Summary

- Silver is in its fifth consecutive year of supply deficit, with demand from solar, EVs, and tech outpacing limited mining growth.

- Industrial demand, especially from solar installations and electrification, now drives over half of silver consumption, creating strong, long-term tailwinds.

- Silver’s safe haven appeal is rising amid geopolitical tensions, inflation, and central bank interest, adding to its investment case.

- With persistent supply constraints and robust demand, I see further price upside for silver and rate it a buy, targeting $40+ per ounce.

Introduction

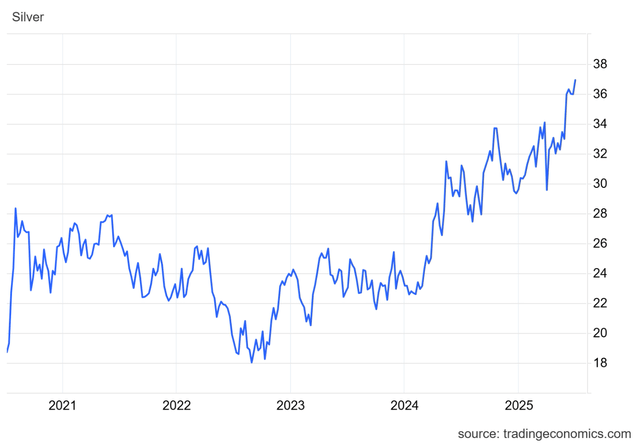

While gold grabs headlines at record highs, its little brother silver has had a rally of its own. So far this year, silver has risen over 25% to reach $37 an ounce, approaching 13-year highs.

Behind this growth lies a fundamental supply crisis: silver faces its fifth consecutive year of deficit in 2025, with growing industrial demand from record solar installations and wider tech sector demand growth colliding with limited growth in supply from mining operations that haven’t meaningfully increased production.

Unlike gold’s near-pure role as a store of value, silver’s dual nature as both an industrial and safe haven metal creates a unique investment thesis. With both factors coming together from growing records of solar deployments driving 32% of total demand and silver’s act as an inflation hedge, I believe the silver price could rise even further.

Silver Price Chart – Trading Economics

Industrial Demand Drivers

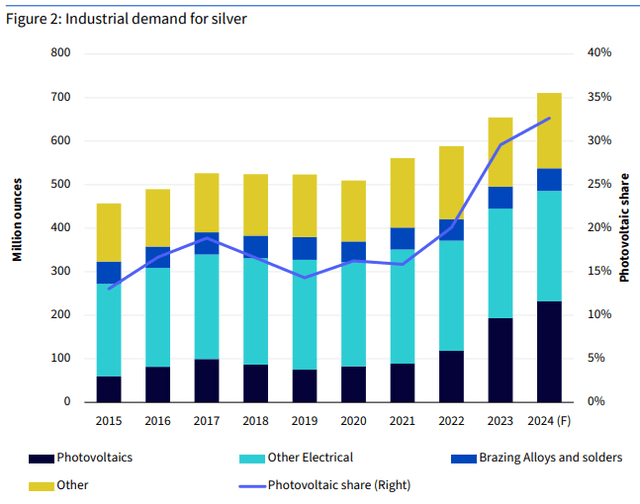

Going back even just a couple of decades, you would find industrial demand making up only a minor proportion of demand for silver. Jump forward, and industrial demand now represents the largest and fastest-growing segment of silver demand, driven by multiple secular trends that show no sign of slowing down.

The green energy transition continues to be the largest driver of silver’s industrial demand growth. Photovoltaic demand reached around 200 million ounces in 2024 and now represents 32% of silver’s industrial demand. With solar installations continuing to accelerate globally as countries pursue renewable energy targets, this creates sustained demand for silver given its conductive properties in solar cells.

Silver Institute – World Silver Survey 2025

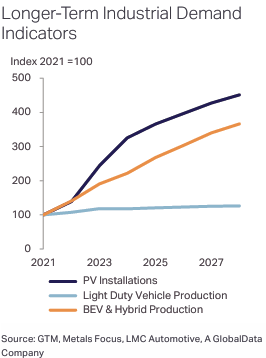

Beyond solar, the ongoing shift to electric vehicles across the world is adding to silver demand. With electric vehicles using between 25 and 50 grams of silver per vehicle and sales surging in many countries, this represents another significant growth driver. In 2025, the automotive sector is expected to use 90 million ounces of silver, a massive 40% increase on 2021 levels.

Metals Focus & Wisdom Tree Silver Outlook Report

In addition to automotive applications, the wider tech space presents another major growth opportunity. Silver’s demand in electronic applications is forecast to have risen 10% in the past five years. With the current artificial intelligence boom, this growth could be accelerated. With silver’s superior electronic and thermal conductivity properties, it has many use cases in this segment. With AI supercharging electronic demand, this is set to be another major driver of silver’s growth.

Put together, the ongoing rapid growth of photovoltaics, electrification, and technology creates multiple trends that support rapid growth in silver demand. Unlike more cyclical demand patterns, these are structural, longer-term shifts, providing fundamental support for silver demand.

Safe Haven Demand

Beyond its industrial applications, silver continues to be seen as a safe haven asset comparable to gold. With the current uncertain geopolitical environment and monetary factors, this has helped support investment demand for silver.

Escalating geopolitical tensions, including conflicts in Ukraine and the Middle East, combined with tariff uncertainty, have increased investor demand for silver. With the ongoing diversification away from the US Dollar in foreign reserves, accelerated by the freezing of Russian foreign reserves due to its actions in Ukraine, could silver be a potential substitute?

Central bank activity provides support. While central bank gold buying is showing strong growth, Russia recently became the first country to add silver to its reserves in over 20 years. If other central banks follow Russia’s lead, it could create substantial demand for silver reserves.

Silver’s status as a physical commodity also adds support. While inflation may have reduced from its recent peak, it continues to gradually eat away at purchasing power. Silver, as a physical asset, provides a store of value that cannot be devalued through monetary expansion as it cannot be printed, adding to its demand as an inflation hedge. With potential lower interest rates and a weaker dollar, this also makes silver more attractive to international buyers by supporting dollar-denominated commodity prices.

Supply Constraints

While demand for silver has been soaring, supply has struggled to keep up. This places the market in its fifth consecutive year of supply deficit, with the Silver Institute forecasting a shortfall of 117.6 million ounces. This persistent shortfall has created a cumulative deficit of over 796 million ounces from 2021–2024, depleting global inventories to multi-decade lows.

With a rising price, it would traditionally be expected that miners would take action to raise supply. This has, however, not been the case due to the fact that approximately 72% of silver production is derived as a byproduct of mining operations for other metals such as copper, zinc, lead, and gold. This means production of silver is heavily influenced by the economics of producing these other metals rather than the spot price of silver, resulting in the silver supply being relatively inelastic. Whilst the copper price has also seen a rise this year, it remains to be seen whether this feeds through to growth in silver production.

Exacerbating the supply issue is the significantly reduced exploration budgets over the past decade, creating a limited supply of new mines. The large discoveries that are made require dozens of permits and assessments before mining can begin. This results in larger projects taking almost 10 years from discovery to production, meaning supply growth will remain constrained for many years, even if a rise in silver and other metal prices makes many projects economical.

Put together, rising demand for silver, driven by its industrial applications but also its safe haven status, has met a constrained supply, generating a demand-supply imbalance. With demand continuing to rise and limited supply growth, I believe silver prices are only heading one way, and that’s higher.

Risks

As with any commodity, silver, there are several potential risks that could put pressure on prices.

The most significant comes from the large usage of solar photovoltaics. Given that solar applications now represent 32% of demand for silver, any meaningful reduction in production would directly impact solar consumption. While the demand for both energy generally and green energy in particular is only growing, there have been concerns that Chinese solar manufacturers face overcapacity, and government plans to regulate the sector more closely could dampen solar demand for silver.

More generally, with 58% of silver’s demand now from industrial production, any widespread manufacturing slowdown would significantly reduce demand. Unlike gold, which is primarily a safe-haven asset, silver’s industrial applications make it more sensitive to the economic cycle.

Finally, silver as a non-yielding asset, meaning it does not produce cash flow, also has an opportunity cost to holding. This means that in a scenario where there are higher interest rates, the attraction of alternative investments to silver increases. In addition, a stronger dollar, which is partly influenced by interest rates, makes silver more expensive for international buyers, which could potentially reduce international demand.

Conclusion

Silver’s current rally appears to reflect more than just momentum. With solar installations hitting record levels and industrial applications now consuming 60% of annual production, silver has evolved from a simple precious metal into a multipurpose metal investment.

The fifth consecutive year of supply deficits, combined with the fact that, as primarily a mining byproduct, silver supply is relatively inelastic, creates a structural imbalance that should continue to push prices higher.

At $37 an ounce, silver has already delivered a strong 25% gain so far this year, but the underlying supply-demand fundamentals suggest the price could rise higher still. With $40 an ounce within reach and potentially higher prices in future years on structural demand growth, silver offers a compelling opportunity. I rate it a buy.

Mountain Valley Value Investments specializes in identifying undervalued companies with strong growth potential across various sectors. Focused on long-term value and buying at the right price, we leverage deep industry insights and rigorous analysis to uncover opportunities with the potential to deliver strong returns. Our investment philosophy is rooted in disciplined research and a commitment to highlighting risks that may impact the thesis. We aim to provide our readers with actionable investment ideas that stand the test of time. Follow us for in-depth analysis and thoughtful perspectives on high-potential stocks.

Analyst’s Disclosure:I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Shared by Golden State Mint on GoldenStateMint.com