Summary

- Markets rallied on news of a Trump-Xi call, but the lack of details and conflicting reports raise questions about the true progress.

- China’s dominance in rare earth processing gives it leverage, and U.S. industries are warning of supply shortages due to export limits.

- Investors are ignoring warning signs in economic data, mistakenly assuming tariffs have had no impact because effects haven’t appeared in hard data yet.

- Tariff impacts are delayed due to inventory buildup and phased implementation; expect meaningful price increases and weaker consumer spending in the coming months.

- This idea was discussed in more depth with members of my private investing community, The Portfolio Architect.

Stocks got a lift at the open yesterday on news that President Trump finally had a telephone conversation with President Xi, but what surprised me at the time was that the announcement came from Chinese state media, noting that it was President Trump who initiated the call. If the call was good news, it seems like our president would have said so first. Regardless, any communication at all is positive after both sides accused the other of violating the tariff truce that was announced three weeks ago.

Finviz

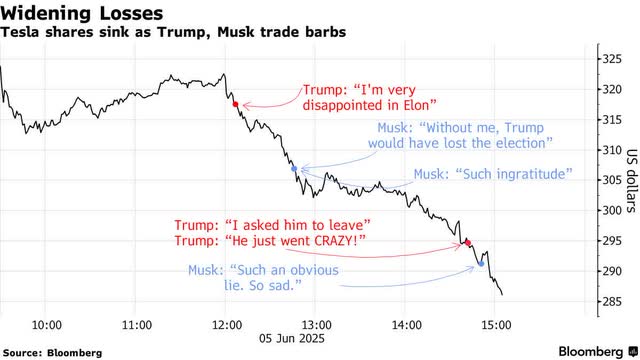

President Trump did say the conversation “resulted in a very positive conclusion,” and that there should no longer be issues with “Rare Earth products,” but no details were announced other than plans for another meeting between trade officials. China’s version of the call made no mention of rare earth minerals, which is what I think prompted the president’s outreach. China has leverage over us in this standoff because they process 90% of the world’s supply. Last week, US automakers warned the Trump administration that without additional rare earth exports, which China is limiting, auto suppliers, as well as other industries, would not be able to produce critical automotive components. In other news, the president and Elon Musk spent the day engaged in a public display of insults that sent Tesla shares reeling.

Bloomberg

It is easy to be distracted by the headlines about phone calls and billionaires “beating each other up”, but investors should be focusing on the leading economic data. Today, markets are trading as though we have nothing but clear skies on the horizon, but the high-frequency economic data suggests otherwise. I think investors have been lulled to sleep because the adverse impacts from tariffs have not shown up yet in the hard data, supporting the view that they will have no impact on the economy. It is too early to come to that conclusion.

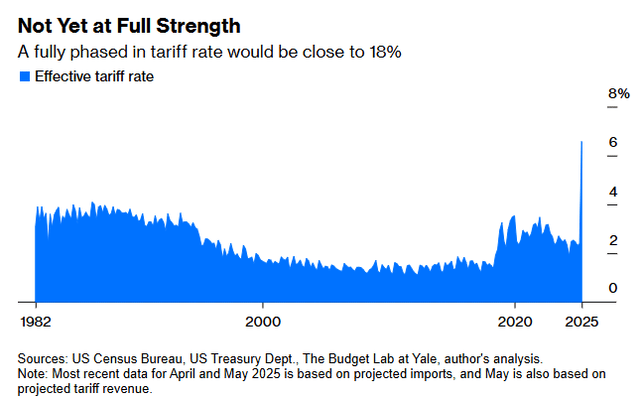

The current effective tariff rate on all imports is estimated to be 16-18%. I think most assume that we would see the impact one month after implementation, but businesses stocked up on inventory before the tariffs took effect, which has to be burned through. Additionally, consumers advanced the purchase of goods they feared would increase in price to front-run tariffs. Finally, tariffs are phased in overtime to reach their fully effective rate, due to delays in collection logistics. Based on the tariff revenue collected to date, the effective rate was just 4.5% in April and 6.5% in May. During that time, we were working off pre-tariff inventory and weaker consumer demand. June and July data should be different stories.

Bloomberg

When President Trump imposed tariffs of 20-50% on imported washing machines in January 2018, consumers advanced purchases, with sales surging 3.6%. It was not until April of that year that we saw a sharp increase in price for this line item in the Consumer Price Index. Using the same timeline, we should see meaningful price increases show up in June numbers, which will be reported in July. Consumer spending is already starting to roll over. Can the S&P 500 power to new all-time highs in the face of these obvious headwinds? Perhaps it can, but it will be doing so on momentum and not improving economic and market fundamentals.

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Lawrence Fuller has been managing portfolios for individual investors for 30 years, starting his career at Merrill Lynch in 1993 and working in the same capacity with several other Wall Street firms before realizing his long-term goal of complete independence when he founded Fuller Asset Management. He also manages the Focused Growth portfolio on the new fintech platform called Dub, which is the first copy-trading platform approved by securities regulators in the US, allowing retail investors to copy the portfolio and ongoing trades of the manager they choose automatically. You can also find him on Substack and lawrencefuller.substack.com.

He is the leader of the investing group The Portfolio Architect, which focuses on an overall economic and market outlook that complements an all-weather investment strategy designed to produce consistent risk-adjusted market returns. Features include: Portfolio construction guidance, access to an “All-Weather” model portfolio and a dividend and options income portfolio, a daily brief summarizing current events, a week ahead newsletter, technical and fundamental reports, trade alerts, and 24/7 chat. Learn More.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Lawrence Fuller is the Principal of Fuller Asset Management (FAM), a state registered investment adviser. He is also the manager of the Focused Growth portfolio on the copy-trading platform Dubapp.com. Information presented is for educational purposes only intended for a broad audience. The information does not intend to make an offer or solicitation for the sale of purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. FAM has reasonable belief that this marketing does not include any false or material misleading statements or omissions of facts regarding services, investment, or client experience. FAM has reasonable belief that the content as a whole will not cause an untrue or misleading implication regarding the adviser’s services, investments, or client experiences. Past performance of specific investment advice should not be relied upon without knowledge of certain circumstances or market events, nature and timing of investments and relevant constraints of the investment. FAM has presented information in a fair and balanced manner. FAM is not giving tax, legal, or accounting advice. Mr. Fuller may discuss and display charts, graphs, formulas, and stock picks which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions. Consultation with a licensed financial professional is strongly suggested. The opinions expressed herein are those of the firm and are subject to change without notice. The opinions referenced are as of the date of publication and are subject to change due to changes in market or economic conditions and may not necessarily come to pass.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Shared by Golden State Mint on GoldenStateMint.com