Before the Great Depression, the prevailing belief was that the value of money was stable. Governmental desire to control the value of currencies brought about the demise of the gold standard. The attempt to manipulate money to achieve desired economic effects, however, turned out to be based on flawed logic.

Before the Great Depression, the prevailing belief was that the value of money was stable. Governmental desire to control the value of currencies brought about the demise of the gold standard. The attempt to manipulate money to achieve desired economic effects, however, turned out to be based on flawed logic.

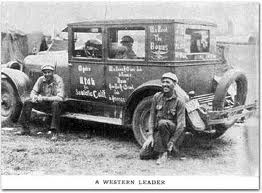

In the short-term, what we know today as “stimulus” and “austerity” measures worked, but they failed long-term. Following the same path of destruction we are currently on, will likely yield the same results. The Great Depression was set in motion by tax hikes, deficit spending, tariff wars and welfare initiatives. Somehow these terms ring an all-too-familiar bell, or maybe, an emergency siren.

As inflation rears its ugly head, logical thinkers can’t help but wonder why government cannot deal directly with economic problems. As the Great Depression should have taught us, spending does not beget savings. The European Union is next in line, as its countries contemplate debasement and withdrawal from the euro.

Pingback: Precious Metals Backed Currency: Unlearned Lessons from the … | Great Depression History