Since launching this newsletter last fall, I’ve been consistently bullish on silver, publishing numerous reports outlining the exceptionally strong case for it. While gold soared over the past year, silver lagged behind, repeatedly held back by two major resistance zones — $32 to $33 and $34 to $35 — which stopped multiple breakout attempts and kept it in a prolonged consolidation phase.

That finally changed a month ago when silver decisively broke through these critical levels. Although it paused in recent weeks, I explained this was simply a healthy consolidation before the next big surge. On Friday, that surge finally arrived, marking a true breakout and the official start of silver’s bull market. In this update, I’ll discuss where silver stands now and share what I expect to happen next.

The chart below shows COMEX silver futures, which I follow closely because they tend to respect key $1 increments, often creating clear support and resistance levels. Over the past month, silver has finally broken through the heavy resistance cluster between $32 and $35, a major technical victory underscored by Friday’s powerful 4.42% surge on strong volume that pushed prices right to the doorstep of $39 an ounce. This is a highly positive development signaling that silver’s bull market is just getting underway. With this strong momentum, silver is likely to make a rapid run at $40 next — and then $50 soon after.

In addition to tracking COMEX silver futures, I also closely monitor silver priced in euros. This helps strip out the influence of U.S. dollar fluctuations and often provides a clearer view of the underlying trend. Euro-denominated silver also tends to respect key €1 increments—such as €30, €31, and €32—which often act as support and resistance levels.

In addition to tracking COMEX silver futures, I also closely monitor silver priced in euros. This helps strip out the influence of U.S. dollar fluctuations and often provides a clearer view of the underlying trend. Euro-denominated silver also tends to respect key €1 increments—such as €30, €31, and €32—which often act as support and resistance levels.

Similar to COMEX silver futures, silver priced in euros had struggled with two major resistance zones — €29–€30 and €31–€32. As of Friday, however, it finally surged decisively through both levels, providing strong bullish confirmation and removing one of the last conditions I was waiting for to fully validate that silver’s bull market has truly begun.

I’ve also developed a proprietary indicator called the Synthetic Silver Price Index (SSPI), designed to help validate silver’s price action and filter out potential false breakouts. The SSPI is calculated as the average of gold and copper prices, with copper scaled by a factor of 540 to prevent gold from dominating the index. Interestingly, even though silver isn’t part of the calculation, the SSPI closely tracks its movements. To learn more, check out the article I published on it a few weeks ago.

I’ve also developed a proprietary indicator called the Synthetic Silver Price Index (SSPI), designed to help validate silver’s price action and filter out potential false breakouts. The SSPI is calculated as the average of gold and copper prices, with copper scaled by a factor of 540 to prevent gold from dominating the index. Interestingly, even though silver isn’t part of the calculation, the SSPI closely tracks its movements. To learn more, check out the article I published on it a few weeks ago.

The SSPI finally broke out of its 2,800–3,000 trading range over the past couple of weeks, after being stuck there since March — a promising sign that foreshadowed the silver breakout I had been anticipating. Copper’s surge and breakout on Tuesday gave the SSPI a major boost and likely played a key role in silver’s move on Friday, as strong performances in both gold and copper often put pressure on arbitrage algorithms to buy silver in sympathy. This breakout in the SSPI was one of the crucial confirmations I had been waiting for, along with a breakout in silver priced in euros.

As the copper futures chart below shows, copper has finally broken above the $5 to $5.20 resistance zone that had held firm for several years. This decisive breakout confirms that copper is now officially in a bull market of its own, as I wrote a few days ago — and this new bull market should also serve as a strong tailwind for silver.

As the copper futures chart below shows, copper has finally broken above the $5 to $5.20 resistance zone that had held firm for several years. This decisive breakout confirms that copper is now officially in a bull market of its own, as I wrote a few days ago — and this new bull market should also serve as a strong tailwind for silver.

Although gold has been relatively quiet since mid-April, it has simply been undergoing a healthy consolidation between the $3,200 support and $3,500 resistance levels, working off its overbought condition after strong gains earlier in the spring.

Although gold has been relatively quiet since mid-April, it has simply been undergoing a healthy consolidation between the $3,200 support and $3,500 resistance levels, working off its overbought condition after strong gains earlier in the spring.

This pattern is very similar to last summer’s consolidation, which was followed by a sharp rally once fall began and trading volume returned. I’m now closely watching for a breakout above the $3,500 resistance, which would signal that gold is ready to resume its bull market. Such a breakout would also give silver an additional boost.

One factor fueling silver’s bull market is the weakening U.S. dollar, which recently broke below the key 100 level on the U.S. Dollar Index — a major technical breakdown. This breakdown indicates further weakness ahead, which is bullish for commodities — including precious metals — given their long-standing inverse relationship with the dollar. For a deeper dive into the bearish case for the dollar and the significance of this technical breakdown, check out my recent article.

One factor fueling silver’s bull market is the weakening U.S. dollar, which recently broke below the key 100 level on the U.S. Dollar Index — a major technical breakdown. This breakdown indicates further weakness ahead, which is bullish for commodities — including precious metals — given their long-standing inverse relationship with the dollar. For a deeper dive into the bearish case for the dollar and the significance of this technical breakdown, check out my recent article.

I also want to revisit gold briefly to highlight how, from 2020 to 2024, it was capped below the $2,000 to $2,100 resistance zone. This ceiling kept gold subdued for years until it finally broke out, igniting the powerful bull market it remains in today. I see strong parallels between gold’s struggle then and silver’s recent battle under the $32 to $35 resistance cluster. Now that silver has decisively broken out, there is a very strong chance it will follow in gold’s footsteps — and it’s even likely to outperform gold for the near future.

I also want to revisit gold briefly to highlight how, from 2020 to 2024, it was capped below the $2,000 to $2,100 resistance zone. This ceiling kept gold subdued for years until it finally broke out, igniting the powerful bull market it remains in today. I see strong parallels between gold’s struggle then and silver’s recent battle under the $32 to $35 resistance cluster. Now that silver has decisively broken out, there is a very strong chance it will follow in gold’s footsteps — and it’s even likely to outperform gold for the near future.

Now let’s take a look at silver’s long-term monthly chart to identify past resistance clusters that are likely to serve as price targets during this new bull run. These resistance zones were formed during periods of price congestion, most notably during silver’s surge and peak in 2011 and 2012. The two most prominent levels that stand out to me are the $42–$44 zone and, ultimately, the $48–$50 zone. There is a strong probability that silver will aim for the most obvious target — $50 — during this rally. And while it will likely pause to consolidate once it gets there, there’s no reason it has to stop at that level.

Now let’s take a look at silver’s long-term monthly chart to identify past resistance clusters that are likely to serve as price targets during this new bull run. These resistance zones were formed during periods of price congestion, most notably during silver’s surge and peak in 2011 and 2012. The two most prominent levels that stand out to me are the $42–$44 zone and, ultimately, the $48–$50 zone. There is a strong probability that silver will aim for the most obvious target — $50 — during this rally. And while it will likely pause to consolidate once it gets there, there’s no reason it has to stop at that level.

What first signaled to me back in April 2024 that silver was on the verge of a powerful bull market was its breakout from a two-decade-long triangle pattern — a development I highlighted in my bullish thesis published in a widely read ZeroHedge article at the time:

What first signaled to me back in April 2024 that silver was on the verge of a powerful bull market was its breakout from a two-decade-long triangle pattern — a development I highlighted in my bullish thesis published in a widely read ZeroHedge article at the time:

Even more exciting is the fact that silver’s logarithmic chart, dating back to the 1960s, reveals a cup-and-handle pattern, indicating the potential for silver to reach several hundred dollars per ounce during this bull market. In order to confirm this particular scenario, silver needs to close decisively above the $50 resistance level.

Even more exciting is the fact that silver’s logarithmic chart, dating back to the 1960s, reveals a cup-and-handle pattern, indicating the potential for silver to reach several hundred dollars per ounce during this bull market. In order to confirm this particular scenario, silver needs to close decisively above the $50 resistance level.

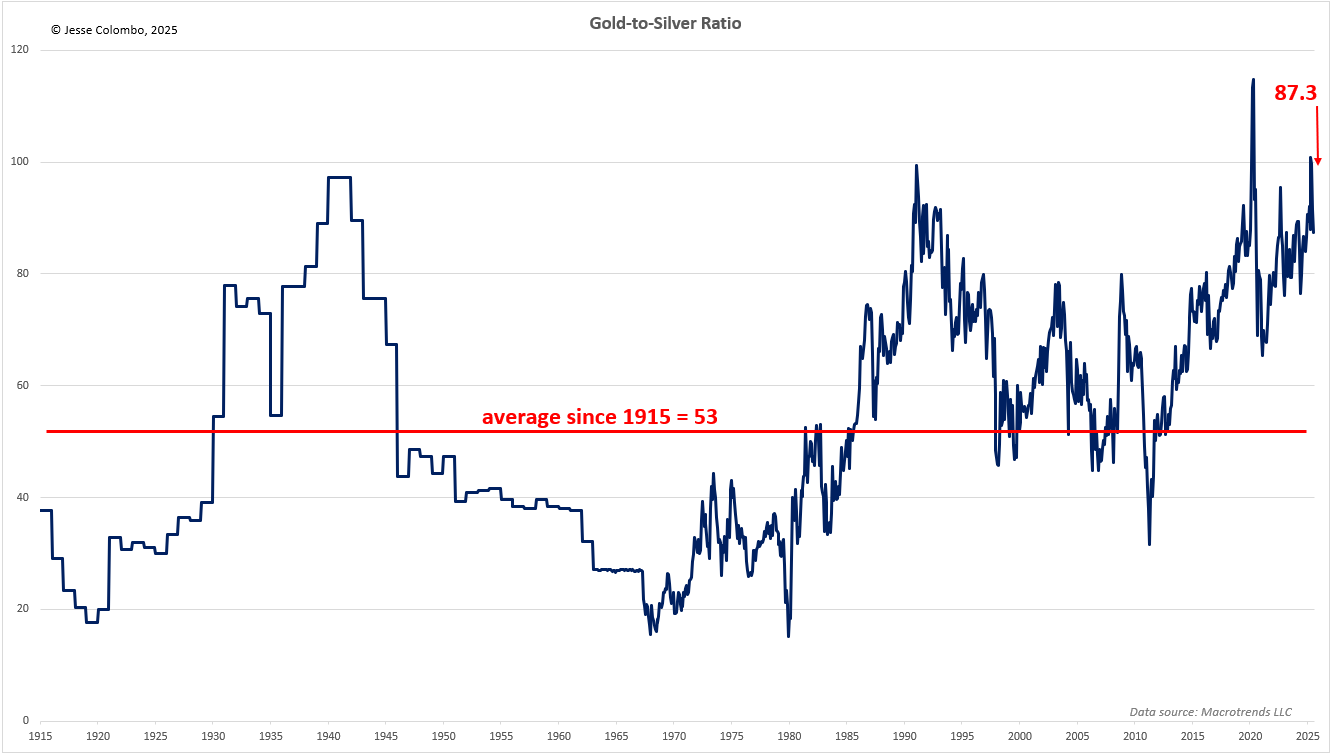

Despite silver’s recent strong performance, it still has substantial upside potential. Several valuation metrics — including the long-term gold-to-silver ratio — indicate that silver remains significantly undervalued.

Despite silver’s recent strong performance, it still has substantial upside potential. Several valuation metrics — including the long-term gold-to-silver ratio — indicate that silver remains significantly undervalued.

The current gold-to-silver ratio stands at 87.3, but if it were to revert to its historical average of 53 (dating back to 1915) — without any increase in gold’s price — silver would be valued at approximately $63.30 per ounce, representing a healthy 65% gain from its current price of $38.40. Naturally, as silver rises to close this gap, the ratio would decline accordingly.

Adjusting silver’s price for inflation further highlights how undervalued it is by historical standards. During the Hunt brothers-induced spike in 1980, silver reached an inflation-adjusted price of $197. In the 2011 bull market, driven by quantitative easing, it hit $71. Currently trading at just $38.40, silver has significant room to rise if it’s to catch up with these previous inflation-adjusted peaks.

Adjusting silver’s price for inflation further highlights how undervalued it is by historical standards. During the Hunt brothers-induced spike in 1980, silver reached an inflation-adjusted price of $197. In the 2011 bull market, driven by quantitative easing, it hit $71. Currently trading at just $38.40, silver has significant room to rise if it’s to catch up with these previous inflation-adjusted peaks.

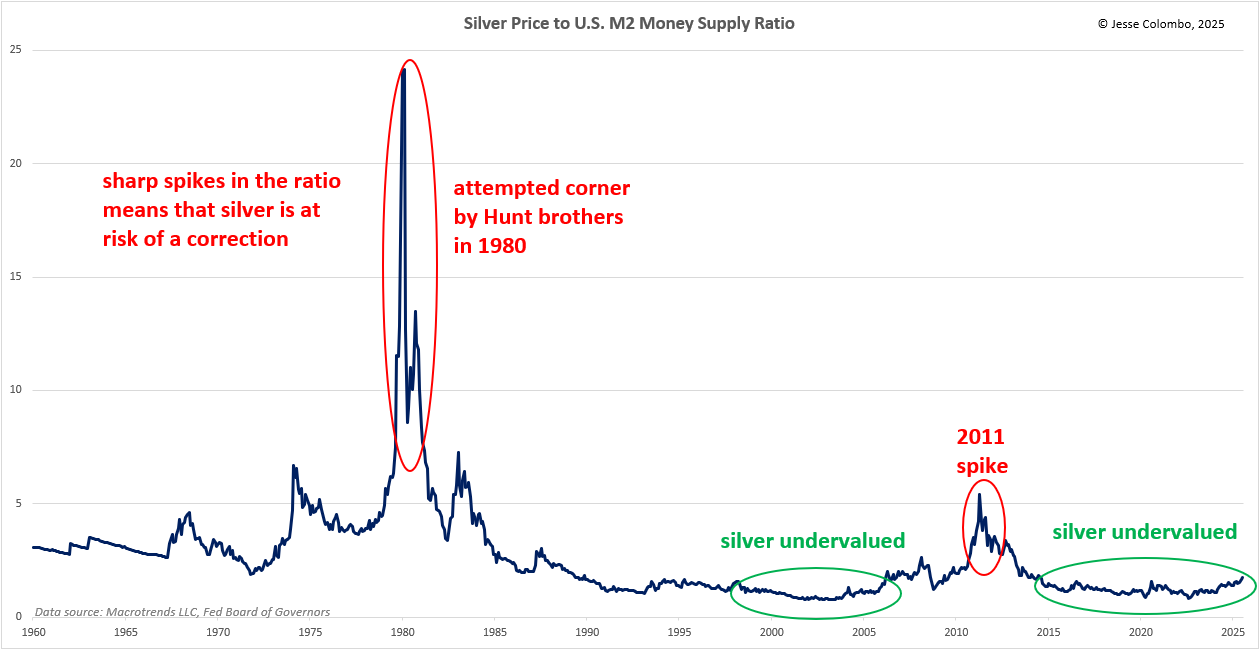

Another way to assess whether silver is undervalued or overvalued is by comparing it to various money supply measures. The chart below shows the ratio of silver’s price to the U.S. M2 money supply, providing insight into whether silver is keeping pace with, outpacing, or lagging behind money supply growth.

Another way to assess whether silver is undervalued or overvalued is by comparing it to various money supply measures. The chart below shows the ratio of silver’s price to the U.S. M2 money supply, providing insight into whether silver is keeping pace with, outpacing, or lagging behind money supply growth.

If silver’s price significantly outpaces money supply growth, the likelihood of a strong correction increases. Conversely, if silver lags behind money supply growth, it suggests a potential period of strength ahead. Since the mid-2010s, silver has slightly lagged behind M2 growth, which, combined with other factors discussed in this piece, positions it for a strong rally.

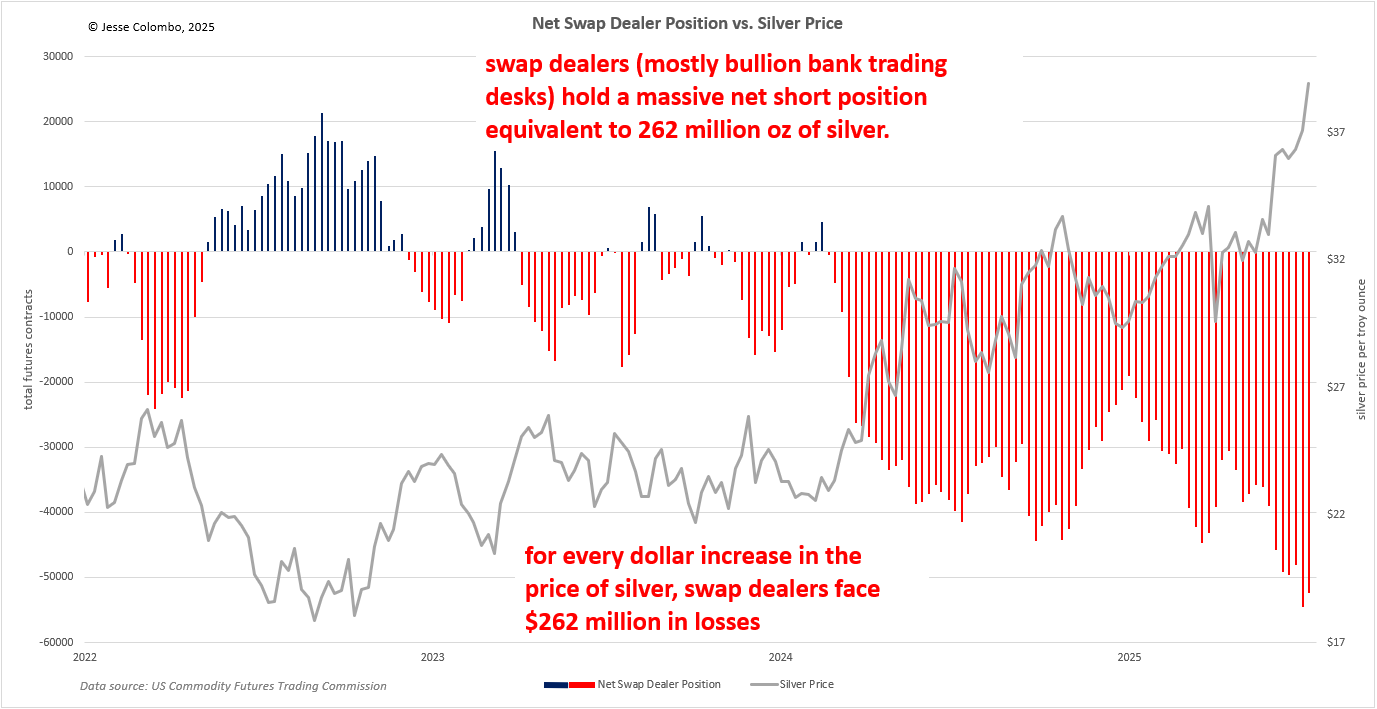

One of the key factors keeping silver’s price suppressed over the past year, even as gold surged, has been the heavy short-selling of COMEX silver futures by swap dealers—primarily the trading desks of bullion banks such as JPMorgan and UBS. This was a deliberate effort to cap silver’s price. In the process, they amassed a massive net short position of 52,324 futures contracts, equivalent to 262 million ounces of silver—nearly one-third of the annual global silver production. This staggering figure highlights the immense downward pressure exerted on the silver market.

One of the key factors keeping silver’s price suppressed over the past year, even as gold surged, has been the heavy short-selling of COMEX silver futures by swap dealers—primarily the trading desks of bullion banks such as JPMorgan and UBS. This was a deliberate effort to cap silver’s price. In the process, they amassed a massive net short position of 52,324 futures contracts, equivalent to 262 million ounces of silver—nearly one-third of the annual global silver production. This staggering figure highlights the immense downward pressure exerted on the silver market.

What’s even more astonishing is how much of this short position in silver futures is naked, meaning it isn’t backed by physical silver. It’s merely “paper” silver being dumped onto the market to suppress prices. However, as silver’s bull market heats up, it could trigger a wave of short-covering—when traders who bet against an asset through short-selling are forced to buy it back as prices rise to limit their losses. As the price climbs, these traders become increasingly desperate to close their positions, further fueling the rally.

If the buying pressure is intense enough, it could even lead to a short squeeze, dramatically amplifying silver’s upward momentum. Given the size of their short position, bullion banks stand to lose approximately $262 million for every $1 increase in the price of silver—a setup for a major price surge. Now, just imagine what will happen as silver climbs by $5, $10, $20, and beyond from this point.

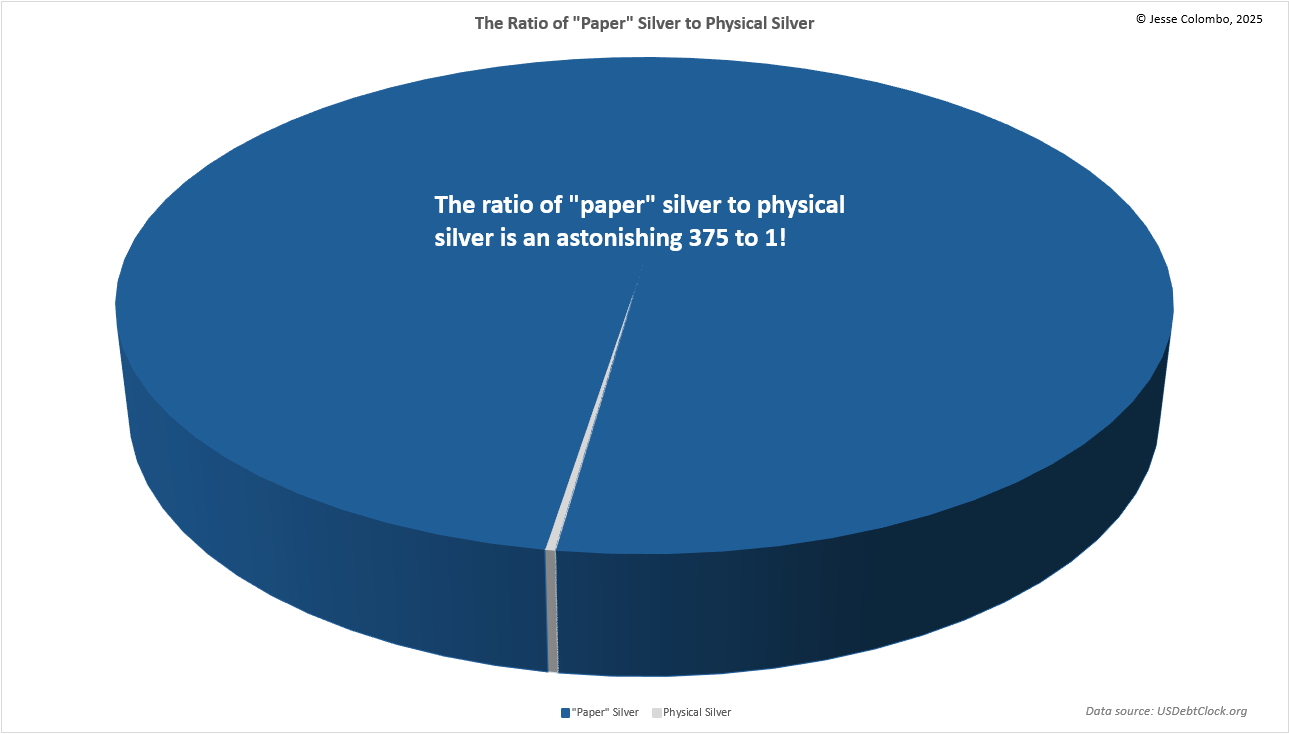

The risk of an explosive silver short squeeze is further amplified by the astonishing ratio of 375 ounces of “paper” silver—ETFs, futures, and other derivatives—for every single ounce of physical silver. In a violent short squeeze, holders of “paper” silver could be forced to scramble for the extremely scarce physical silver to fulfill their contractual obligations.

The risk of an explosive silver short squeeze is further amplified by the astonishing ratio of 375 ounces of “paper” silver—ETFs, futures, and other derivatives—for every single ounce of physical silver. In a violent short squeeze, holders of “paper” silver could be forced to scramble for the extremely scarce physical silver to fulfill their contractual obligations.

This would cause the price of “paper” silver products to collapse, while physical silver prices would skyrocket to jaw-dropping levels, potentially reaching several hundred dollars per ounce (this event is what may fulfill the price target implied by the cup and handle pattern I showed earlier).

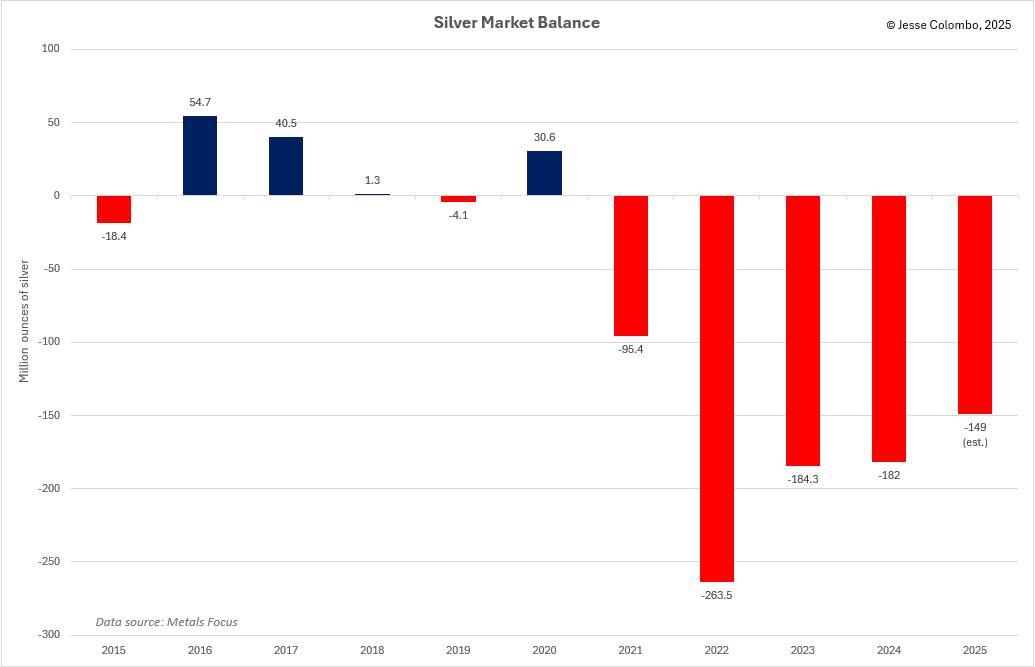

One key reason I believe silver will soon break free comes down to basic Economics 101: supply and demand. Over the past five years, silver demand has consistently exceeded supply, resulting in a persistent deficit—as shown in the chart below. In 2024 alone, the shortfall reached 182 million ounces, with an estimated additional 117.6 million ounces this year—and deficits are expected to continue for the foreseeable future.

One key reason I believe silver will soon break free comes down to basic Economics 101: supply and demand. Over the past five years, silver demand has consistently exceeded supply, resulting in a persistent deficit—as shown in the chart below. In 2024 alone, the shortfall reached 182 million ounces, with an estimated additional 117.6 million ounces this year—and deficits are expected to continue for the foreseeable future.

As a result, above-ground silver stocks are dwindling rapidly. While bullion banks can create unlimited amounts of paper silver to suppress prices, they can’t manufacture the real physical silver that is crucial for a wide range of industries, alongside growing investment demand.

The persistent silver deficit stems from both dwindling supply and surging demand—a combination that, in an unmanipulated market, would naturally drive prices higher. That’s why I described silver as a beach ball held underwater over the past year — the pressure kept building, and it was only a matter of time before it burst upward.

The persistent silver deficit stems from both dwindling supply and surging demand—a combination that, in an unmanipulated market, would naturally drive prices higher. That’s why I described silver as a beach ball held underwater over the past year — the pressure kept building, and it was only a matter of time before it burst upward.

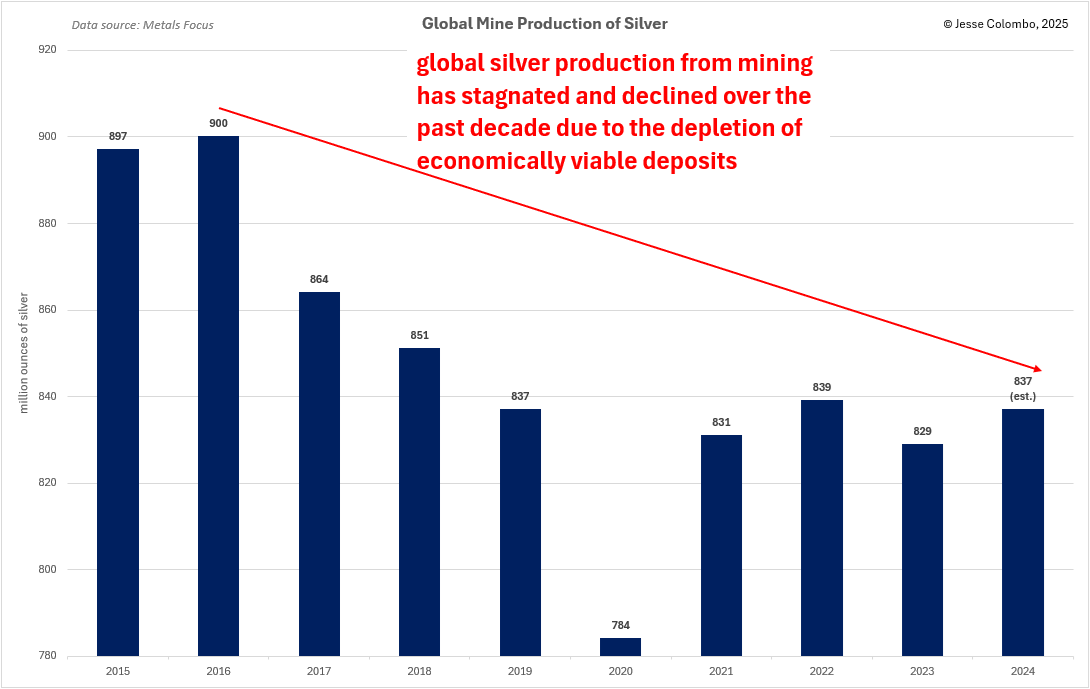

On the supply side, global silver mine production has peaked and declined over the past decade as economically viable deposits become depleted—something the bullion banks have absolutely no control over. And as time goes on, this supply crunch is only likely to worsen.

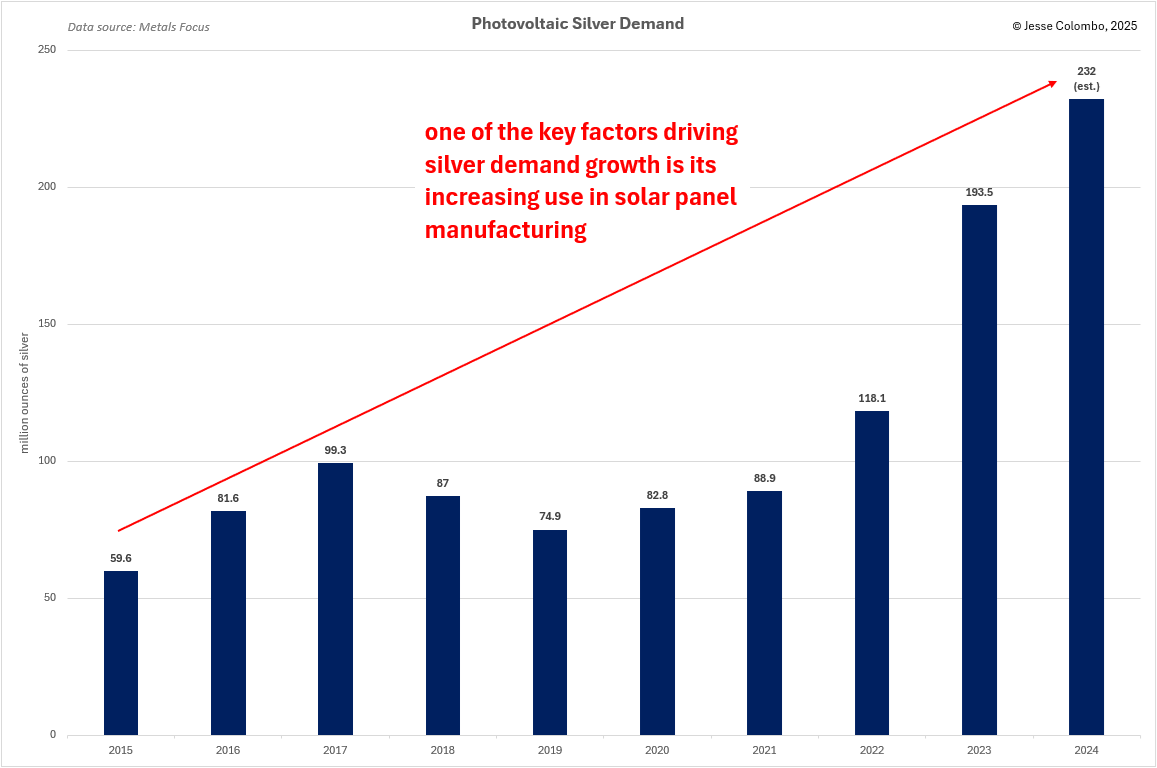

At the same time, demand for physical silver has skyrocketed across multiple sectors, with the biggest driver being the surge in solar panel manufacturing. As the world shifts away from fossil fuels toward renewable energy, this trend is only in its early stages. Silver demand for photovoltaic (solar panel) applications alone has nearly tripled over the past four years, increasing by an astonishing 143.1 million ounces. With global efforts to expand clean energy accelerating, this demand is set to grow even further.

At the same time, demand for physical silver has skyrocketed across multiple sectors, with the biggest driver being the surge in solar panel manufacturing. As the world shifts away from fossil fuels toward renewable energy, this trend is only in its early stages. Silver demand for photovoltaic (solar panel) applications alone has nearly tripled over the past four years, increasing by an astonishing 143.1 million ounces. With global efforts to expand clean energy accelerating, this demand is set to grow even further.

In addition to the most obvious and straightforward approach — owning physical silver bullion — I also look to silver mining stocks for their amplified upside potential, especially as someone with a higher-than-average risk tolerance. These stocks are leveraged to the price of silver and tend to move more dramatically—both up and down—so they’re not for the faint of heart. While riskier than holding bullion, they can offer explosive returns as silver truly takes off.

In addition to the most obvious and straightforward approach — owning physical silver bullion — I also look to silver mining stocks for their amplified upside potential, especially as someone with a higher-than-average risk tolerance. These stocks are leveraged to the price of silver and tend to move more dramatically—both up and down—so they’re not for the faint of heart. While riskier than holding bullion, they can offer explosive returns as silver truly takes off.

I use the Global X Silver Miners ETF (SIL) as a useful proxy to track the performance of silver mining stocks. SIL broke out of a long-term triangle pattern a few months ago, which is a bullish development. However, a decisive close above the key $48–$52 resistance zone is still needed to fully confirm that the bull market in silver mining stocks is truly underway — and we’re getting very close.

Junior silver mining stocks, as measured by the SILJ ETF, are finally perking up but remain confined within a long-term triangle pattern that dates back to 2013. Once this pattern decisively breaks to the upside, I believe silver mining stocks—especially the juniors—are poised to surge in a truly spectacular fashion. Check out my recent report on my favorite junior silver mining stock, Apollo Silver, which also includes a detailed breakdown of the broader bullish case for silver mining stocks.

Junior silver mining stocks, as measured by the SILJ ETF, are finally perking up but remain confined within a long-term triangle pattern that dates back to 2013. Once this pattern decisively breaks to the upside, I believe silver mining stocks—especially the juniors—are poised to surge in a truly spectacular fashion. Check out my recent report on my favorite junior silver mining stock, Apollo Silver, which also includes a detailed breakdown of the broader bullish case for silver mining stocks.

To summarize: the moment I — and many loyal readers of this newsletter — have been waiting for is finally here. Silver’s bull market has officially kicked off, and all systems are go. Now, I’m looking for continued follow-through on this breakout, which is highly likely given silver’s strong momentum. Of course, it’s important that this breakout holds for my bullish tactical thesis to remain intact — but so far, the setup looks excellent, and I’m feeling very optimistic. As always, I’ll keep you updated on this exciting development as it unfolds.

To summarize: the moment I — and many loyal readers of this newsletter — have been waiting for is finally here. Silver’s bull market has officially kicked off, and all systems are go. Now, I’m looking for continued follow-through on this breakout, which is highly likely given silver’s strong momentum. Of course, it’s important that this breakout holds for my bullish tactical thesis to remain intact — but so far, the setup looks excellent, and I’m feeling very optimistic. As always, I’ll keep you updated on this exciting development as it unfolds.

If you found this report valuable, subscribe to The Bubble Bubble Report for more content like it.

Shared by Golden State Mint on GoldenStateMint.com