Americans are thinking twice before they travel, dine out, or shop this summer, with the vast majority of consumers worried about their personal finances as uncertainty over tariffs and a muddied outlook for the US economy weigh on confidence.

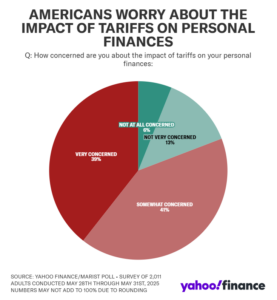

According to a new Yahoo Finance/Marist Poll released Monday, roughly 80% of Americans surveyed expressed some level of concern about the impact of President Trump’s tariffs on their personal finances. And that fear is shifting how they plan to spend.

US consumers plan to cut back the most on spending when it comes to entertainment, clothing, tech, furniture, and appliances, according to the poll, which surveyed roughly 2,000 adults between May 28 and May 31. That’s followed by plans to spend less on toys and games, beauty and wellness items, as well as grocery hauls and household goods.

President Trump’s pause on some of his steepest tariffs was in place at the time of the poll, which left in place a 10% tariff on imports from most countries and a 30% tariff on goods from China.

The poll also ran prior to Trump doubling tariffs on steel and aluminum to 50% on June 3 and a deal reached with Vietnam last week that left a 20% tariff on all goods sent into the US and a 40% tariff on goods that are subject to transshipping.

Coresight Research founder and CEO Deborah Weinswig told Yahoo Finance that even if consumers are “not necessarily” feeling the impact of tariffs on their wallets just yet, “they are definitely reining it in on spending.”

These changes are starting to show up in economic data. US retail sales for May fell 0.9%, a sharper drop than economists had forecast. Spending at grocery stores fell 0.8% from the prior month, while restaurants and bars saw spending drop 0.9% in May. Building material sales, a sign of consumers investing in larger purchases for their homes, fell 2.7%.

More than half of respondents to the Yahoo Finance/Marist Poll expect the tariffs to negatively affect the overall economy. Inflation is the top concern (42%), followed by tariffs (22%) and housing costs (13%).

That sentiment also materialized in the Conference Board’s consumer confidence data for June. Consumer confidence — a key indicator of how consumers feel about the overall economy — fell 5.4 basis points to 93 in June from 98.4 in May as concerns about the effects of tariffs on prices and the economy remained top of consumers’ minds.

Those concerns are translating into fewer summer vacation plans — or, perhaps, staycation plans. More than a third of respondents (39%) said they’ll travel less this summer.

“This summer might be just kind of middle of the road as far as travel is concerned,” AAA Northeast’s Robert Sinclair Jr. told Yahoo Finance.

The poll results come as airlines including JetBlue (JBLU) and Delta (DAL) have warned of weaker summer travel demand. Airline fares decreased 7.3% in May from a year ago, per the latest Consumer Price Index report.

JetBlue and Delta stock prices have dropped 17% and 3%, respectively, over the past month.

Americans who are staying close to home also plan to be frugal. Roughly a third (32%) said they’ll attend fewer social events, and more than half (52%) said they plan to eat out less this summer.

May’s Consumer Price Index report, released earlier this month, marked the 27th straight month that inflation for food at home was below inflation for food away from home, per JPMorgan analyst Ken Goldman.

More than a third (34%) are holding off from splurging on large purchases, the results showed, and nearly half (45%) said they are seeking out the best deals. Some (28%) said they are shopping more at discount and big box stores.

These shifts have already appeared in results for dollar store chains like Dollar General (DG) and Dollar Tree (DLTR), which have outperformed the broader retail chains as higher-income shoppers look to save money.

Dollar General CEO Todd Vasos told investors the company saw the “highest percent of trade-in customers” in the first quarter than in the past four years.

“We have seen increased trade-in activity from both middle- and higher-income customers,” Vasos said. “These behaviors suggest that we are continuing to attract higher-income customers who are looking to maximize value while still shopping for items they want and need.”

Walmart’s (WMT) US same-store sales also outpaced those of peers like Target (TGT) as consumers sought low-cost groceries, which make up the majority of Walmart’s sales nationwide.

Brooke DiPalma is a senior reporter for Yahoo Finance. Follow her on X at @BrookeDiPalma or email her at bdipalma@yahoofinance.com.

Shared by Golden State Mint on GoldenStateMint.com