Summary

- President Trump is unlikely to fire Fed Chair Powell, as it would destabilize markets and damage his own economic barometer, the S&P 500.

- Trump fuels rumors of firing Powell to pressure the U.S. dollar lower, favoring exports and countering foreign currency devaluations.

- If Powell were fired, it would trigger a crisis: collapsing the dollar, spiking bond yields, crashing stocks, and sending gold soaring.

- Even without firing Powell, appointing a dovish successor could gradually weaken the dollar, bonds, and stocks, while boosting gold over time.

Douglas Rissing/iStock via Getty Images

Since President Trump took office, it has been more than a rumor that the President of the United States could fire the Chairman of the Federal Reserve, since, in Trump’s eyes, Powell is keeping official interest rates too high, and this would be hampering economic activity and the country’s sovereign debt to be refinanced on better terms.

I say more than a rumor because it is something that he himself has commented on several occasions, although he has had to retract all of them, since it is perceived by the financial markets as an event that could profoundly destabilize the global economy.

My main scenario is that this ultimately does not happen, first because doing so would be an extremely negative event for the stock markets, and it is no secret that Trump considers the S&P 500 Index (SP500) as a barometer of his management (besides, the President was already scared enough in April).

Aside from this, it also seems an unlikely scenario, because theoretically the law does not allow him to fire Powell unless it is for clear reasons of fraud on the part of the Fed chairman, but he could not fire him simply for disagreeing with him on monetary policy.

And, as if these reasons were not enough, there are only 10 months left for Powell to finish his term, and it would not make much sense to stir up the hornet’s nest and the risk involved when there is so little left of his chairmanship at the Fed.

I am commenting on all this because this week, specifically on July 16, a headline came out again, this time supposedly from “a White House official,” where it was said that Trump was considering firing Powell and that he would even have a draft of a “termination letter” ready.

Then the stock markets and bonds began to fall relatively strongly, and gold soared. However, Trump reacted immediately and denied everything, less than an hour after the headline that began to shake the markets.

That said, the truth is that Trump is playing both at generating rumors and later denying them. For example, according to information published on July 16, Trump would have been sounding out with legislators of the Republican Party about the possibility of firing Powell (news that he knows will be leaked in the media).

Or, in another example, Trump frequently recalls, of course, also this time, that the Fed (Powell) is under investigation for major cost overruns incurred by some construction work at the Fed’s main headquarters in Washington. Where it was supposed to be a $1.9 billion job, it has finally been $2.5 billion, about $700 million more than expected.

Aside from asking myself if the reason for these costs for a building is that they are doing it with gold columns, this alleged irregularity is exploited every so often by Trump as a threat that he might fire Powell for fraud, just the one loophole in the law that would allow him to be fired.

However, if the main scenario, mine and virtually everyone else’s, is that he is not going to fire him, why is Trump continually stoking the rumor and then denying it?

In my opinion, it is a way of continuing to cause the dollar to depreciate against the rest of the global currencies, something that the Trump administration officially denies, but which seems to be something they are looking for. First, because historically Trump has always wanted a weak dollar to favor the country’s industrial fabric and encourage exports, and secondly, so that other countries do not resort to depreciating their currencies in response to tariffs imposed by the United States against them (something China already did in Trump’s first term).

As is often said, I have no proof, but no doubt either, that this is Trump’s real objective: to make the U.S. dollar depreciate.

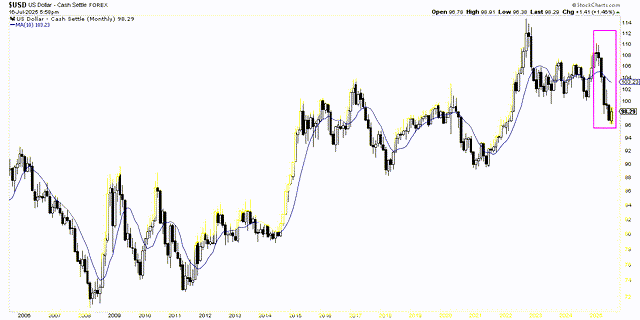

The dollar (DXY) has been trading high against global currencies since 2022, something that, in Trump’s view, does not facilitate the progress of the industrial fabric in the U.S. The magenta line in the following chart highlights the evolution of the dollar index in recent months, with a depreciation that has been as high as -11% since January.

US Dollar Index (Stockcharts.com)

So the first conclusion, if I am correct, that Trump is not looking to fire Powell but is interested in rumors about it, is that it is part of a bearish strategy on the U.S. dollar, both for internal and external economic reasons.

While Trump failed in his April attempt to lower long-term interest rates, he is succeeding in this segment of the market for the time being.

All of this, beyond a natural very short-term bounce, seems to indicate that the dollar will continue to come under strong downward pressure, something that hurts investors outside the U.S. tremendously and which makes it probably a good idea to be hedged against exchange rate risk against the dollar (and something that makes investing, for example, in Europe even more favorable for U.S. investors).

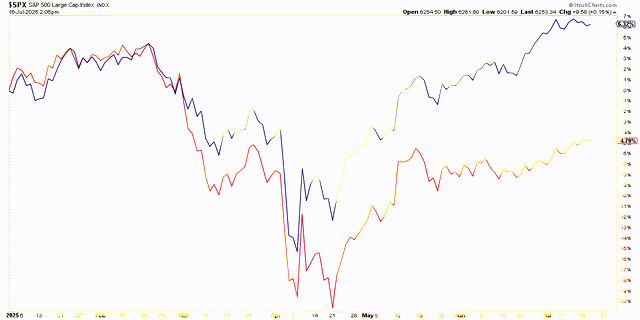

S&P 500 in dollars (blue) and in euros (red). (Stockcharts.com)

Obviously, all this would be more intense if, for whatever reason, Trump decides to fire Powell. It would be a very bearish event for the dollar because the market would be interpreting that the next Fed Chairman would be a mere puppet in the hands of the U.S. President, in the style of Turkish President Erdoğan’s central bankers, and because it would completely collapse the market’s confidence in the sustainability of the U.S. public accounts (no one would believe anymore that the high fiscal deficit could be solved).

Already continuing with the idea of Trump firing Powell, something that, again, I consider unlikely, if it were to get to that point, it would cause the collapse of U.S. sovereign debt; by extension, it would also cause a sharp fall in the stock markets; and, finally, it would cause a strong rally in gold, both dollar-denominated and in absolute terms against all currencies on the planet.

These considerations, apart from having intrinsic economic logic, are confirmed by how the different investment assets react when the rumor re-emerges and before Trump denies them again.

U.S. Dollar and Sovereign Bonds

All investment assets are closely related to each other, but, for obvious reasons, a country’s currency and its own sovereign bonds are two assets with a very close relationship.

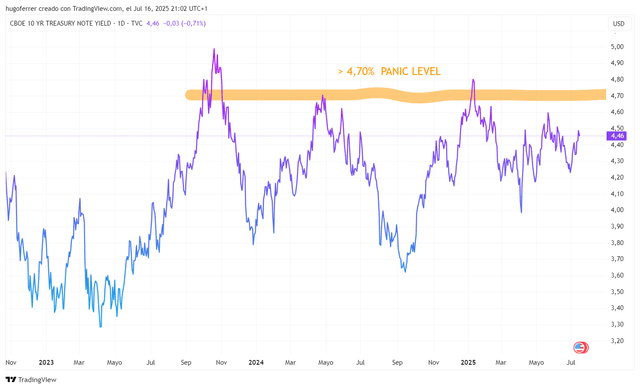

Thus, as I have related, if Trump were to fire Powell, the dollar would go into a downward spiral, and, for the same reasons of zero credibility about the future evolution of the country’s finances, sovereign bonds would also go into a tailspin.

In other words, the interest rates on these bonds, which move inversely to prices, would skyrocket, causing the United States to refinance itself on worse terms and enter a vicious circle, because a more expensive debt would paradoxically cause the country to have to issue even more debt to pay its bills.

In other words, it would be very bearish for sovereign bonds, and, given that everyone is invested in bonds, Powell’s dismissal would create the mother of all financial crises. This is exactly why it is unreasonable to expect it to happen. Trump is erratic but not a madman.

U.S. 10-year interest rates (TradingView)

Stock Market

Of course, once a bond market crisis begins, it would also be a very bearish event for the stock market. This would be true both if long-term interest rates lose control and if, immediately after the initial shock, the U.S. government is forced to tighten its belt on government spending to try to regain market credibility.

This would be because if the government were to “tighten its belt,” it would be instantly withdrawing the main stimulus force from the current stock market bull market.

In other words, if we saw how the U.S. economy did not go into recession despite the fastest rise in official interest rates in 40 years, thanks to the strong stimulus the economy received from the high public deficit, if the country were to tighten its belt, the opposite would happen: the stock markets would deflate with great force. As they say, “no money, no honey.”

Gold

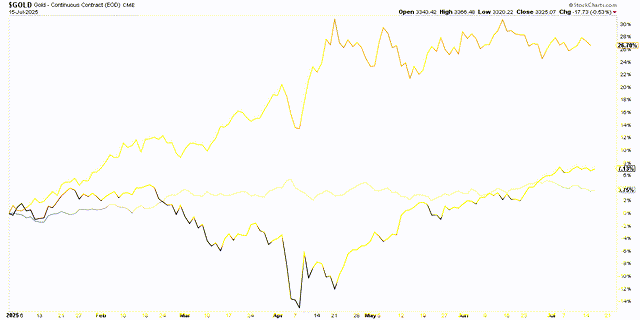

Finally, Gold would behave as the inverse of the dollar and sovereign bonds, and, for the same reasons that these would decline sharply, Gold would act as a safe haven in a phase of such high uncertainty as the global economy would enter if President Trump “goes off the deep end.”

Gold would be practically the only asset that would be perceived by investors as a safe haven in the face of the implosion, not only of the world’s economic locomotive but of the global reserve currency itself. A new economic and monetary system would be priced in, and, under such circumstances, gold would function as an escape valve for all the uncertainty that this process would bring.

If since the end of 2023 I have been pointing out that Gold (XAUUSD:CUR) is in a historical uptrend, which of course we do not know how far it can go, but in which it is worth being in, if the unlikely event of Trump firing Powell were to occur, this strong uptrend in Gold would feed back with even greater vigor.

Total returns in 2025 for Gold, Stocks (S&P 500) and Bonds (ETF IEF) (Stockcharts.com)

This is all that would happen if Trump finally decides to press “the nuclear button” and fire Powell. In any case, as I explained at the beginning, this would wreak such havoc on the economy as to make it highly unlikely.

Now, let’s remember that things are not necessarily black and white but can also run the gamut of grays. Trump will probably not fire Powell, but he will also probably choose as the next Fed chairman someone closer to his ideas, a Fed chairman who could keep official interest rates lower than necessary.

And if that were the case, everything explained here could happen just as I have described. Instead of happening in a few weeks and months, it would happen more gradually over quarters and years.

That is why I have written this analysis—not to explain the improbable that would occur almost immediately, but to explain something more likely that could occur more slowly but could be equally lethal for the dollar, bonds, and stocks. And extraordinarily bullish for the golden metal.

Analyst’s Disclosure:I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Shared by Golden State Mint on GoldenStateMint.com