President Trump’s recent trade framework announcements have included sketchy initial details that can take days to fill in and sometimes are even contradicted by those on the other side of the table.

Yet markets don’t seem to mind this emerging pattern. In fact, the signal investors are apparently taking from these pacts from Europe to Japan to Vietnam is one of increased stability down the road.

Even vague details are perhaps better than the ups and downs of negotiations — or the worse outcomes that had previously been on the table.

As Mark Malek, Siebert Financial CIO, put it recently on Yahoo Finance, what is known about these complex deals to investors “basically fit into an index card [and] they are basically leaving it all to us to figure out.”

But Malek added that markets have remained stable because of the overall signal that worst case scenarios are being avoided “so I think for the most part we’re happy.”

Whether that happiness continues remains to be seen with plenty of moving trade pieces still on offer.

Negotiations continue with Europe as trade watchers await a formal joint statement on the deal and negotiators still apparently at work to lock in legally binding text.

Other major talks — like those with India — remain outstanding and talks with China continue Tuesday in Sweden amid continuing expectation-setting from both sides that another 90-day pause is in the offing.

The economic effects of the deals are also starting to come into focus based on what details are available.

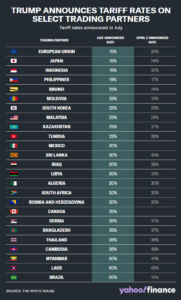

The latest analysis from the Budget Lab at Yale found that consumers are set to face an overall average effective tariff rate of 18.2% — the highest since 1934 — if all the tariffs announced through Monday go forward.

Despite that over 90 year high, markets have continued to be relatively sanguine.

Another way to explain the market’s relatively subdued response was put forth by Tobin Marcus of Wolfe Research. He outlined in a recent note that what is known may be sketchy but it’s “a bullish outcome v. the range of possibilities, especially the reduction of sectoral tariffs to 15%” — adding that this emerging 15% standard is “better-than-feared.”

He added that markets also appear to have shifted and instead of a previous hope for a dynamic of “escalate to deescalate” — that is to a say a tense standoff followed by a deal to lower rates — the dynamic now apparently being priced in is one he termed an “escalate-to-escalate-less.”

Often fuzzy math

And the fuzziness of the details is a pattern that has been repeated and appears likely to continue.

Earlier this month, Trump announced a deal with Vietnam that included a 20% tariff rate. Later reporting from Bloomberg revealed that Vietnam’s leadership was caught off guard by the number and continues to want a lower rate.

Likewise in a deal last week with Japan.

First, Trump announced a deal including plans for a “new Japanese/USA investment vehicle” even as questions cropped up immediately about what that would entail, with the US and Japanese side offering vastly different accounts.

It happened again with a Europe deal announced this weekend that saw Trump suggest the new 15% rate did not apply to sector-specific tariffs at one point calling pharmaceuticals “unrelated to this deal.”

While 50% tariffs currently levied on steel and aluminum (and on planned duties at the same rate on copper) will remain outside the pact, pharmaceuticals and semiconductors appear very much part of the European deal.

European Commission President Ursula von der Leyen said the overall 15% rate would apply and, by Monday, the White House confirmed that account with a deal fact sheet that the 15% rate will apply to “autos and auto parts, pharmaceuticals, and semiconductors.”

As Terry Haines, Pangaea Policy Founder, put it on Yahoo Finance Monday: “The way markets have been looking at these deals, kind of the fact of the deal is much more important than the details.”

Ben Werschkul is a Washington correspondent for Yahoo Finance.

Shared by Golden State Mint on GoldenStateMint.com