lower tariff for Japanese imports with virtually no U.S. content than it does North American-built vehicles with high U.S. content is a bad deal for the U.S. industry and U.S. auto workers

GM (GM) reported recently that tariffs cost them $1 billion in profit in their latest quarter (about 19% of their pre-tariff profit), while Stellantis (STLA)(Chrysler, Jeep) said it expects to lose $2.7 billion from tariffs in the first half of 2025. Of course, with so many tariffs on so many countries on so many things like auto parts, steel, aluminum and maybe copper and with those tariffs changing frequently, it is impossible to say whether US or Japanese auto companies have the better deal. But this is what happens when you start “protecting” sectors of the economy – the protected are always in favor of more protection and will object to anything that might lower the barrier to foreign competition. So what happens now? Will the President now offer concessions to US automakers? Or will he change the terms of the deal before anything is signed? No one knows and the market now just seems to ignore anything on trade coming from the White House economic team. How seriously can anyone take someone like Commerce Secretary Howard Lutnick when he says things like this:

“Whatever Donald Trump wants to build, the Japanese will finance it for him. Pretty amazing.”

Does anyone really believe that Japan – or any other country – would just hand over $550 billion or 10% of its GDP to a US President to spend as he sees fit? And let him keep 90% of the profits for himself? It is absurd on its face. Here’s something else that no one believes – that the tariffs are in any way permanent. Does anyone else find it odd that there has been no mention of the need for Congress to approve this or any other “deal” the President strikes under the emergency powers he has claimed? While Congress has, through several laws, ceded some of its powers on trade to the executive branch, none of them allow the President to commit the US to actual permanent trade agreements without Congressional approval.*

Investors have, at this point, just tuned out the administration on almost all economic policy, except one. Speculation is rampant these days with meme stocks and SPACs making a comeback, margin debt at an all-time high, cryptocurrencies, stablecoins and crypto treasury companies in a frenzy over the recent GENIUS Act (which is another illusion promoted by Secretary Bessent that I’ll save for another day), short-term option volume (0 days to expiration which is as short term as you can get) hitting new highs, call option volume (bets on a rising market) surging while the cost of hedging downside risk hits near all-time lows, high-yield credit spreads almost all the way back to their tightest for this cycle and not far from the dot com boom lows, all while the S&P forward P/E has touched a level only seen 7% of the time in the last 40 years. Do you think this has anything to do with President Trump making sure everyone knows the next Fed chairman is going to love low interest rates?

I don’t know when the fever will break but I am sure that it will and I’m sure of a few other things too. Meme stocks are not a reliable way to build wealth despite all the articles about people who have scored big betting on companies with questionable (and that is generous) fundamentals; they don’t write articles about the losers until the frenzy is over. Bitcoin (BTC-USD) still doesn’t have a viable use case after trading for 16 years. Stablecoins are nothing more than a convenient way to transfer interest payments from the individuals who hold the cash to those who run the stablecoins. And stablecoins will not, as Bessent continues to claim, increase the net demand for Treasuries and reduce interest rates (unless they are bought with money that has – literally – been buried in someone’s backyard). Companies copying MicroStrategy’s (MSTR) bitcoin idiocy will never produce anything of value except the liquidity they are providing for OG bitcoin holders. SPACs – or blank check companies as they were once called – will continue to be the province of scammers and high finance wannabes. High-yield bonds bought at these spread levels will always be a bad deal over any reasonable investment time line. Options trading is still a zero-sum game where one winner means one loser. Tariffs will always be a net negative for the economy. Margin debt will always be a bad idea for retail traders but a great deal for their brokers. And there are no free lunches. Ever.

Someday soon we’ll stop to ponder what on earth’s this spell we’re under

We made the grade and still we wonder who the hell we are

Joe Calhoun

*Trade treaties are not like other treaties that require the advise and consent of the Senate, but it has been broadly accepted that the US may enter into trade agreements with other countries via “congressional-executive agreements,” which are negotiated by the President and approved—either in advance or afterward—by Congress. That’s how all the big free trade agreements – which really aren’t free trade – such as NAFTA have been approved. Since the Constitution vests Congress with the power to regulate foreign commerce and impose tariffs, it is doubtful that the President may enter into trade agreements via “sole executive agreements,” which are not approved by Congress.

Environment

The dollar had a rough week, down 0.83%; the rally that I said last week looked like it might be the start of a correction of the downtrend, faded fast. With the ECB on hold and the Fed likely cutting in August – an obvious bullish sign for the Euro – the dollar may just keep fading lower. Trump’s confusing comments last week didn’t help.

Bonds continue to mark time, waiting for… the Fed? Tariff certainty? The 10-year Treasury yield has traded in a 50 basis point range since the tariffs were paused so maybe we’ll get some movement next Friday when the pause is officially over – unless the President extends it again. Or maybe the bond market just reflects the extreme uncertainty of its participants about the impact of tariffs, immigration and the budget bill. I’ve read more of the budget bill than most and I know what is going on with tariffs as much as anyone and everyone knows that immigration has ground to a halt, but I have no idea what the overall impact of all these big changes will be. The budget bill has some positive growth items but it also has some really dumb industrial policy embedded in it and who knows what impact the increased deficit will have on interest rates. If the budget bill is a positive for growth overall, it doesn’t appear to be a large effect. The tariffs are an obvious negative – they have been every time they’ve been tried and this time won’t be different – and immigration is as well but are they negative enough to overwhelm any positives from the budget bill? No clue. And I think that’s probably the same way bond traders feel right now.

Markets

The first month of the quarter will be done next week, and so far the only losers are bonds. All risk assets and other diversifying assets are up, with REITs leading the diversifying assets and small/mid caps leading the risk assets. Small cap continues to struggle YTD though, down a little over 1% although midcaps have had a very good start, up nearly 11%.

Earnings season has started, and the results so far are very mixed. Overall, profit margins have held up so far with net margins over 12%; if that sticks, it will be 5 quarters in a row. On the other hand, there are only 3 sectors reporting a year-over-year increase in margins: communication services, technology, and financials, none of which are particularly affected by tariffs. 8 sectors are reporting a year-over-year fall in margins. 5 sectors are reporting margins above their 5-year average, but 6 are reporting lower than the 5-year average. The same is true quarter to quarter.

The percentage of companies reporting positive surprises in earnings is above average, but the magnitude of the surprises is below average. Earnings are, so far, coming in better than was expected at the end of the quarter, but it is still the slowest year-over-year earnings growth (5.8%) since Q1 2024. Lastly, more sectors are reporting year-over-year earnings declines (6) than are reporting gains (5).

It will be interesting to see how margins evolve in the coming quarters. The effect of tariffs is generally distributed through several channels:

- The importer can raise prices to his customers to offset some of the cost of the tariff.

- The importer can convince his supplier to lower his prices.

- The importer can reduce his payroll (headcount) to offset some of the cost of the tariff.

- The importer can reduce his capital investment budget or some other expense.

- The importer can just operate with lower margins.

Secretary Bessent was recently seen on TV explaining that companies haven’t done #1 above but are instead absorbing the cost of the tariffs, a statement he made with a large smile on his face. Does he really think that is a positive outcome? Okay, prices haven’t risen much – yet – but in that list above, only 1 of 5 possibilities is a positive. Companies don’t pay taxes, people pay taxes.

Sectors

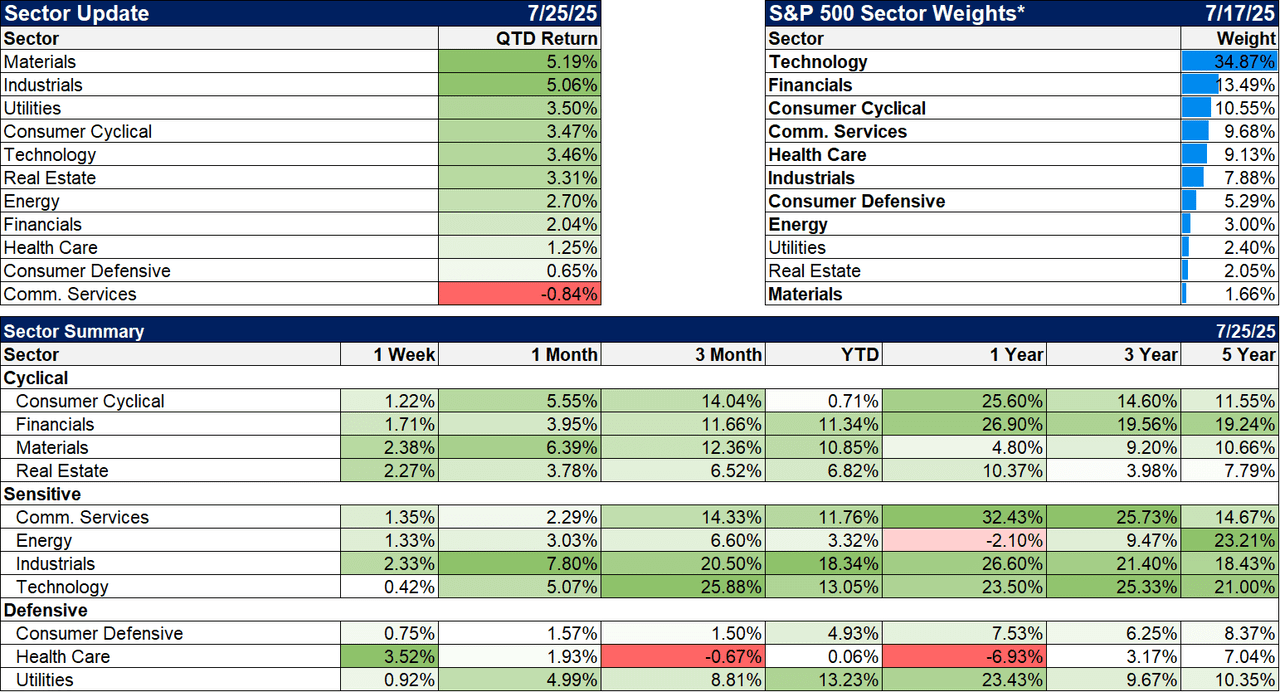

The leading sectors YTD are industrials (+18.3%), technology (+13.1%) and utilities (+13.2%), which I think can be translated as “AI” – build data centers, install technology, turn on the power.

QTD, the materials sector is catching up fast after lagging over the last year. The gains in the sector are across multiple industries, from steel to mining to chemicals. One exception is Dow, which got hit on a poor earnings report last week.

For the bargain hunters, health care is flat YTD, down nearly 7% over the last year and only up an average of 3.2% over the last 3 years.

Economy/Market Indicators

Credit spreads have narrowed again as risk appetite has picked up and are now just about 25 basis points from their tightest reading this economic cycle. Just another indication that there’s no fear in these markets.

Economy/Economic Data

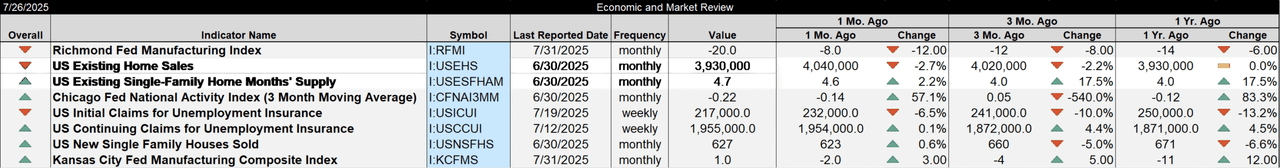

The economic data recently has been softening slightly. It isn’t anything dramatic, and it’s just a few items, so it’s more of a vibe than anything concrete. There have certainly been positives to offset the negatives. The Chicago Fed National Activity Index, CFNAI, which is an amalgamation of many individual economic indicators, is an economic trend indicator. When it is positive, growth is above trend, and when it is negative, growth is below trend. When the 3-month average is below -0.75, the economy is likely in recession. The reading for June was -0.1, which is essentially trend growth, but it is also the 10th negative reading in the last 13 months, so there is a trend to the trend indicator. The 3-month average is only -0.22, so not near recession but down from -0.12 a year ago. That’s one of the reasons I am concerned about the tariff and immigration impact on growth – growth was already waning before the Trump administration, so we don’t have as much of a cushion as I’d like.

Outside of the CFNAI, the other reports basically confirm that below trend growth theme. The Richmond Fed manufacturing survey was weaker than expected, while the KC Fed version was better than expected (along with Empire State and Philly last week). Existing home sales fell, but new homes managed a weak gain. Jobless claims remain very low, although continuing claims are up 4.5% from last year.

Not shown here is the Durable Goods report, which Orion hasn’t updated yet. Mixed is again in the news. Overall orders were down 9.3%, but that was after a 16.5% jump last month. Both of those are due to changes in aircraft orders (basically Boeing (BA)) which seem to be one of Trump’s favorite bargaining chips – “Want to make a trade deal? Step right over here to the Boeing booth and we’ll get you hooked up.” Ex-transportation, orders were up just 0.2% and Non defense capital goods ex-aircraft – so called core capital goods – orders were down 0.7%. As I said – mixed.

Joe has worked in the financial services industry since 1992 in various capacities, including Operations Manager, Compliance Manager, Registered Representative and Portfolio Manager. From 1997 to 2006, when he founded Alhambra Investment Management, Mr. Calhoun was a Director of Investments at Oppenheimer & Co. Mr. Calhoun holds the Series 63 (Uniform Securities Agent State Law) and 65 (Uniform Investment Advisor Law) securities licenses. He has previously taken and passed the Series 7 (General Securities Representative) and Series 9/10 (General Securities Sales Supervisor) securities exams.

Joe proudly served in the U.S. Navy’s nuclear submarine service for 8 years (1983-1990) and was awarded several commendations including the Navy Achievement Medal in 1987. He studied engineering at the University of South Carolina and is a graduate of the U.S. Navy’s Nuclear Propulsion School. He founded Alhambra Investment Management as a registered investment advisory to address the needs of the individual investor. His market commentaries are widely read and published at various online outlets. He has appeared on Larry Kudlow’s program on CNBC and various radio programs. He is also an editor of the website RealClearMarkets.com.

Shared by Golden State Mint on GoldenStateMint.com